1 Introduction

Since the seminal work by Kagel et al. (Reference Kagel, Harstad and Levin1987), overbidding, i.e., bidding above the own value, has been shown to occur frequently and persistently in second-price sealed-bid auctions (see, e.g., Andreoni et al., Reference Andreoni, Che and Kim2007; Aseff, Reference Aseff2004; Cooper & Fang, Reference Cooper and Fang2008; Drichoutis et al., Reference Drichoutis, Lusk and Nayga2015; Georganas et al., Reference Georganas, Levin and McGee2017; Harstad, Reference Harstad2000; Kagel et al., Reference Kagel, Harstad and Levin1987; Kagel & Levin, Reference Kagel and Levin1993; Karmeliuk et al., Reference Karmeliuk, Kocher and Schmidt2022; Rutström, Reference Rutström1998). Although bidding one’s value is a weakly dominant strategy in sealed-bid second-price private-value auctions (henceforth SPAs), there is substantial heterogeneity in bidding behavior, even among experienced bidders (Garratt & Wooders, Reference Garratt and Wooders2010). Li (Reference Li2017) suggests that overbidding in SPAs may result from the fact that a cognitively limited agent may not recognize true-value bidding as the weakly dominant strategy in SPAs, and recent contributions indicate that cognitive ability may predict overbidding in SPAs (see, e.g., Bartling & Netzer, Reference Bartling and Netzer2016; Lee et al., Reference Lee, Nayga, Deck and Drichoutis2020).Footnote 1 Bidders with higher cognitive ability are more likely to adhere to true-value bidding whereas cognitively less able bidders are prone to overbid, and, among those who overbid, deviations from true values are stronger for cognitively less able bidders.Footnote 2 It is thus important to understand how bidders with lower cognitive ability may compensate for their lack of ability.

A natural way of compensation through which bidders with lower cognitive ability may learn not to overbid is feedback about bidding mistakes. However, feedback-based learning within SPAs is difficult. Overbidding and winning an SPA does not necessarily provide the required feedback because winners paying the second-highest bid may still pay a price below or equal to their value (Kagel, Reference Kagel, Kagel and Roth1995). As SPAs often mask overbidding errors, overbidding is not only frequent but also persistent. A promising alternative approach to learning within an auction format is cross-game learning. Cross-game learning may allow decision makers to integrate important elements of one situation into their “mental models” and recall them in similar situations (see also Wickens, Reference Wickens1992). That is, bidders may benefit from experience in other, but similar, auction formats if these formats render reasonably acceptable prices and potential losses from high bids salient (see Harstad, Reference Harstad2000; Kagel et al., Reference Kagel, Harstad and Levin1987).

The ability of experimental subjects to transfer knowledge between different games (cross-game learning) has been studied in various contexts. Fudenberg and Kreps (Reference Fudenberg and Kreps1988) argue that, in reality, the exact same situation is unlikely to occur again and again, suggesting that players may learn how to play an equilibrium from ‘similar situations’ and across different games. Kagel (Reference Kagel1995) provides evidence for cross-game learning effects in the context of common-value auctions. Subjects improve bidding in English auctions after experiencing first-price sealed-bid auctions, but not vice versa. Kagel (Reference Kagel1995) argues that, in principle, there can be positive, zero, or negative learning transference between the different strategic situations. Exploring when positive learning occurs, Cooper and Kagel (Reference Cooper and Kagel2003, Reference Cooper and Kagel2005, Reference Cooper and Kagel2008, Reference Cooper and Kagel2009) provide evidence from a series of papers that employ entry limit-pricing games to study cross-game learning. They find that meaningful context and team play can facilitate transfer between games and improve strategic play. Jehiel (Reference Jehiel2005) proposes the concept of analogy-based expectations equilibrium, in which players are boundedly rational in the sense that they do not understand the strategies of other players, but best-respond to their opponents’ average behavior across similar games or nodes in extensive-form games. Huck et al. (Reference Huck, Jehiel and Rutter2011) test this concept by providing subjects with various forms of feedback on opponents’ play in a series of normal-form games. They find that, depending on the accessibility of feedback, behavior can be well explained by the analogy-based equilibrium concept. Bednar et al. (Reference Bednar, Chen, Liu and Page2012) study cross-game learning from simultaneous play of different games. They find evidence for subjects’ use of heuristics across games in the sense that behavior from games with low variation in outcomes is transferred to games with higher variation in outcomes but not vice versa. Cooper and Van Huyck (Reference Cooper and Van Huyck2018) show that subjects who have learned to play the payoff-dominant equilibrium in stag-hunt games are able to transfer this general principle to a different coordination game, compared to subjects who did not have this prior experience. Grimm and Mengel (Reference Grimm and Mengel2012) study learning spillovers between similar games, varying the complexity of the strategic situation and the number of different games participants had to play. In their experiments, convergence to Nash play occurs more frequently in simpler setups.Footnote 3 These contributions have typically not related behavior to subjects’ cognitive ability, except Grimm and Mengel (Reference Grimm and Mengel2012), who show that higher scores in the cognitive-reflection test (CRT) are associated with more Nash play in the aggregate. However, they do not discuss how CRT scores relate to cross-game learning.

We hypothesize that cross-game learning opportunities may be particularly helpful for cognitively less able bidders and may hence reduce cognitive-ability differences in overbidding. We test this hypothesis experimentally. Our approach focuses on a simple form of cross-game learning by studying how experience in sealed-bid private-value first-price auctions (henceforth FPAs) affects subsequent bidding behavior in SPAs. FPAs are common and render potential losses from high bids particularly salient. However, FPAs are not strategically equivalent to SPAs. Hence, cognitively able decision-makers may realize that there is no lesson to be learned for optimal bidding in SPAs from experience in FPAs, whereas cognitively less able bidders may transfer a simple bidding heuristic from FPAs to SPAs (“Don’t bid too high"). If so, experience in FPAs may help reduce cognitive-ability differences in the inclination to overbid. In the experiment, we first proxy individual cognitive ability using Raven Progressive Matrices (Raven, Reference Raven1962). Then participants encounter both auction formats. We employ an order-balanced design that allows us to study the role of cognitive ability for participants’ bidding behavior with and without being exposed to the opportunity of cross-game learning. Participants bid in pairs in computerized auctions, and each participant either bids first in a series of FPAs followed by a series of SPAs or vice versa. Importantly, when experiencing the first auction format, participants are not aware that they will encounter another auction format subsequently. This way, we can naturally study how cognitive ability relates to bidding behavior without experience, as well as how experience in one auction format affects behavior in the other.

The main objective of our study is to understand whether cross-game learning through experience in FPAs can help cognitively less able participants improve their bidding behavior in SPAs, and to what extent highly cognitively able participants may benefit at all from learning across games. Further, our order-balanced experimental design allows us to shed light on how experience in SPAs may affect bidding behavior in FPAs. Bidders with lower cognitive ability are expected to overbid in SPAs. As outlined above, there is also little room for these bidders to learn from bidding in SPAs for optimal bidding in FPAs. Bidders with higher cognitive ability are more likely to bid true values within SPAs and may—with experience—even form a habit of true-value bidding. Although cognitively more able bidders may be aware that FPAs are not strategically equivalent to SPAs, they may erroneously stick with high bids when switching to the FPAs. It is thus possible that experience in SPAs even worsens the performance of cognitively more able bidders.

Our experimental results are threefold: First, we find that cognitive ability predicts overbidding in SPAs without experience in another auction format. The majority of bids by less cognitively able bidders are higher than their true values whereas the majority of bids by higher cognitively able bidders correspond to their induced values. Second, and most importantly, we find strong cross-game learning among cognitively less able participants. After experiencing FPAs, the majority of bids in SPAs by cognitively less able bidders correspond to their values. Cross-game learning reduces overbidding by less cognitively able participants by about 40 percent (this corresponds to 20 percentage points), while the fraction of cognitively more able bidders who overbid does not change. Third, experiencing SPAs before participating in FPAs does not substantially alter bidding behavior in FPAs by less cognitively able participants. However, participants with higher cognitive ability who experienced SPAs first tend to shade bids less in FPAs and thus perform worse in terms of payoffs compared to participants with similar cognitive ability who bid in FPAs first. Hence, in line with Kagel (Reference Kagel1995), our results reveal that there can be positive but also negative learning transference between different auction formats. We find that overbidding by cognitively less able bidders can be reduced substantially by cross-game learning, but that cross-game learning can also have adverse effects.

Our findings advance the literature on the causes of overbidding in SPAs and the means to reduce it (see, e.g., Cooper & Fang, Reference Cooper and Fang2008; Kagel & Levin, Reference Kagel, Levin, Kagel and Roth2016, and references therein). Building on the finding that overbidding is much less pronounced in strategically equivalent English auctions, Kagel et al. (Reference Kagel, Harstad and Levin1987) have shown that experience in English auctions can reduce overbidding in SPAs. Harstad (Reference Harstad2000) confirms the latter finding and extends this work by showing that experience in an auction that avoids bidding dynamics of the English auction but still renders acceptable prices salient (such as Price Acceptance List auctions) reduces overbidding in SPAs, too. Although his experiment does not focus on experience in FPAs, in one of his many treatments, fourteen participants bid in SPAs after experiencing FPAs. Harstad’s main finding is that experience in all three auction formats reduces overbidding in SPAs, but also that overbidding and learning across games are very heterogeneous. Our analyses advance his work and provide guidance on how the observed heterogeneity comes about. We find that without prior experience in other auction formats, cognitively less able bidders overbid more frequently in SPAs than cognitively more able bidders. With experience in FPAs, this difference is reduced substantially. When experiencing FPAs before SPAs, cognitively less able bidders start with rather high bids in FPAs but learn to lower their bids when bidding repeatedly in FPAs. Those bidders also react strongly to experiences within FPAs and adjust their bidding behavior when experiencing forgone profits, e.g., reducing their subsequent bids when winning an FPA with a higher bid than the competitor. These reactions to experiences in FPAs also relate systematically to reductions in overbidding in subsequent SPAs among the cognitively less able bidders.Footnote 4

Our results further complement recent contributions on the relationship between cognitive ability and overbidding in SPAs (Bartling & Netzer, Reference Bartling and Netzer2016; Lee et al., Reference Lee, Nayga, Deck and Drichoutis2020). We show that cognitive ability is a robust predictor of overbidding in SPAs when participants have no prior experience in other auction formats, but not when participants have experienced bidding in FPAs. These findings connect also to the literature on learning across games more broadly, highlighting that experience in SPAs may yield payoff losses for cognitively more able participants when they afterwards bid in FPAs in which no dominant strategy exists.

Finally, our findings deliver some practical implications. Experiencing another auction format that renders bidding errors more salient (in our experiment FPAs) can be beneficial to cognitively less able bidders, who bid later in SPAs. Even though FPA experience may not necessarily lead to a better understanding of the SPA format and thus not to actual learning, dealing with FPAs before bidding in SPAs helps low-ability bidders to transfer the idea of lower bids to the SPA format. As such, low-ability bidders benefit from “cross-game transfer” rather than “cross-game learning” (akin to situations in which low-ability bidders benefit from misinterpreting SPAs as FPAs, see, e.g., Ockenfels & Roth, Reference Ockenfels and Roth2002, Reference Ockenfels and Roth2006). However, our results also serve as a warning that such “cross-game transfer” may backfire, e.g., when bidders transfer the idea of true-value bidding from SPAs to FPAs, even if they exhibit relatively high levels of cognitive ability.

The remainder of the paper is organized as follows. Section 2 introduces the experimental design, Sect. 3 presents the results, and Sect. 4 provides a discussion and conclusion. The Online Supplementary Material contains the Appendix with further analyses as well as the experimental instructions (translated from German).

2 Experimental design

Our experimental design aims at understanding whether and how cognitive ability shapes bidding behavior in first- and second-price auctions and how cross-game learning changes bidding behavior by cognitively more and cognitively less able bidders. We, therefore, structured the experiment in four independent parts and informed participants at the beginning of the experiment that they would receive instructions for each of the four parts only after completion of the previous part. Part I elicited cognitive ability. Part II assessed participants’ risk attitudes. In Parts III and IV, each participant either bids first in a series of FPAs followed by a series of SPAs (treatment FPA/SPA) or vice versa (treatment SPA/FPA).

2.1 Elicitation of cognitive ability (Part I)

To proxy cognitive ability, participants were given 5 min to answer as many (out of 22) Raven Progressive Matrices as possible.Footnote 5

The matrices were of progressing difficulty, and participants were aware of this. Each matrix had eight potential answers, exactly one of which was correct. Participants could only solve one matrix at a time, and they could not revisit earlier matrices. For each correctly solved matrix, participants earned EUR 0.30. Participants had the possibility to familiarize themselves with the matrix task in two unpaid dry runs. Performance feedback on Part I was provided only after the entire experiment to avoid behavioral complementarities in performance between parts or behavioral effects from wealth accumulation.

2.2 Elicitation of risk preferences (Part II)

In Part II, we elicited risk attitudes following Holt and Laury (Reference Holt and Laury2002). Participants made ten binary lottery choices with payoffs given in EUR. One of the ten choice items was randomly selected and implemented for real payment. A risk-neutral subject should choose the less risky lottery four times before switching to the more risky lottery. A later switch point indicates a higher level of risk aversion. Most of our participants are risk averse. The average switch point in our sample is 5.74 (median 6).Footnote 6 The estimated individual risk preferences range from -0.315 at the 5th percentile to 0.98 at the 95th percentile, with a median level of 0.55.Footnote 7 There are no significant differences between treatments in the distributions of the observed switch points as well as of the estimated risk preferences (

![]() , resp.

, resp.

![]() , t-tests). Similar to Part I, participants were informed of their income from Part II only at the very end of the experiment.

, t-tests). Similar to Part I, participants were informed of their income from Part II only at the very end of the experiment.

2.3 Auctions (Parts III and IV)

Parts III and IV consisted of 20 two-bidder sealed-bid private-value auctions each, either of the FPA or the SPA format. Each participant either bid first in a series of 20 FPAs in Part III, followed by a series of 20 SPAs in Part IV, or vice versa, and we varied the order of the auction formats (between subjects) at the session level. For each auction, participants were randomly matched within matching groups of 10 participants.Footnote 8 Participants first received instructions for Part III, and only after completion of Part III, they received instructions for Part IV. This approach excludes ‘reverse’ spillovers that would complicate the interpretation of learning effects from one auction format to the other.

In each auction, every participant received a private value (resale value) that was independently drawn from a uniform distribution of integer numbers on [0, 100]. Each participant was required to submit a bid in each auction. Participants could choose non-negative integer bids.Footnote 9 In the FPA, the highest bidder wins, and she pays her bid. In the SPA, the highest bidder wins, and she pays the second-highest bid. If both bids were equal, the buyer was randomly chosen with equal probability. After each auction, participants were informed about whether they won (or not), the price paid by the winner, the rival’s bid, and their own profit, and we reminded participants about their own private value and bid. We provided the same information to all subjects in order to provide the same learning opportunities and avoid asymmetric information between losers and winners. Values, bids, and profits were stated in Experimental Currency Units (ECU, with a pre-announced exchange rate of 1 ECU = 0.03 EUR).Footnote 10 At the beginning of Part III and Part IV, participants received an endowment of 30 ECU to cover potential losses. Further, losses in single auctions could be compensated by gains in other auctions, as all auctions were payoff-relevant.

2.4 Post-experimental questionnaire and procedures

After the four main parts, participants had to fill in a post-experimental questionnaire that contained, among other things, a self-assessed, hypothetical measure of risk attitude on a 0–10 scale (SOEP), gender, age, field of study, and the number of semesters at university.

Altogether, the experiment encompasses a total of 4,720 bidding decisions (2,360 for each auction format by 118 participants (43% female), with 60 participants experiencing FPAs first (FPA/SPA: 1,200 decisions) and 58 participants experiencing SPAs first (SPA/FPA: 1,160 decisions). The experiment was conducted at Technische Universität Berlin. Participants were students from the local participant pool, mostly from economics, engineering, or the natural sciences. Participants were invited to the experiment with ORSEE (Greiner, Reference Greiner2015). All experimental sessions were conducted using z-Tree (Fischbacher, Reference Fischbacher2007). The average length of a session was 75 minutes. The average total earnings per subject amounted to 24.26 EUR. Earnings were paid out in cash directly after the end of the experiment.

3 Results

We structure the presentation of our results along our main research questions. First, we ask whether Raven scores explain overbidding in SPAs and study who benefits the most from cross-game learning through experiencing FPAs. Second, we document how Raven scores relate to bidding behavior in FPAs and whether experience in SPAs also shapes bidding behavior in FPAs. Third, as we document substantial differences in cross-game learning through experiencing FPAs among bidders with lower Raven scores, we discuss potential mechanisms at play based on bidder types and dynamics in bidding behavior.

3.1 Raven scores

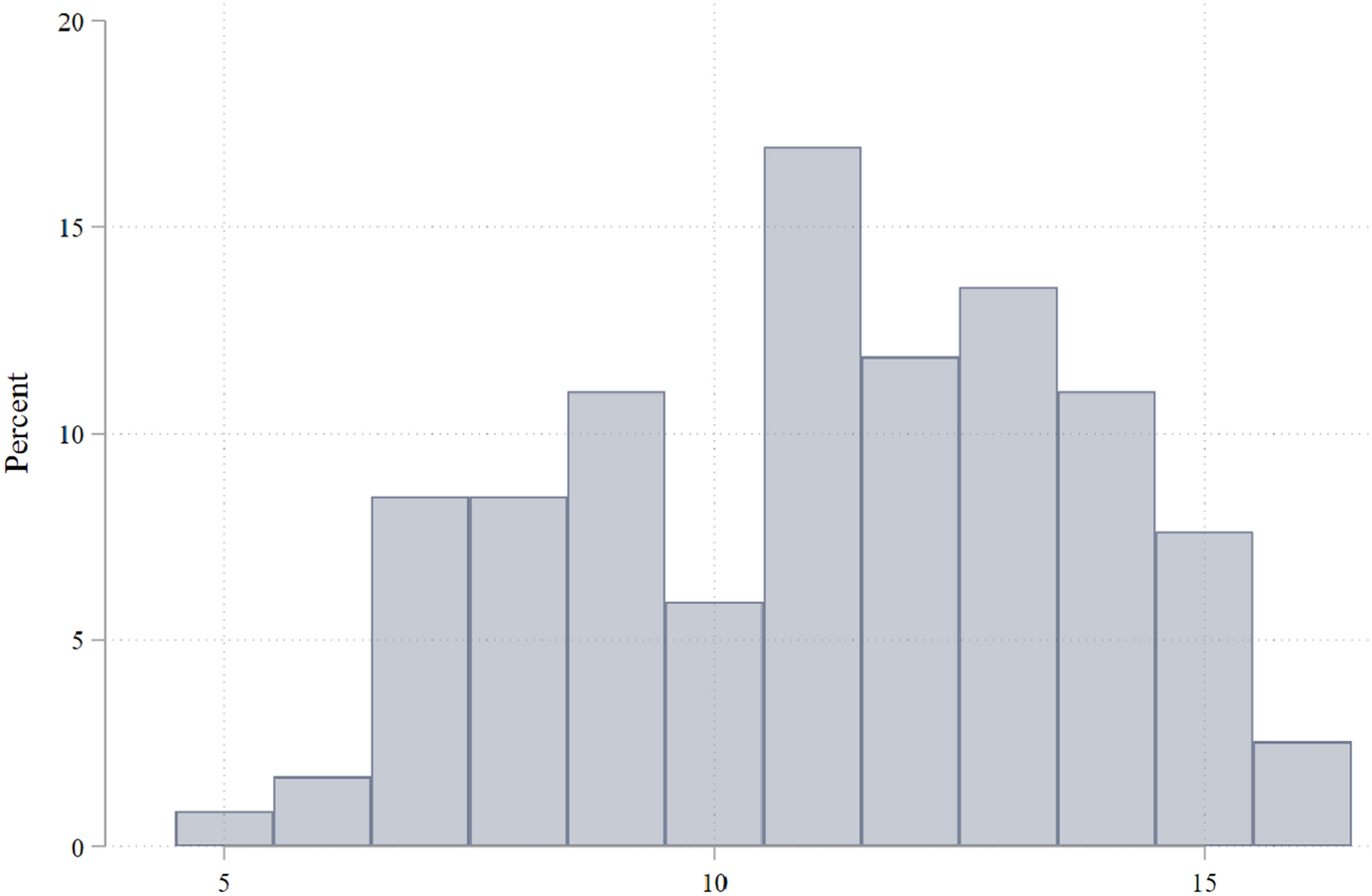

We calculate each participant’s score in the Raven progressive matrices test, i.e., the number of correctly solved matrices, and find substantial heterogeneity in participants’ scores. Individual scores range from five to 16 correctly solved matrices, with an overall average score of 11.14 and a standard deviation of 2.63 (see Fig. 1 and Table 1). Importantly, Raven scores do not differ across the order of auction formats (SPA/FPA vs. FPA/SPA, t-test:

![]() , Kolmogorov-Smirnov test:

, Kolmogorov-Smirnov test:

![]() , see also Table 1) and do not correlate with risk attitudes measured in Part II (Spearman’s

, see also Table 1) and do not correlate with risk attitudes measured in Part II (Spearman’s

![]() ,

,

![]() ).

).

Fig. 1 Distribution of Raven scores

We categorize bidders into two groups when studying whether Raven scores predict behavior in auctions as well as participants’ scope to benefit from cross-game learning. Our classification follows similar approaches used in the literature, e.g., Bergman et al. (Reference Bergman, Ellingsen, Johannesson and Svensson2010), Grimm and Mengel (Reference Grimm and Mengel2012), Lee et al. (Reference Lee, Nayga, Deck and Drichoutis2020). A participant belongs to the lower cognitive-ability group (henceforth LC–group) if their Raven score is below the total average score (11.14) of all 118 participants and to the high-ability group (henceforth HC–group) otherwise. Table 1 illustrates this classification. The median score in our sample is 11, such that our categorization coincides with a median split in which the median is included in the group of less cognitively able participants. Further, in the Appendix, we provide several robustness tests for our main results (using the Raven score instead of this classification as well as simply excluding the observations of individuals whose Raven score is equal to the median value).

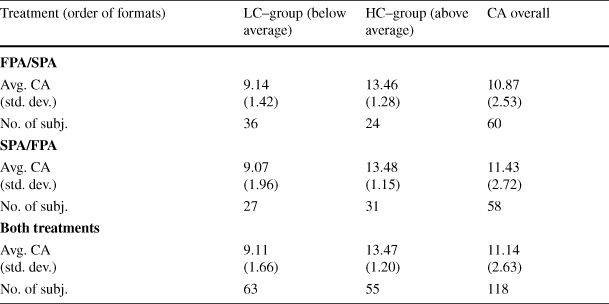

Table 1 Definition of cognitive ability (CA) groups based on Raven scores

|

Treatment (order of formats) |

LC–group (below average) |

HC–group (above average) |

CA overall |

|

|---|---|---|---|---|

|

FPA/SPA |

||||

|

Avg. CA (std. dev.) |

9.14 (1.42) |

13.46 (1.28) |

10.87 (2.53) |

|

|

No. of subj. |

36 |

24 |

60 |

|

|

SPA/FPA |

||||

|

Avg. CA (std. dev.) |

9.07 (1.96) |

13.48 (1.15) |

11.43 (2.72) |

|

|

No. of subj. |

27 |

31 |

58 |

|

|

Both treatments |

||||

|

Avg. CA (std. dev.) |

9.11 (1.66) |

13.47 (1.20) |

11.14 (2.63) |

|

|

No. of subj. |

63 |

55 |

118 |

|

3.2 Second-price auction

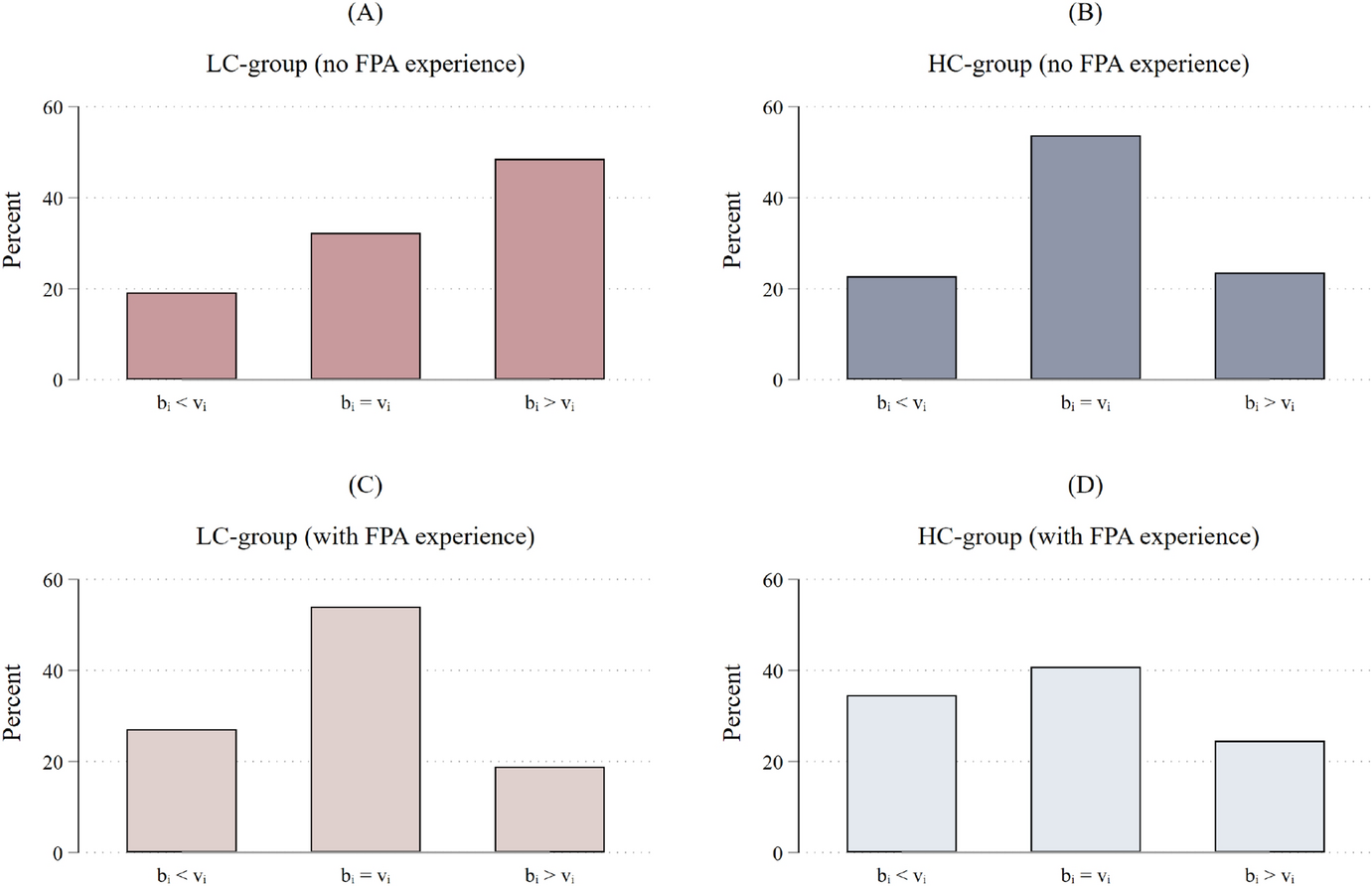

Although the dominant strategy in SPAs is to bid one’s true value,

![]() , research has shown that a substantial fraction of bidders overbid in SPAs (see, e.g., the surveys by Kagel, Reference Kagel, Kagel and Roth1995; Kagel & Levin, Reference Kagel, Levin, Kagel and Roth2016). Figure 2 shows the relative frequency of overbidding,

, research has shown that a substantial fraction of bidders overbid in SPAs (see, e.g., the surveys by Kagel, Reference Kagel, Kagel and Roth1995; Kagel & Levin, Reference Kagel, Levin, Kagel and Roth2016). Figure 2 shows the relative frequency of overbidding,

![]() , underbidding,

, underbidding,

![]() , and true-value bidding,

, and true-value bidding,

![]() , across groups and treatments in our experiment.Footnote 11 Figure 2 illustrates that cognitive ability is an important driver of overbidding without experience in other auction formats. Without experience, more than 50 percent of bids in the LC–group are higher than the own value (Panel (A)), whereas overbidding is much less pronounced among participants in the HC–group (Panel (B)). That is, overbidding occurs about twice as often in the LC–group as compared to the HC–group.

, across groups and treatments in our experiment.Footnote 11 Figure 2 illustrates that cognitive ability is an important driver of overbidding without experience in other auction formats. Without experience, more than 50 percent of bids in the LC–group are higher than the own value (Panel (A)), whereas overbidding is much less pronounced among participants in the HC–group (Panel (B)). That is, overbidding occurs about twice as often in the LC–group as compared to the HC–group.

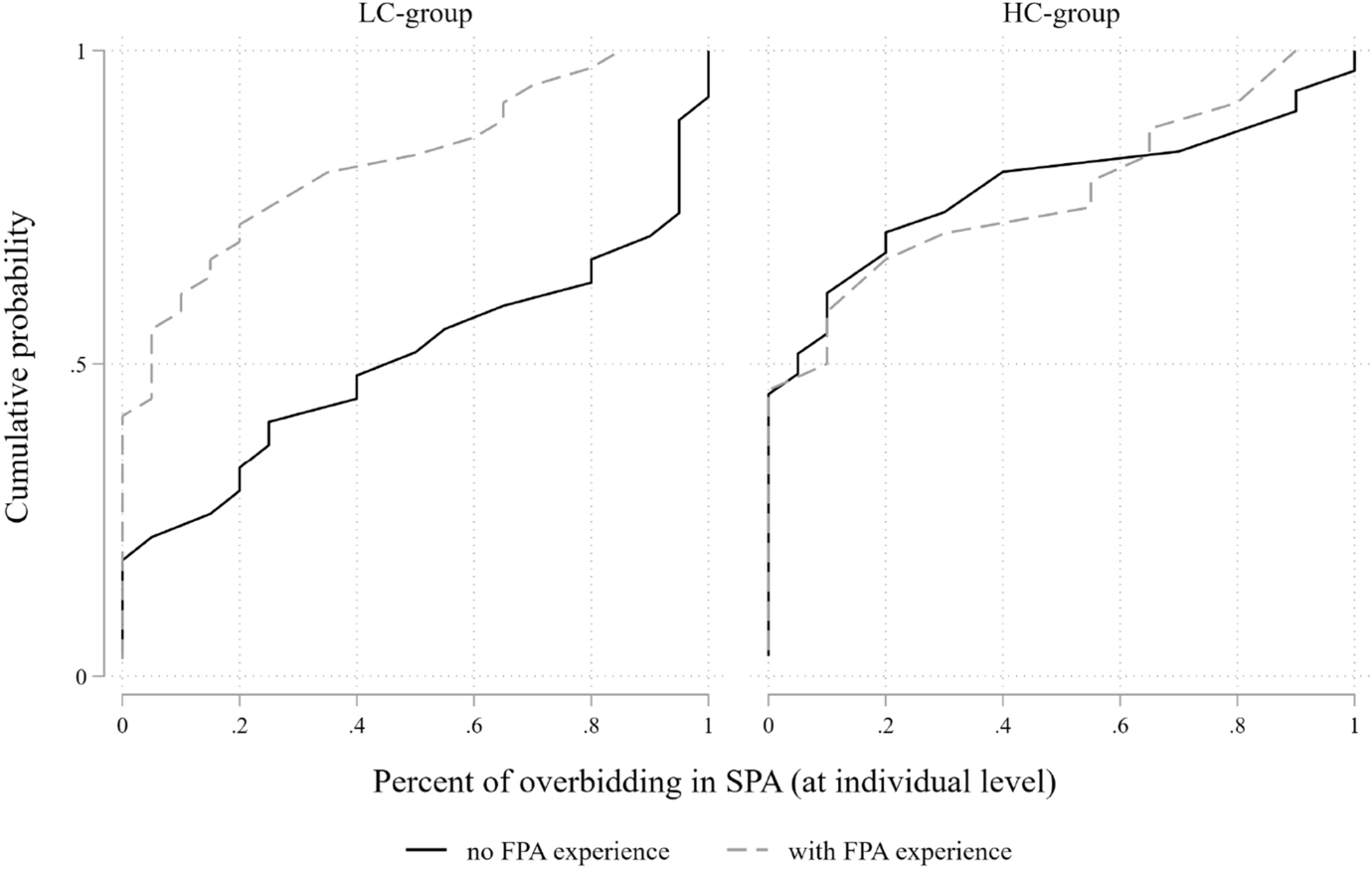

For each participant, we also calculate the fraction of SPAs in which she overbids, respectively underbids, or bids her true value. Figure 3 shows the cumulative distribution functions for the average individual frequency of overbidding for the LC– and HC–groups, while Figs. A1 and A2 in the Appendix show CDFs for true-value and underbidding, respectively. Clearly, without experience, the distributions of individual overbidding fractions differ significantly between the HC– and LC–groups (Mann-Whitney,

![]() ). True-value bidding—which is the modal choice among the HC–group bids (see Fig. 2, Panel (B))—is significantly less frequent among the LC–group as compared to the HC–group without prior experience in FPAs (Mann-Whitney,

). True-value bidding—which is the modal choice among the HC–group bids (see Fig. 2, Panel (B))—is significantly less frequent among the LC–group as compared to the HC–group without prior experience in FPAs (Mann-Whitney,

![]() , see also Fig. A1 in the Appendix).

, see also Fig. A1 in the Appendix).

Result 1

Without prior experience in FPAs, bidders in the LC–group overbid substantially more often in SPAs than bidders in the HC–group.

Fig. 2 Bidding behavior in SPAs across treatments and cognitive groups

Experiencing FPAs before bidding in SPAs substantially reduces overbidding by bidders with lower cognitive ability (see Fig. 2, Panel (C), Mann-Whitney at the individual level,

![]() ), whereas bidders with high cognitive ability do not overbid substantially less in SPAs when experiencing FPAs first (see Panel (D), Mann-Whitney at the individual level,

), whereas bidders with high cognitive ability do not overbid substantially less in SPAs when experiencing FPAs first (see Panel (D), Mann-Whitney at the individual level,

![]() ). Figure 3 shows that among the LC–group (left panel), FPA experience substantially reduces the fraction of bidders bidding more than the true value. Without FPA experience, only 18 percent of the LC–group never overbid, whereas, with FPA experience, 46 percent refrain completely from overbidding. Further, the cdf of the FPA-inexperienced LC–bidders first-order stochastically dominates the cdf of the experienced LC–bidders, reflecting a strong general tendency of a reduction in overbidding at the individual level after experiencing FPAs. Two-thirds of LC–bidders with FPA experience overbid in less than 20 percent of their bids (whereas only about a quarter of inexperienced LC–bidders have such a low overbidding rate). For the HC–group, the individual propensity to overbid does not differ across treatments and looks very similar to the individual overbidding rates among experienced LC–bidders. Figures A1 and A2 in the Appendix mirror these results. In particular, we find that when bidders experience FPAs before bidding in SPAs, the fraction of bidders in the LC–group that never bid true values is substantially reduced, and overall true-value bidding becomes more prevalent at the individual level: Without FPA experience, about 30 percent of the LC–group never bid the true value (while only 6 percent of HC–bidders do so). With FPA experience, only eight percent of LC-bidders never bid their true value. Further, the true-value bidding cdf of experienced LC–bidders first–order stochastically dominates the cdf for inexperienced bidders (see Fig. A1 in the Appendix), reflecting a strong tendency for more true-value bidding at the individual level with FPA experience, even though few bidders among the LC–group always bid their value. For the HC–group, the individual propensity to bid the true value differs less (Mann-Whitney,

). Figure 3 shows that among the LC–group (left panel), FPA experience substantially reduces the fraction of bidders bidding more than the true value. Without FPA experience, only 18 percent of the LC–group never overbid, whereas, with FPA experience, 46 percent refrain completely from overbidding. Further, the cdf of the FPA-inexperienced LC–bidders first-order stochastically dominates the cdf of the experienced LC–bidders, reflecting a strong general tendency of a reduction in overbidding at the individual level after experiencing FPAs. Two-thirds of LC–bidders with FPA experience overbid in less than 20 percent of their bids (whereas only about a quarter of inexperienced LC–bidders have such a low overbidding rate). For the HC–group, the individual propensity to overbid does not differ across treatments and looks very similar to the individual overbidding rates among experienced LC–bidders. Figures A1 and A2 in the Appendix mirror these results. In particular, we find that when bidders experience FPAs before bidding in SPAs, the fraction of bidders in the LC–group that never bid true values is substantially reduced, and overall true-value bidding becomes more prevalent at the individual level: Without FPA experience, about 30 percent of the LC–group never bid the true value (while only 6 percent of HC–bidders do so). With FPA experience, only eight percent of LC-bidders never bid their true value. Further, the true-value bidding cdf of experienced LC–bidders first–order stochastically dominates the cdf for inexperienced bidders (see Fig. A1 in the Appendix), reflecting a strong tendency for more true-value bidding at the individual level with FPA experience, even though few bidders among the LC–group always bid their value. For the HC–group, the individual propensity to bid the true value differs less (Mann-Whitney,

![]() ), and if at all, experiencing FPAs appears to slightly reduce true–value bidding for the HC–group.

), and if at all, experiencing FPAs appears to slightly reduce true–value bidding for the HC–group.

Fig. 3 Percent of overbidding decisions at the individual level in SPAs, across treatments and cognitive groups

Focusing on relative overbidding, defined as

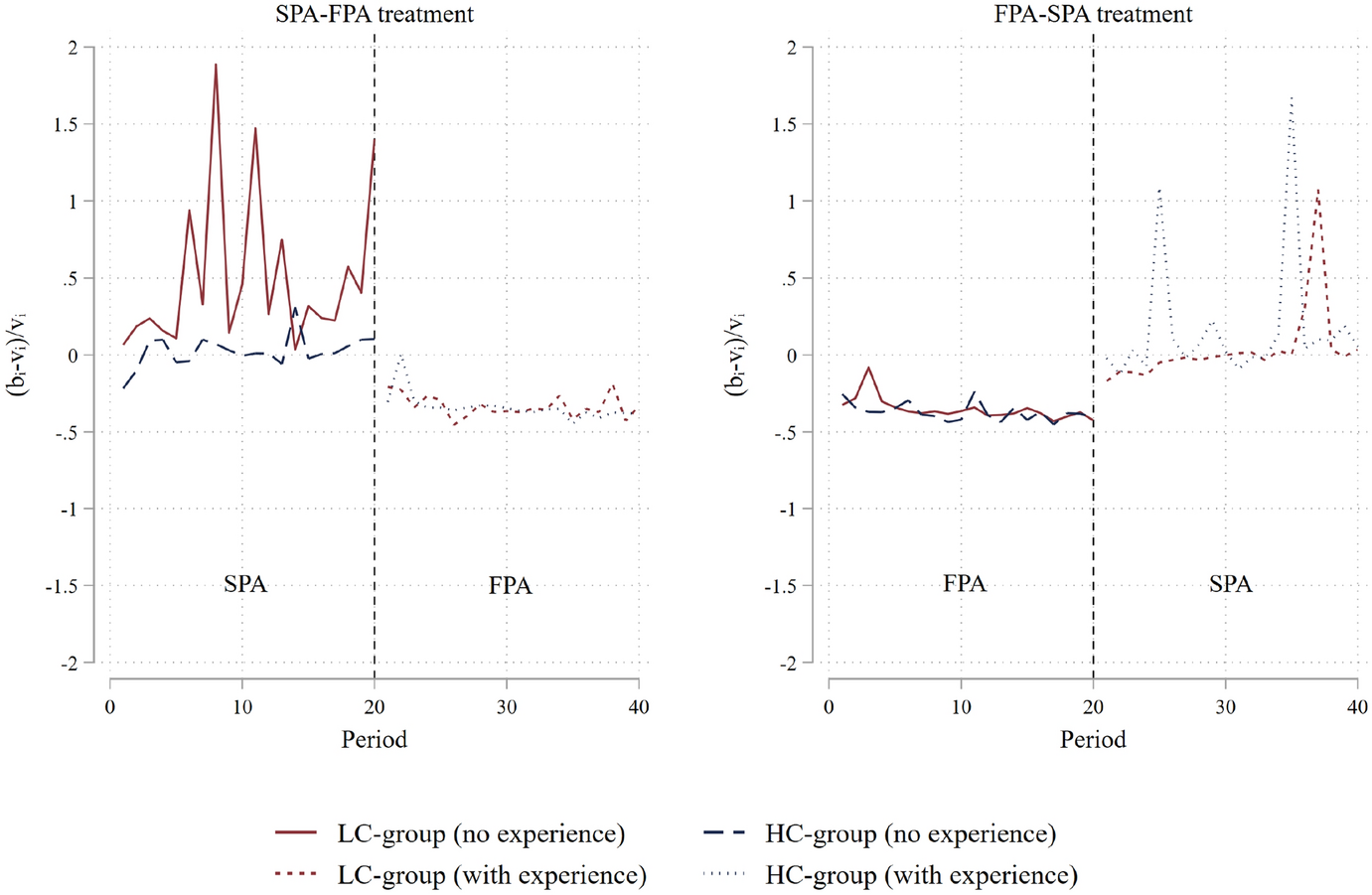

![]() , Fig. 4 illustrates the average relative overbidding over time within each auction across both treatments by cognitive group. The left panel depicts the treatment in which participants first experience SPAs and thereafter bid in FPAs, and the right panel shows the treatment starting with FPAs. Bidders of the LC–group overbid substantially when bidding first in 20 SPAs (left panel), whereas average relative overbidding in the HC–group is stable and close to zero. After experiencing 20 FPAs, this difference in relative overbidding in SPAs between the LC–group and the HC–group vanishes.Footnote 12

, Fig. 4 illustrates the average relative overbidding over time within each auction across both treatments by cognitive group. The left panel depicts the treatment in which participants first experience SPAs and thereafter bid in FPAs, and the right panel shows the treatment starting with FPAs. Bidders of the LC–group overbid substantially when bidding first in 20 SPAs (left panel), whereas average relative overbidding in the HC–group is stable and close to zero. After experiencing 20 FPAs, this difference in relative overbidding in SPAs between the LC–group and the HC–group vanishes.Footnote 12

Fig. 4 Average relative overbidding,

![]() , over time by treatment and cognitive group

, over time by treatment and cognitive group

Table 2 SPA: Bid deviation from true-value bidding; GLS regressions

|

Dependent variable |

(1a) |

(1b) |

(2a) |

(2b) |

(3a) |

(3b) |

(4a) |

(4b) |

|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

Reference category |

LC–group (without CGL, first 10 auctions) |

LC–group (without CGL) |

LC–group (without CGL, first 10 auctions) |

|||||

|

Constant |

4.078*** |

8.681** |

−3.519** |

−5.975*** |

6.080*** |

7.152*** |

4.135** |

5.205*** |

|

(1.529) |

(3.911) |

(1.726) |

(2.175) |

(1.650) |

(0.655) |

(1.765) |

(0.903) |

|

|

CognD (HC=1) |

−6.394*** |

−6.080** |

2.815 |

3.204* |

−6.662*** |

−6.547*** |

−6.451*** |

−6.413** |

|

(2.120) |

(2.371) |

(1.985) |

(1.782) |

(1.442) |

(1.687) |

(2.311) |

(2.566) |

|

|

TimeD (auctions 11–20) |

4.004*** |

4.107*** |

3.803*** |

3.678*** |

3.889*** |

3.834*** |

||

|

(0.676) |

(0.728) |

(1.001) |

(0.981) |

(0.614) |

(0.617) |

|||

|

CGL-D (FPA experience=1) |

−7.698*** |

−7.881*** |

−7.698*** |

−7.880*** |

||||

|

(2.025) |

(1.952) |

(2.027) |

(1.952) |

|||||

|

CognD

|

−0.536 |

−0.517 |

−2.107** |

−2.038** |

−0.421 |

−0.270 |

||

|

(2.323) |

(2.339) |

(0.907) |

(0.892) |

(2.681) |

(2.713) |

|||

|

CognD

|

8.424*** |

8.624*** |

9.310*** |

9.595*** |

||||

|

(2.073) |

(2.182) |

(2.772) |

(2.889) |

|||||

|

CognD

|

−1.772 |

−1.939 |

||||||

|

(3.148) |

(3.179) |

|||||||

|

Value |

−0.007 |

−0.015 |

−0.0119 |

−0.011 |

||||

|

(0.054) |

(0.062) |

(0.0405) |

(0.042) |

|||||

|

Value

|

−0.001 |

−0.000 |

−0.000 |

−0.000 |

||||

|

(0.001) |

(0.000) |

(0.000) |

(0.000) |

|||||

|

Female |

1.518 |

0.941 |

1.083 |

1.082 |

||||

|

(2.066) |

(1.891) |

(1.695) |

(1.698) |

|||||

|

Switch point (H &L) |

−0.517 |

0.636** |

0.0988 |

0.099 |

||||

|

(0.862) |

(0.307) |

(0.450) |

(0.451) |

|||||

|

Incl. Obs. |

SPA/FPA |

SPA/FPA |

FPA/SPA |

FPA/SPA |

All |

All |

All |

All |

|

Observations |

1,160 |

1,160 |

1,200 |

1,200 |

2,360 |

2,360 |

2,360 |

2,360 |

|

Number of Subj. |

58 |

58 |

60 |

60 |

118 |

118 |

118 |

118 |

Robust standard errors in parentheses

Giebe et al.p < 0.01, **p < 0.05, *p < 0.1

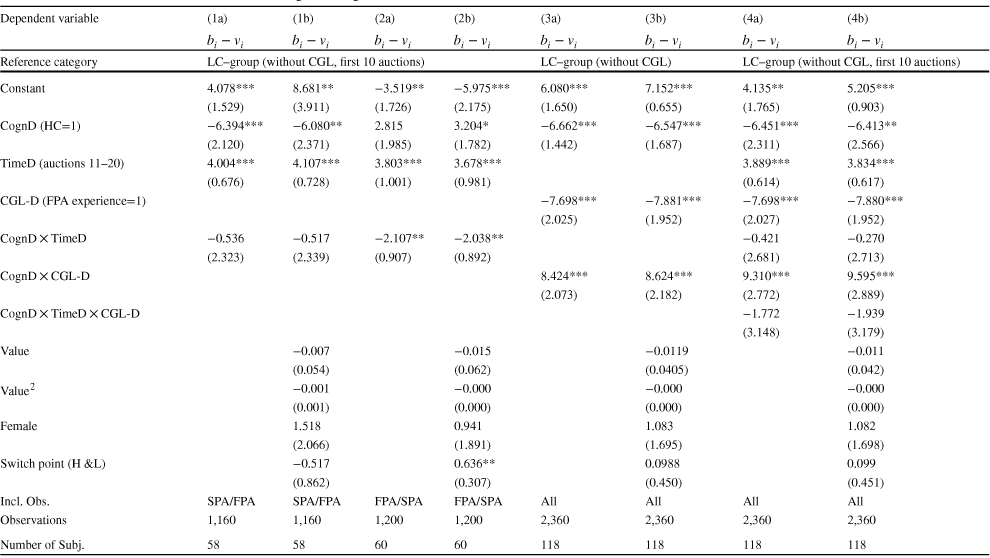

The important role of cognitive ability for overbidding of inexperienced bidders as well as for the benefits of cross-game learning is corroborated by the empirical analysis of the likelihood to overbid as well as of the extent of overbidding. Table 2 presents GLS regression results on bid deviation from true-value bidding,

![]() , with random effects at the subject level and clustered standard errors at the matching group level to account for correlated decisions by the same subject and within the same matching group. Analyses on the likelihood to submit a bid higher than the own value mirror the findings from Table 2 and can be found in the Appendix (Table A2). The regression specifications include our three main variables of interest: direct effects of cognitive ability (the dummy CognD = 0 if LC; 1 if HC), learning within the 20 periods of the SPA (the dummy TimeD = 0 if first 10 auctions; 1 if auctions 11–20), and cross-game learning from experience of FPAs prior to SPAs (the dummy CGL-D = 0 if order SPA/FPA, 1 if order FPA/SPA). Additional control variables include gender and risk attitude (switch point in the Holt/Laury task; increasing in the degree of risk aversion). We also control for value and value squared because bid deviation from true-value bidding can depend on the underlying value.

, with random effects at the subject level and clustered standard errors at the matching group level to account for correlated decisions by the same subject and within the same matching group. Analyses on the likelihood to submit a bid higher than the own value mirror the findings from Table 2 and can be found in the Appendix (Table A2). The regression specifications include our three main variables of interest: direct effects of cognitive ability (the dummy CognD = 0 if LC; 1 if HC), learning within the 20 periods of the SPA (the dummy TimeD = 0 if first 10 auctions; 1 if auctions 11–20), and cross-game learning from experience of FPAs prior to SPAs (the dummy CGL-D = 0 if order SPA/FPA, 1 if order FPA/SPA). Additional control variables include gender and risk attitude (switch point in the Holt/Laury task; increasing in the degree of risk aversion). We also control for value and value squared because bid deviation from true-value bidding can depend on the underlying value.

In Table 2, specifications without and with control variables are distinguished by the letters a and b in the column headings, respectively. The subsample in specification (1) includes only the observations from treatment SPA/FPA and hence focuses on overbidding in SPAs without bidding experience in FPAs. Specification (2) includes only observations from treatment FPA/SPA, i.e., focusing on bidding behavior of participants who experienced 20 FPAs, while specifications (3) and (4) include both treatments.Footnote 13

Specification (1a) of Table 2, mirrors the pattern observed in the left panel of Fig. 4, showing that, without prior FPA experience, cognitively more able bidders overbid substantially less than cognitively less able bidders, and further, that overbidding is not reduced with experience within the SPA format. Hence, within-game learning does not lead to convergence to the dominant strategy. This holds also when adding controls for risk attitude and gender, see specification (1b). In contrast, overbidding does not significantly differ between the LC–group and the HC–group when both groups have experienced 20 FPAs before bidding in the SPAs, see specifications (2a) and (2b). Specifications (3) and (4) estimate the causal effect of experiencing 20 FPAs on overbidding in SPAs and show that such cross-game learning eliminates the significant difference between the LC–group and the HC–group. This finding is also reflected at the individual bid level (see Fig. A4 in the Appendix, which shows scatter plots of individual bids across treatments and cognitive-ability groups), and is mainly driven by bidders with lower Raven scores, who overbid less after FPA experience (see the violin plots for bid deviations,

![]() , conditional on Raven scores in Fig. A5 in the Appendix). Qualitative results neither change if we use the individual Raven score instead of the cognitive-group dummy (see Table A3 in the Appendix) nor if we exclude the observations of individuals whose Raven score is equal to the median value (see Table A4 in the Appendix).

, conditional on Raven scores in Fig. A5 in the Appendix). Qualitative results neither change if we use the individual Raven score instead of the cognitive-group dummy (see Table A3 in the Appendix) nor if we exclude the observations of individuals whose Raven score is equal to the median value (see Table A4 in the Appendix).

Result 2

Cross-game learning reduces overbidding in SPAs for the LC–group and thereby eliminates significant differences between the two cognitive-ability groups.

3.3 First-price auction

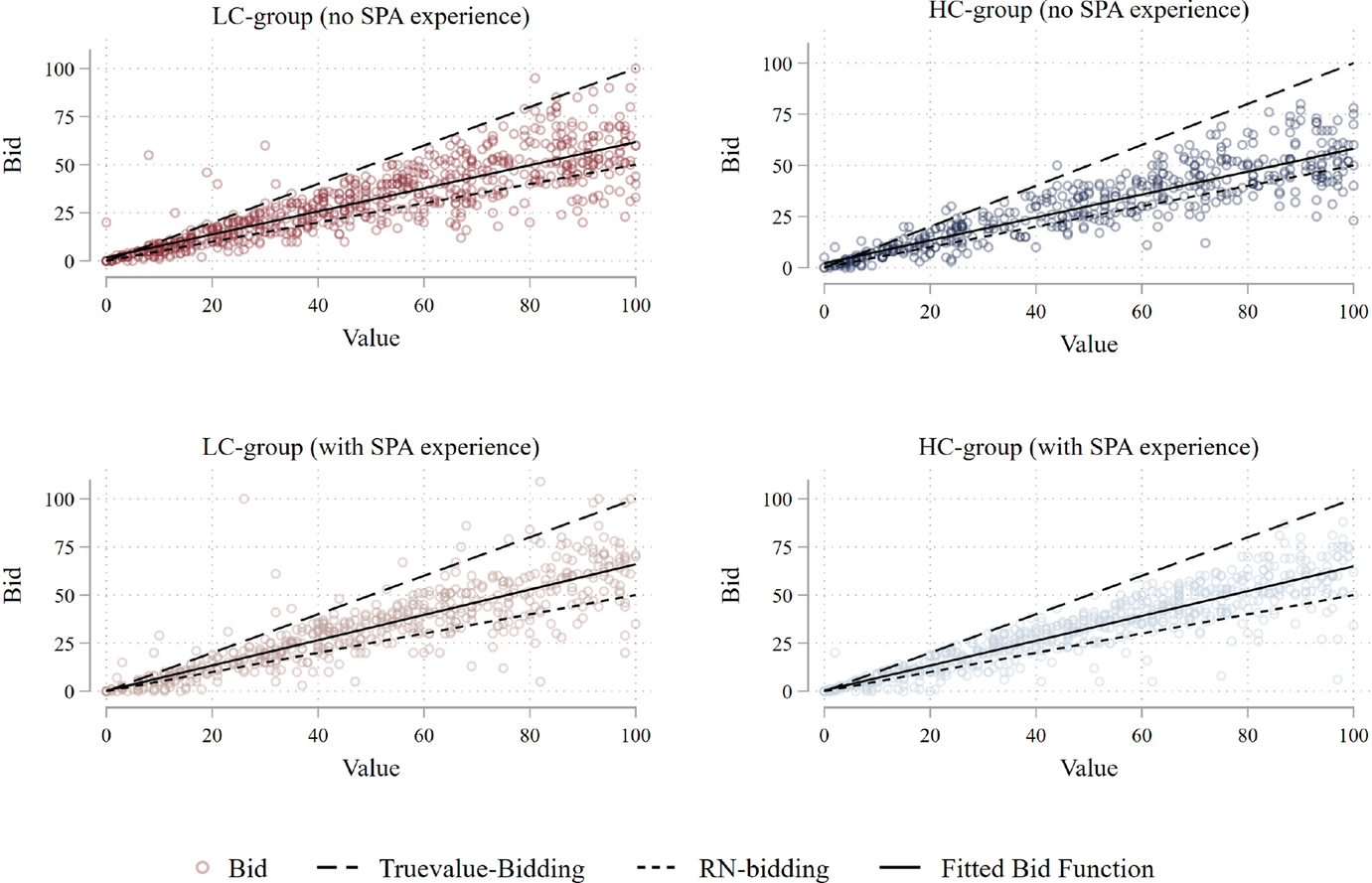

Next, we shed light on bidding behavior in FPAs. Figure 5 presents scatter plots of individual bids in FPAs by treatment (no SPA experience vs. with SPA experience) and cognitive-ability group (LC– vs. HC–group), conditional on induced values.Footnote 14 Each panel of Fig. 5 also includes three reference lines. From top to bottom, these lines indicate, respectively, true-value bidding, the fitted (observed) linear ‘bid function’, and the risk-neutral Nash-equilibrium (benchmark) bidding. In the FPA, bidding above the risk-neutral benchmark is rational for risk-averse bidders. However, a positive profit in the FPA requires bid shading, i.e., bidding below one’s value,

![]() . Thus, bidding at or above the true value cannot be rationalized. Hence, rational bids should fall between the two outer lines in Fig. 5. As can be seen, this is indeed the case for the overwhelming majority of observations, and the few overbidding decisions in FPAs originate mainly from the LC–group (left panels).

. Thus, bidding at or above the true value cannot be rationalized. Hence, rational bids should fall between the two outer lines in Fig. 5. As can be seen, this is indeed the case for the overwhelming majority of observations, and the few overbidding decisions in FPAs originate mainly from the LC–group (left panels).

Without experience in SPAs (see top panels in Fig. 5), bidders in the LC–group tend to shade bids less than bidders in the HC–group, particularly for higher values. However, these differences appear to be less pronounced when bidders experience SPAs before bidding in FPAs (see bottom panels).

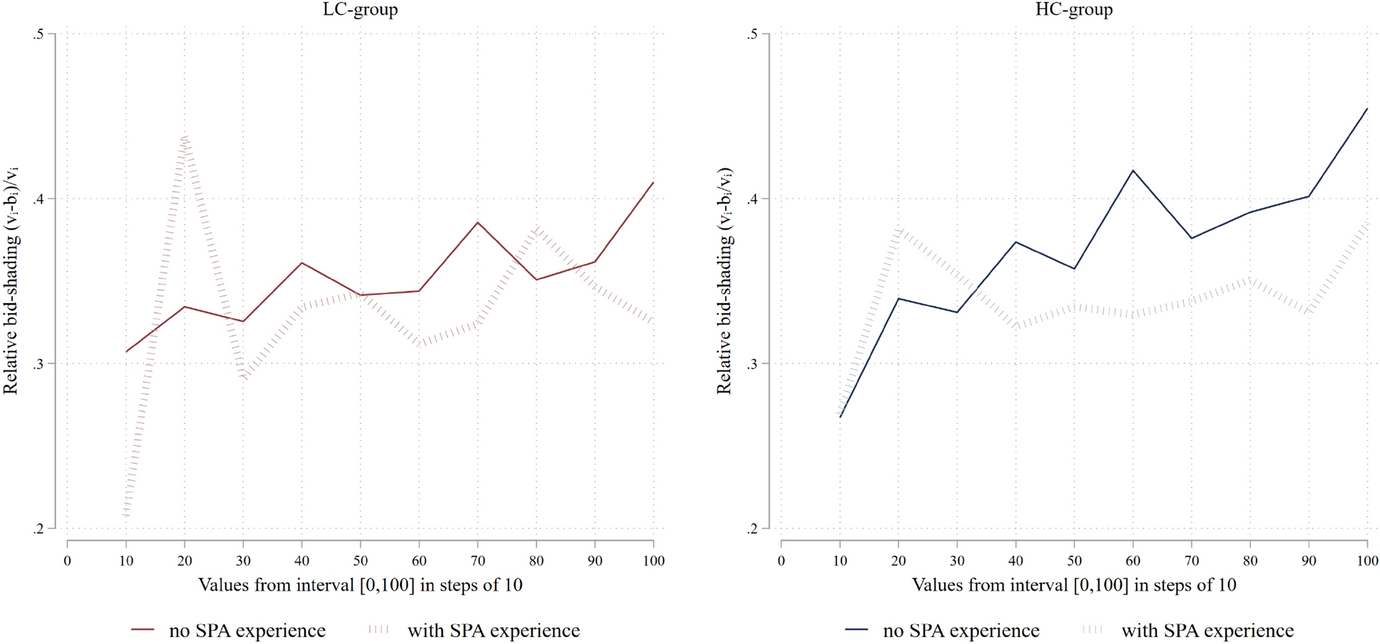

Figure 6 depicts the average degree of relative bid shading,

![]() , by cognitive group across values. Note that a higher level of bid shading is associated with a larger profit in case of winning but a lower probability of winning, i.e., bidding closer to the risk-neutral Nash equilibrium (unless the bid is below that benchmark). We have grouped values into ten value bins in order to better distinguish participants’ bidding behavior for low values from that for high values.

, by cognitive group across values. Note that a higher level of bid shading is associated with a larger profit in case of winning but a lower probability of winning, i.e., bidding closer to the risk-neutral Nash equilibrium (unless the bid is below that benchmark). We have grouped values into ten value bins in order to better distinguish participants’ bidding behavior for low values from that for high values.

The left panel shows that bid shading in FPAs by less cognitively able participants is not strongly affected by the preceding bidding experience in SPAs. However, for highly cognitively able bidders (right panel), and especially for high values, bid shading tends to ‘deteriorate’ when these bidders experienced SPAs before participating in FPAs. Note that, if values are low, the expected profit from rational bidding will be low, too. In contrast, for high values, stakes but also the probability of winning the auction are higher such that the own bid becomes payoff-relevant more often. There are different approaches in the literature to deal with the problem of unmotivated behavior that can interfere with data analysis when values are low (see, e.g., Harstad, Reference Harstad2000; Lee et al., Reference Lee, Nayga, Deck and Drichoutis2020). With higher values, incentives to consider one’s bid more carefully are stronger. In our statistical analyses (see Table 3), we follow Lee et al. Reference Lee, Nayga, Deck and Drichoutis2020, p.1501, and provide estimations for all observations as well as for the subsample restricted to cases in which bidders were assigned values higher than 50.

Fig. 5 FPA: Scatter plots of individual bids by treatment and cognitive group

Fig. 6 FPA: Average relative bid shading,

![]() , by treatment and cognitive group

, by treatment and cognitive group

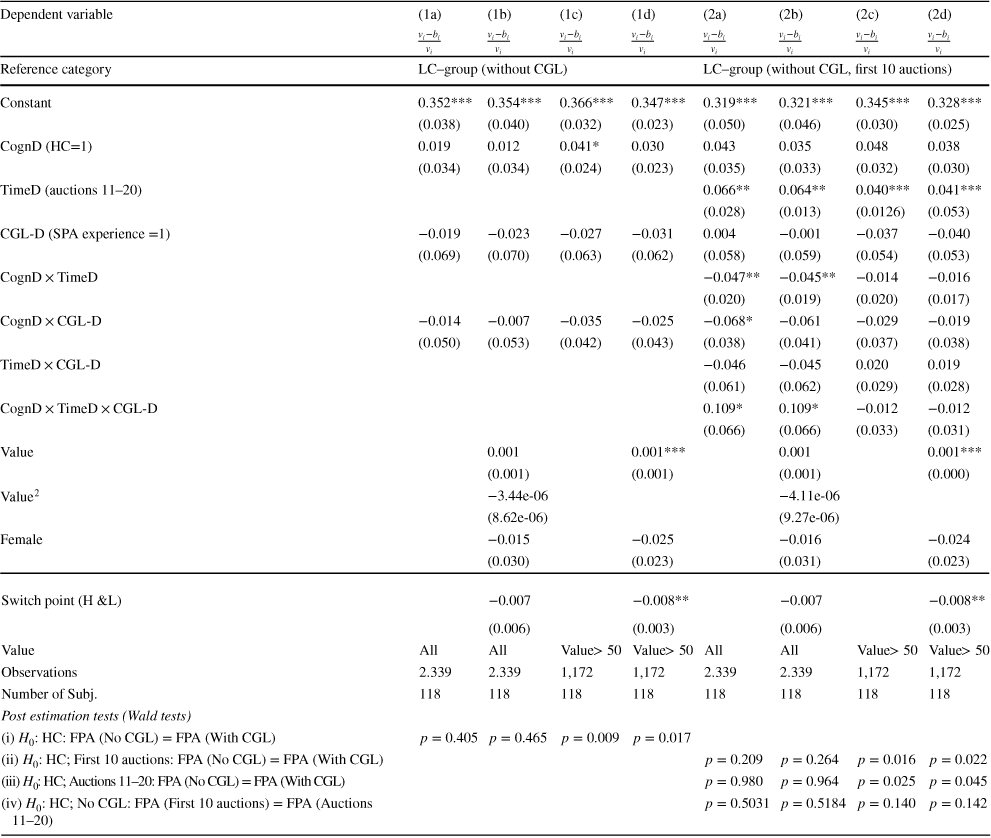

Table 3 reports the estimation results of how cognitive ability, cross-game learning (i.e., experience in SPAs before bidding in the FPA), and within-game learning affect participants’ extent of relative bid shading,

![]() . Similar to our analysis of bidding behavior in SPAs, we include a cross-game learning treatment dummy CGL–D (=1 if bidders experienced SPAs before bidding in FPAs) and a dummy variable for belonging to the HC–group (CognD) as well as interaction variables. Regression specifications a/b include all induced values while specifications c/d include only high valuations,

. Similar to our analysis of bidding behavior in SPAs, we include a cross-game learning treatment dummy CGL–D (=1 if bidders experienced SPAs before bidding in FPAs) and a dummy variable for belonging to the HC–group (CognD) as well as interaction variables. Regression specifications a/b include all induced values while specifications c/d include only high valuations,

![]() . Specifications a/c do not include additional control variables while we add controls for gender (dummy for female), risk attitude, and induced values in specifications b/d. Again, all specifications are generalized least squares (GLS) models with random effects at the subject level and clustered standard errors at the matching group level to account for correlated decisions by the same subject and within the same matching group. First, we find that for values larger than 50 and without experience in SPAs, bidders in the HC–group tend to shade bids slightly more than bidders in the LC–group (see specification (1c) in Table 3). This result is corroborated using the individual Raven score instead of the cognitive group dummy (see Table A5 in the Appendix, specifications (1c) and (1d)). Higher individual Raven scores relate positively and statistically significantly to bid shading (p-values<0.05). Second, we observe that experience in SPAs before bidding in FPAs (CGL–D) has no effect on the cognitively less able bidders. Somewhat surprisingly, the cognitively more able bidders shade their bids less, in particular for values larger than 50, when experiencing SPAs before bidding in FPAs (see Table 3, post-estimation Wald test (i) for specifications (1c) and (1d), p-values<0.05).Footnote 15 Finally, specifications (2a)-(2d) document within-game learning in FPAs (TimeD), which will be discussed in greater detail in Sect. 3.4.

. Specifications a/c do not include additional control variables while we add controls for gender (dummy for female), risk attitude, and induced values in specifications b/d. Again, all specifications are generalized least squares (GLS) models with random effects at the subject level and clustered standard errors at the matching group level to account for correlated decisions by the same subject and within the same matching group. First, we find that for values larger than 50 and without experience in SPAs, bidders in the HC–group tend to shade bids slightly more than bidders in the LC–group (see specification (1c) in Table 3). This result is corroborated using the individual Raven score instead of the cognitive group dummy (see Table A5 in the Appendix, specifications (1c) and (1d)). Higher individual Raven scores relate positively and statistically significantly to bid shading (p-values<0.05). Second, we observe that experience in SPAs before bidding in FPAs (CGL–D) has no effect on the cognitively less able bidders. Somewhat surprisingly, the cognitively more able bidders shade their bids less, in particular for values larger than 50, when experiencing SPAs before bidding in FPAs (see Table 3, post-estimation Wald test (i) for specifications (1c) and (1d), p-values<0.05).Footnote 15 Finally, specifications (2a)-(2d) document within-game learning in FPAs (TimeD), which will be discussed in greater detail in Sect. 3.4.

Table 3 FPA: Relative bid shading; GLS regressions

|

Dependent variable |

(1a) |

(1b) |

(1c) |

(1d) |

(2a) |

(2b) |

(2c) |

(2d) |

|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

Reference category |

LC–group (without CGL) |

LC–group (without CGL, first 10 auctions) |

||||||

|

Constant |

0.352*** |

0.354*** |

0.366*** |

0.347*** |

0.319*** |

0.321*** |

0.345*** |

0.328*** |

|

(0.038) |

(0.040) |

(0.032) |

(0.023) |

(0.050) |

(0.046) |

(0.030) |

(0.025) |

|

|

CognD (HC=1) |

0.019 |

0.012 |

0.041* |

0.030 |

0.043 |

0.035 |

0.048 |

0.038 |

|

(0.034) |

(0.034) |

(0.024) |

(0.023) |

(0.035) |

(0.033) |

(0.032) |

(0.030) |

|

|

TimeD (auctions 11–20) |

0.066** |

0.064** |

0.040*** |

0.041*** |

||||

|

(0.028) |

(0.013) |

(0.0126) |

(0.053) |

|||||

|

CGL-D (SPA experience =1) |

−0.019 |

−0.023 |

−0.027 |

−0.031 |

0.004 |

−0.001 |

−0.037 |

−0.040 |

|

(0.069) |

(0.070) |

(0.063) |

(0.062) |

(0.058) |

(0.059) |

(0.054) |

(0.053) |

|

|

CognD

|

−0.047** |

−0.045** |

−0.014 |

−0.016 |

||||

|

(0.020) |

(0.019) |

(0.020) |

(0.017) |

|||||

|

CognD

|

−0.014 |

−0.007 |

−0.035 |

−0.025 |

−0.068* |

−0.061 |

−0.029 |

−0.019 |

|

(0.050) |

(0.053) |

(0.042) |

(0.043) |

(0.038) |

(0.041) |

(0.037) |

(0.038) |

|

|

TimeD

|

−0.046 |

−0.045 |

0.020 |

0.019 |

||||

|

(0.061) |

(0.062) |

(0.029) |

(0.028) |

|||||

|

CognD

|

0.109* |

0.109* |

−0.012 |

−0.012 |

||||

|

(0.066) |

(0.066) |

(0.033) |

(0.031) |

|||||

|

Value |

0.001 |

0.001*** |

0.001 |

0.001*** |

||||

|

(0.001) |

(0.001) |

(0.001) |

(0.000) |

|||||

|

Value

|

−3.44e-06 |

−4.11e-06 |

||||||

|

(8.62e-06) |

(9.27e-06) |

|||||||

|

Female |

−0.015 |

−0.025 |

−0.016 |

−0.024 |

||||

|

(0.030) |

(0.023) |

(0.031) |

(0.023) |

|||||

|

Switch point (H &L) |

−0.007 |

−0.008** |

−0.007 |

−0.008** |

||||

|

(0.006) |

(0.003) |

(0.006) |

(0.003) |

|||||

|

Value |

All |

All |

Value

|

Value

|

All |

All |

Value

|

Value

|

|

Observations |

2.339 |

2.339 |

1,172 |

1,172 |

2.339 |

2.339 |

1,172 |

1,172 |

|

Number of Subj. |

118 |

118 |

118 |

118 |

118 |

118 |

118 |

118 |

|

Post estimation tests (Wald tests) |

||||||||

|

(i)

|

|

|

|

|

||||

|

(ii)

|

|

|

|

|

||||

|

(iii)

|

|

|

|

|

||||

|

(iv)

|

|

|

|

|

||||

Robust standard errors in parentheses ***p < 0.01, **p < 0.05, *p < 0.1

(note: relative bid shading not defined for

![]() )

)

Result 3

Without prior experience in SPAs and for high values (larger than 50), bidders with higher cognitive ability tend to shade bids more than bidders with lower cognitive ability in FPAs. Experiencing SPAs eliminates this difference by reducing bid shading in FPAs among HC–bidders but not LC–bidders.

3.4 Potential cross-game learning mechanisms: experience in FPAs and bidding behavior in SPAs

So far, our results have shown that cognitive ability is a meaningful predictor of overbidding behavior by inexperienced bidders in SPAs (Result Footnote 1), but that experience in FPAs results in substantial cross-game learning that eliminates differences in overbidding rates among cognitively more and less able bidders (Result Footnote 2). In this section, we provide exploratory analyses on potential mechanisms for how dealing with FPAs may help to reduce overbidding by cognitively less able bidders in SPAs.

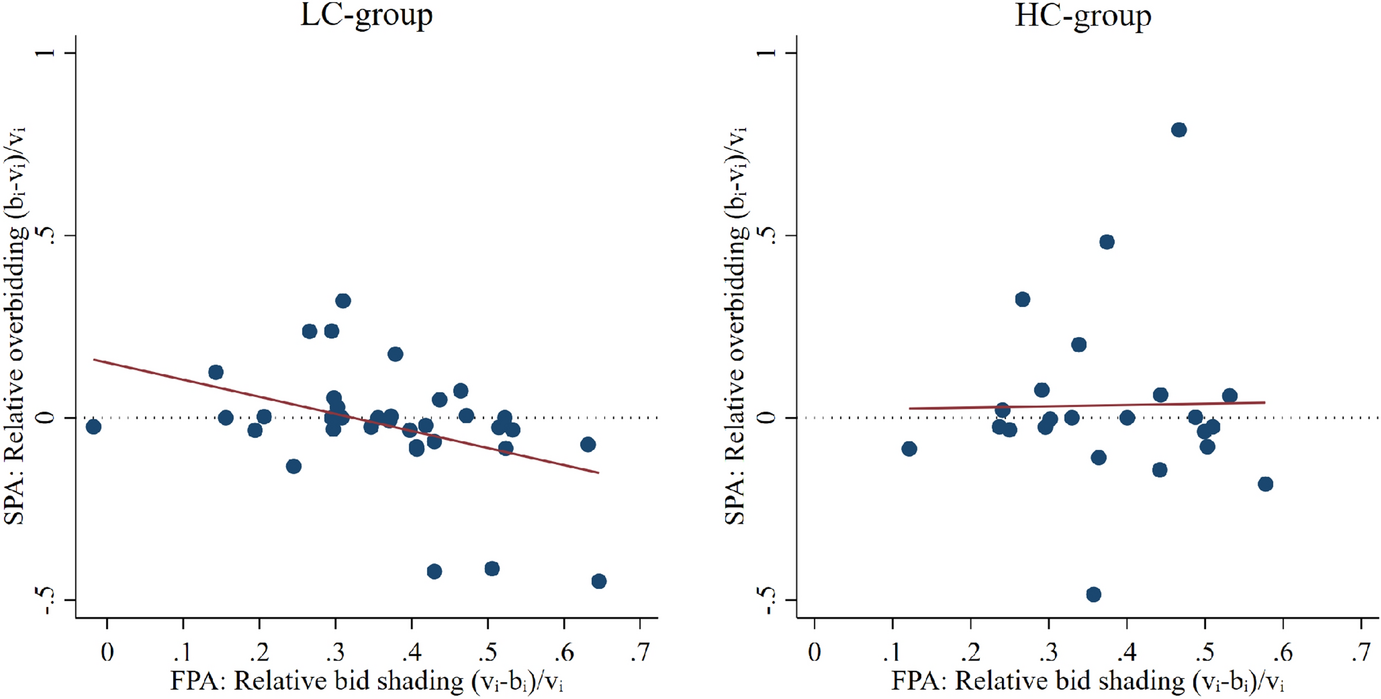

In a first step, we establish whether bidding behavior in FPAs systematically relates to bidding behavior in SPAs for the LC– and HC–groups. Afterwards, we study bidders’ experiences in FPAs in more detail and show how FPA experiences affect bidding behavior in SPAs. Figure 7 illustrates the relation of bid-shading behavior in FPAs and overbidding in SPAs for both cognitive groups.Footnote 16 As can be seen, LC–bidders’ behavior in the two auctions is systematically related while HC–bidders’ behavior is not (

![]() ,

,

![]() ,

,

![]() ,

,

![]() ).

).

We also relate each subject’s average relative overbidding,

![]() , in SPAs to the average profit achieved in the FPAs, or the percent of times the individual won an FPA (see Table A7 in the Appendix). The results show that LC–bidders who tend to bid high in FPAs also tend to bid high in SPAs. For HC–bidders, bidding behavior in FPAs does not strongly relate to their bidding in SPAs.

, in SPAs to the average profit achieved in the FPAs, or the percent of times the individual won an FPA (see Table A7 in the Appendix). The results show that LC–bidders who tend to bid high in FPAs also tend to bid high in SPAs. For HC–bidders, bidding behavior in FPAs does not strongly relate to their bidding in SPAs.

Fig. 7 Treatment FPA/SPA: Relative overbidding in SPAs and relative bid shading in FPAs (individual averages)

In a next step, we deepen the analysis regarding individual experience within FPAs and investigate to what extent experience in FPAs does affect bidding behavior in subsequent SPAs. To analyze individual experience in FPAs in more detail, we run random effects GLS regressions in which we estimate how participants adjust their bid shading within the 20 FPAs before they bid in SPAs. The complete regression analysis can be found in Table A6 in the Appendix. Mirroring earlier results from Table 3 in Sect. 3.3 that indicate that LC–bidders shade bids significantly more in the second as compared to the first half of bidding in FPAs (see the coefficient for TimeD in Table 3, specifications (2a)-(2c)), we find a positive time trend in bid shading within FPAs among the LC–group. LC–bidders also react systematically to the bids they have observed by others. They decrease (increase) their bids if they have observed lower (higher) bids by others in the previous period (or two periods ago), and hence systematically adjust their bids over time (specifications (2) and (3) in Table A6 in the Appendix). For the HC–group, we do not observe strong reductions in bid shading over time and no systematic reactions to others’ past bids (post-estimation Wald tests (iv) for specifications (2c) and (2d) in Table 3 and specifications (4) to (6) in Table A6 in the Appendix). We further find that LC–bidders systematically react to experiencing forgone profits within FPAs. Forgone profits may either occur when an auction is lost but the bidder could have profitably won the auction (by bidding higher) or when an auction was won, but the bidder could have achieved higher profits (by bidding lower). As forgone profits are endogenous (they depend on an individual’s bid in

![]() ), we instrument winning or losing with forgone profits in

), we instrument winning or losing with forgone profits in

![]() by the competitor’s bid in

by the competitor’s bid in

![]() in specifications (7)-(10) of Table A6 in the Appendix. This is reasonable, as the competitor, and thus her bids, was randomly assigned to the individual bidder. In doing so, we find systematic reactions to incurring forgone profits by the LC–group. LC–group bidders increase their bids if they could have profitably won the previous auction with a higher bid (specification (7) of Table A6 in the Appendix) and decrease their bids if they won the previous auction but could have won with larger profits by bidding lower (specification (8) in Table A6 in the Appendix). Again, such reactions are absent for the HC–group (specifications (9) and (10) in Table A6 in the Appendix). Hence, LC–bidders react substantially differently to experience than HC–bidders within FPAs.

in specifications (7)-(10) of Table A6 in the Appendix. This is reasonable, as the competitor, and thus her bids, was randomly assigned to the individual bidder. In doing so, we find systematic reactions to incurring forgone profits by the LC–group. LC–group bidders increase their bids if they could have profitably won the previous auction with a higher bid (specification (7) of Table A6 in the Appendix) and decrease their bids if they won the previous auction but could have won with larger profits by bidding lower (specification (8) in Table A6 in the Appendix). Again, such reactions are absent for the HC–group (specifications (9) and (10) in Table A6 in the Appendix). Hence, LC–bidders react substantially differently to experience than HC–bidders within FPAs.

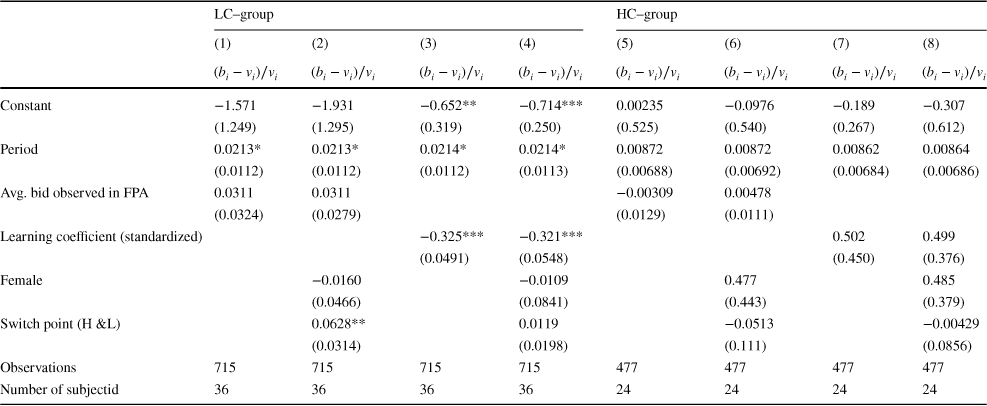

To analyze whether such reactions to experience in FPAs are also transferred to SPAs, we estimate a “learning coefficient” for each individual bidder. We do so by regressing (for each bidder) the relative bid shading on the lagged bid of their competitor (using data from 20 periods) and use the slope coefficient as an individual measure of how strongly the bidder “reacts” to a (randomly assigned) experience in the FPA when bidding in the SPA. In addition, we also consider the possibility of a simpler form of cross-game learning, namely, by studying whether the average competitors’ bid in FPAs affects subsequent bidding behavior of bidders in SPAs. Specifications (1) to (4) of Table 4 show how FPA experience affects bidding behavior in the SPA by the LC–group. Specifications (1) and (2) show that the average bid observed does not significantly affect LC–bidders’ behavior in SPAs (similarly when controlling for gender and risk preferences). Specifications (3) and (4) then relate the individual “learning coefficient” to bidding behavior in SPAs showing that stronger reactions to (randomly assigned) experience in FPAs indeed lowers relative overbidding,

![]() , in SPAs. A one standard deviation increase in the learning coefficient reduces relative overbidding by 0.32. Hence, LC–bidders who adjusted their initial bids the most within FPAs, overbid substantially less in SPAs. In specifications (5) to (8), we repeat this exercise for the HC–group, and find that experience in FPAs does not significantly affect their bidding in SPAs, neither when considering the average bid, nor when considering the “learning coefficient”. We summarize these findings in Result Footnote 4.

, in SPAs. A one standard deviation increase in the learning coefficient reduces relative overbidding by 0.32. Hence, LC–bidders who adjusted their initial bids the most within FPAs, overbid substantially less in SPAs. In specifications (5) to (8), we repeat this exercise for the HC–group, and find that experience in FPAs does not significantly affect their bidding in SPAs, neither when considering the average bid, nor when considering the “learning coefficient”. We summarize these findings in Result Footnote 4.

Result 4

LC-bidders’ bidding behavior in FPAs relates systematically to their bidding behavior in SPAs. LC-bidders who experience and learn from forgone profits within FPAs overbid less in subsequent SPAs. For HC-bidders, we do not find such systematic relations.

Table 4 SPA: Relative bid-value deviation in SPA after experiencing FPA; GLS regressions

|

LC–group |

HC–group |

|||||||

|---|---|---|---|---|---|---|---|---|

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

Constant |

−1.571 |

−1.931 |

−0.652** |

−0.714*** |

0.00235 |

−0.0976 |

−0.189 |

−0.307 |

|

(1.249) |

(1.295) |

(0.319) |

(0.250) |

(0.525) |

(0.540) |

(0.267) |

(0.612) |

|

|

Period |

0.0213* |

0.0213* |

0.0214* |

0.0214* |

0.00872 |

0.00872 |

0.00862 |

0.00864 |

|

(0.0112) |

(0.0112) |

(0.0112) |

(0.0113) |

(0.00688) |

(0.00692) |

(0.00684) |

(0.00686) |

|

|

Avg. bid observed in FPA |

0.0311 |

0.0311 |

−0.00309 |

0.00478 |

||||

|

(0.0324) |

(0.0279) |

(0.0129) |

(0.0111) |

|||||

|

Learning coefficient (standardized) |

−0.325*** |

−0.321*** |

0.502 |

0.499 |

||||

|

(0.0491) |

(0.0548) |

(0.450) |

(0.376) |

|||||

|

Female |

−0.0160 |

−0.0109 |

0.477 |

0.485 |

||||

|

(0.0466) |

(0.0841) |

(0.443) |

(0.379) |

|||||

|

Switch point (H &L) |

0.0628** |

0.0119 |

−0.0513 |

−0.00429 |

||||

|

(0.0314) |

(0.0198) |

(0.111) |

(0.0856) |

|||||

|

Observations |

715 |

715 |

715 |

715 |

477 |

477 |

477 |

477 |

|

Number of subjectid |

36 |

36 |

36 |

36 |

24 |

24 |

24 |

24 |

Robust standard errors in parentheses

Giebe et al.p < 0.01, **p < 0.05, *p < 0.1

3.5 Profits and (potential) benefits from cross-game learning

While in SPAs bidding behavior itself is indicative of bidders’ sophistication and profits, FPAs are strategically more complex, such that it is natural to study profits as a proxy for bidders’ sophistication in the FPA format. In our setting, a subject’s actual profit in each two-bidder auction depends not only on the sophistication of the own bid but to a large extent on the rival bid as well as on the random values drawn in each given auction. To analyze bidders’ sophistication in FPAs in greater detail, we calculate a subject’s hypothetical profit (in every single auction), as the profit that would have been obtained if the subject had bid against the average bid of all participants in the FPA (31.96). The idea is that each subject plays against a rival that, in each auction, is randomly drawn from the population of participants.Footnote 17 Descriptive statistics on average profits and standard deviations can be found in Table A8 in the Appendix.

Table 5 Regression results on hypothetical profits in FPAs and realized profits in FPAs and SPAs (GLS regressions), as well as total profits (SPA+FPA, OLS regressions)

|

Dependent variable |

(1a) |

(1b) |

(2a) |

(2b) |

(3a) |

(3b) |

(4a) |

(4b) |

|---|---|---|---|---|---|---|---|---|

|

Hyp. Profit: FPA |

Profit: FPA |

Profit:SPA |

Profit: Total |

|||||

|

Reference category |

LC–group (without CGL) |

LC–group (without CGL) |

LC–group (without CGL) |

LC–group (without CGL) |

||||

|

Constant |

10.78*** |

−8.971*** |

11.09*** |

−3.664*** |

14.42*** |

−10.29*** |

339.3*** |

415.5*** |

|

(1.074) |

(1.139) |

(1.196) |

(0.480) |

(1.433) |

(1.774) |

(15.31) |

(34.16) |

|

|

CognD (HC=1) |

2.934** |

1.682* |

1.154 |

0.201 |

1.562 |

1.697 |

7.611 |

1.471 |

|

(1.384) |

(0.992) |

(1.241) |

(1.065) |

(1.951) |

(1.534) |

(22.70) |

(21.46) |

|

|

CGL-D (SPA Exp.=1) |

−0.472 |

−1.034 |

−0.850 |

−1.344 |

2.545** |

3.070*** |

−134.6*** |

−138.8*** |

|

(1.439) |

(1.204) |

(2.018) |

(2.170) |

(1.233) |

(1.016) |

(28.37) |

(31.63) |

|

|

CognD

|

−1.623 |

−0.489 |

−0.915 |

0.118 |

−1.181 |

−0.860 |

−2.836 |

4.750 |

|

(1.134) |

(1.410) |

(1.462) |

(1.699) |

(1.480) |

(1.252) |

(24.19) |

(28.05) |

|

|

Value |

0.406*** |

0.336*** |

0.518*** |

|||||

|

(0.0128) |

(0.0155) |

(0.0103) |

||||||

|

Female |

−2.155*** |

−1.179 |

−0.171 |

−9.571 |

||||

|

(0.396) |

(0.853) |

(1.053) |

(22.70) |

|||||

|

Switch point (H &L) |

0.169 |

−0.195 |

−0.300* |

−12.05* |

||||

|

(0.164) |

(0.166) |

(0.180) |

(5.311) |

|||||

|

Observations |

2,360 |

2,360 |

2,360 |

2,360 |

2,360 |

2,360 |

118 |

118 |

|

Number of Subj. |

118 |

118 |

118 |

118 |

118 |

118 |

118 |

118 |

|

Post estimation (Wald) tests,

|

||||||||

|

|

|

|

|

|

|

|

|

|

Robust standard errors in parentheses

Giebe et al.p < 0.01, **p < 0.05, *p < 0.1

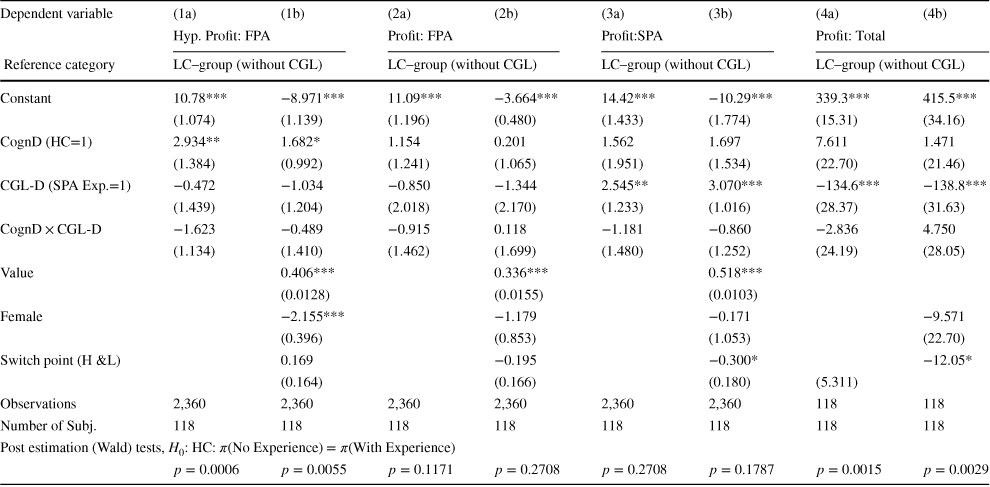

Table 5 reports the results from regressions on hypothetical profits in FPAs and realized profits in FPAs and SPAs, as well as total profits (SPA+FPA). The comparison of the hypothetical profits across treatments and cognitive groups in FPAs (see specifications (1a) and (1b)) reveal that, without experience, participants with high cognitive ability achieve significantly higher hypothetical profits in FPAs than participants with low cognitive ability. Interestingly, high-ability participants that bid in FPAs first (FPA/SPA) also earn more than the high-ability participants that bid in FPAs only after experiencing SPAs (see post-estimation Wald tests in specifications (1a) and (1b)). That is, highly cognitively able participants do not benefit in FPAs from cross-game “learning” through experience in SPAs. If at all, they achieve lower profits in FPAs when experiencing SPAs before bidding in FPAs, because SPA experience tends to reduce bid shading in FPAs for highly cognitively able bidders.Footnote 18

In SPAs, highly cognitively able participants do neither suffer nor benefit in terms of payoffs from experience in FPAs, whereas FPA bidding experience reduces overbidding in SPAs by subjects with lower cognitive ability and thereby increases their profits (see specifications (3a) and (3b)).

Finally, we compare total profit (FPA+SPA) between treatments. It turns out that both cognitive groups achieve higher profits in the treatment FPA/SPA, i.e., when FPAs are encountered first (see specifications (4a) and (4b)), but they do so for different reasons: Prior experience in SPAs reduces bid shading by the cognitively more able bidders such that they benefit from bidding in FPAs first. Cognitively less able bidders are not affected by experience in SPAs but benefit substantially from experience in FPAs before bidding in SPAs, as they transfer the idea of bidding lower from FPAs to SPAs. That is, overall we rather observe “cross-game transfer” of behavior than cross-game learning. From FPAs to SPAs, such transfer helps the LC-group to improve bidding quality in SPAs. From SPAs to FPAs, cross-game transfer appears irrelevant for the low cognitive group, but tends to be even counterproductive for the profits of HC-bidders.

Result 5

Expected profits of HC–bidders are higher than expected profits of LC–bidders in FPAs (with and without SPA experience). FPA experience before bidding in SPAs increases LC–bidders’ profits substantially. Overall, both cognitive groups achieve higher total profits when experiencing the FPA/SPA order (due to less overbidding in SPAs by LC–bidders and the tendency for more bid shading in FPAs by HC–bidders).

4 Discussion and conclusion

We study the role of cognitive ability, within-game learning, and cross-game learning for bidding behavior in first- and second-price sealed-bid private-value auctions. We first document that cognitive ability is indeed an important predictor of bidding behavior in auctions. Bidding quality in both, SPAs and FPAs, depends on cognitive ability: high-ability participants, when not having previous experience in other auction formats, exhibit less overbidding in SPAs and shade their bids more in FPAs than low-ability participants. Second, we complement previous findings on very limited within-game learning in SPAs. Within FPAs, we find that low-ability bidders learn to lower their bids when bidding repeatedly. Such learning within the set of FPAs is less pronounced for high-ability bidders who seem to know how to shade bids early on.

Inspired by the work of Kagel (Reference Kagel1995) on cross-game learning, we then study whether cognitively less able bidders can indeed compensate for the lack of cognitive ability by experiencing FPAs before bidding in SPAs. Although FPAs and SPAs are not strategically equivalent, we find that with previous FPA experience, low-ability bidders overbid substantially less, such that cognitive ability is not indicative of bidding quality in SPAs anymore. In contrast, experiencing SPAs before bidding in FPAs does not improve bidding quality (in terms of bid shading in FPAs) by low-ability bidders and, if at all, is irrelevant or even reduces bidding quality by high-ability bidders.

Our findings shed new light on the drivers of overbidding in SPAs. Several such drivers as well as potential means to reduce overbidding have been discussed in the literature. For example, Li (Reference Li2017) has argued that overbidding in SPAs may result from the fact that a cognitively limited agent may not recognize true-value bidding as the weakly dominant strategy in SPAs. We find, indeed, that cognitive ability is an important predictor of overbidding in SPAs without prior experience in other auction formats. In fact, one third of the LC–bidders never submit a bid equal to the own value. Hence, it is particularly cognitively less able bidders who misperceive the logic of SPAs. Further, Kagel et al. (Reference Kagel, Harstad and Levin1987) argued that overbidding in SPAs may occur due to an illusion that overbidding increases the probability of winning with often no immediate effects on profits. If so, rendering potential effects on profits more salient may reduce overbidding in SPAs. Experience in FPAs may not be a remedy for such an illusion in general. However, experience in FPAs may render potentially forgone payoffs from too high bids salient for cognitively less able bidders. Our findings highlight that cognitively less able inexperienced bidders respond strongly to experience in FPAs. They bid high in FPAs at the beginning but learn to reduce forgone profits by shading their bids more when bidding in FPAs repeatedly. Moreover, experience in FPAs is transferred to SPAs: a stronger reaction to experience in FPAs reduces overbidding in SPAs. As such it seems that experience in FPA does not increase the general understanding of the logic of SPA but rather provides low-ability bidders with a simple bidding rule to follow also in SPAs.

Interestingly, we also observe that high-ability bidders react when cross-game learning from SPAs to FPAs is possible. We find that bid shading in FPAs by high-ability participants is reduced after previous SPA experience. Here, a similar effect could be at play: prior experience of SPA bidding could induce an ‘excessive’ focus on the winning probability relative to the price being paid conditional on winning, leading to higher bids in the subsequent FPA. Given that bids in FPAs tend to be too high rather than too low (as compared to the risk-neutral benchmark) such an upwards adjustment of bids reduces participants’ expected profits.

Overall, our findings suggest that experiencing other auction formats before participating in an auction may be beneficial for some groups, but at the same time can also reduce bidding quality. Experience seems to render particular aspects of bidding strategies more salient and, as such, experience does not necessarily enable bidders to learn or better understand the underlying logic of alternative auction formats. Hence, rather than observing actual “cross-game learning”, we identify “cross-game transfer” of behavior as a potentially strong driver of subsequent bidding quality.

Supplementary Information

The online version contains supplementary material available at https://doi.org/10.1007/s10683-023-09789-8.

Funding

Open access funding provided by Linnaeus University.

(bi-vi)/vi

(bi-vi)/vi

(vi-bi)/vi

(vi-bi)/vi