1 Introduction

We define a family as a household consisting of two adults with at least one child. When there are no children we refer to the household as a couple. Households with only one individual we call singles. We think it fair to say that most of theoretical tax policy analysis takes singles as the basic behavioural unit, though often referring to ‘the household’ in general, and this reflects the historical roots of models of economic decisions in economic theory.

Despite the fact that the large majority of taxpayers live in couple or family households, family taxation occupies a rather peripheral place in the optimal income tax literature. It is usually viewed as dealing with specialised issues such as the design of transfer payments for families with young children, or the supposed impossibility of having a tax system with the three properties of: not distorting the decision on whether to get married; exhibiting marginal rate progressivity; and satisfying a condition for horizontal equity which claims that households with the same incomes should pay the same amount of tax. The first of these is very important, the second requires further discussion in countries in which cohabitation without marriage is becoming relatively common, and the third is simply a fallacy: horizontal equity does not require equal taxation of equal household incomes, because household income is an inaccurate measure of a household’s standard of living.

In fact, we would argue, analysis of family taxation is of central importance to tax policy, concerning as it does the fundamentals of the design of the income tax system, and such issues as whether or not indirect taxation should be included in an optimal tax system, and if so how.

Occam’s Razor is quite rightly a much-prized instrument in economic analysis: why complicate models with details that add nothing to the fundamental insights? This could be put forward as a rationalisation for ignoring the real nature of family households. Unfortunately this does not stand up against the arguments we will present here. Although there is absolutely no doubt that the body of theory developed for singles offers many insights and methods of analysis that are of great use in the theory of family taxation, there are important questions to which it gives no answers, or worse, implies misleading policy recommendations. One example of this is the proposition that indirect taxation, if it is used at all, should optimally be at a uniform rate. However the Atkinson and Stiglitz (Reference Atkinson and Stiglitz1976) Theorem and more recent developments related to it show that this does not hold in general for family households.

There are two basic reasons for taking the family household as the behavioural unit for the economic analysis of taxation. The first was pointed out by Paul Samuelson in his classic paper on social indifference curves.Footnote 1 Economic models give primacy to the well-being of individuals, and these are still the basic units of analysis, but many households consist of at least two individuals and so individual outcomes are mediated through joint decision taking. Households should best be thought of as social groups. Though they disagreed profoundly on details, both Samuelson and Gary Becker, usually regarded as the founder of modern family economics, agreed entirely on that point.

The second reason is the economic significance of household production, the use of household members’ time and bought-in resources to provide goods and services for within-household consumption, such as child care, food preparation, financial planning, in-house entertainment, as well as all those necessary chores such as shopping, cleaning and doing laundry that perhaps many of us prefer not to think about. Time use studies show that household production is a very substantial, untaxed use of individuals’ time and budget studies show that it involves a significant amount of their expenditure.Footnote 2 Gayle and Shephard (Reference Gayle and Shephard2019) provide an innovative analysis of optimal taxation by integrating a marriage market model with a collective household model in which individuals allocate their time between market work, household production and leisure activities.

The principle of Occam’s Razor could suggest that this alone is not a reason for including household production explicitly in a model. Why not simply bundle household production with leisure time and stick with the formulation of individual utilities as functions of consumption and leisure, thus augmented? This has in fact been standard practice even in family economics. There are three main arguments against doing this, which we find convincing.

First is the considerable heterogeneity in second earner market labour supply. In recognition of the fact that in many countries there is still a significant degree of specialisation in household vs market work, we define the primary earner as the one who is more specialised in market work while the second earner does relatively more of the household production. It has become less accurate to define the two roles strictly in terms of gender, even if it may sometimes be convenient to do so. In the days when the traditional pattern of specialisation prevailed, where the husband went out to work and the wife stayed at home and did virtually all the household production, the labour supply decisions of the household relevant to tax analysis could reasonably be modelled as if it were a single individual. But since the 1950s and 1960s this pattern has been displaced by one in which the density function of hours worked by second earners on the interval from zero to full-time is not far off from uniform, with spikes at zero and full-time.Footnote 3

Why should that matter? In a nutshell, because it implies that the joint labour earnings of a couple are no longer a reliable indicator of the level of well-being of the household members. This is determined in the aggregate by the sum of labour earnings and value of household production, just as the GDP of a country is determined by the value of its exports and domestically produced non-traded goods. Although it could be argued that this ‘household GDP’ is not the sole determinant of household well-being, just as in the case of countries, we would argue that it is a far better measure than household joint income.

This is one important reason for the claim that horizontal equity, if it is meant to apply to individual well-being no longer implies that households with the same joint market incomes are equally well off. At any given wage pair, market income and the time a second earner spends in household production are typically inversely related. Two couples with the same household income, one with a single-earner and the other with two earners, are unlikely to be equally well off. The latter household is very likely to have both lower consumption of household goods and less leisure time, and some of its expenditure has to be diverted to substitutes for home production. This must have an impact on the equity-efficiency trade-offs at the core of optimal tax analysis. The question of how the existence of significant levels of second earner labour supply and the income it generates should be taken account of in the tax system is an important one, and has strong implications for both across-household and within-household distributions of well-being.

Looked at from a somewhat different angle, if one individual in a couple has a close to zero income from market labour supply but a consumption level of market goods much higher than her earnings, then in a model without household production this must be regarded as resulting from an altruistic transfer from the primary earner, whereas in a model with household production, it can be seen as the outcome of the fundamental economic principle of specialisation and exchange. Such differences in perception should not be regarded as trivial. They are also relevant for tax analysis. Another, somewhat more sophisticated example of the potentially misleading effects of ignoring household production, discussed in Section 4, is the proposition that women’s labour income should be taxed more heavily than men’s because, if they have less bargaining power in the household than the planner would like, then they are receiving too little leisure and therefore spending too much time in market work than is socially optimal. Being taxed out of the labour market is doing women a favour. This argument fails if the lack of bargaining power is reflected in having to specialise in household production and so supply less time to the market than the household might wish, an effect that is likely to be magnified by higher taxes on women as second earners.

The second reason for taking household production seriously is its implication for labour supply elasticities, a sufficient statistic central to optimal tax analysis. Why do women on average have much higher labour supply elasticities than men, whether at the intensive or the extensive margin? At the intensive margin, why would a second earner with the same wage as another and in a household with the same demographic characteristics supply far fewer hours in the labour market? In a model without household production, the usual answer is leisure preferences, since labour supply is determined by the marginal rate of substitution between leisure and consumption or income. Then a similar issue arises as in the case of singles: why should a household with higher labour income make a transfer to one with a lower income if the reason for the difference results simply from a stronger preference for leisure?

In a model with household production, on the other hand, the higher elasticity of market labour supply is simply explained by the fact that the second earner has a margin of substitution between work in the household and work in the market that exerts a stronger influence on labour supply choices for her than for the primary earner. Moreover, a difference in market labour supply between second earners in different households can be explained in terms of the feasible set: the households’ elasticities of substitution between the second earner’s time and bought-in inputs may differ because of differences in productivities, and/or there may be differences in prices and quality of bought-in inputs such as child care, differences in the wage rate of the primary earner and associated differences in demand for household goods. Welfare comparisons based on differences in market labour supplies between households arising from differences in feasible sets do not raise the same conceptual issues as differences due to preferences.

At the extensive margin, the usual explanation for non-participation in the labour market is the (assumed) fixed cost of work, for example commuting costs, the cost of work clothing, and so on. Sometimes foregone household production is also suggested, but it is a mistake to consider this only as a fixed cost. For example, with children in the household of an age at which they still require care, each hour the second earner spends in market work must be replaced by an hour’s child care, and if that has to be bought in then the cost acts more like a tax per unit of labour supply than a fixed cost. Moreover, the costs associated with substituting bought-in market inputs for parental time can vary substantially across households, as exemplified again by child care: the hourly cost may vary from the opportunity cost of the time of a grandparent or other family member, through fees for child-minders or child-care centres, to the services of a posh nanny, with associated variations also in child care quality. Such quality-adjusted costs, and their variation across households, should not be ignored in the analysis of family taxation.

A more fruitful approach to the extensive margin question is not, we would argue, to regard it as a discrete choice between work or leisure, but rather as an allocation of non-leisure time between two types of work, in the household and in the labour market. An insight that results from this approach is that, if the household optimum is at a corner solution in its time allocation problem, the market wage that may be estimated for a (potential) second earner with a zero market labour supply is only a lower bound to her marginal value product in household production.

Finally, a third reason for taking household production seriously relates to the methodology of optimal tax analysis itself. Given the way this methodology has developed over the past four or five decades, there is something of a stumbling block created by the fact that the household has multiple dimensions of private information. There is not just the one dimension emphasised by James Mirrlees (Reference Mirrlees1971) – innate ability as possibly reflected in the (unobservable) wage rate – though restricting attention simply to this already implies that a couple household must then have at least two dimensions of private information, which, as we show in Section 4, is a challenge to modelling the tax system. As we argue in greater detail in Section 3, the mechanism design approach is faced with a multidimensional screening problem the solutions of which are complex, not very robust to reasonable variations in assumptions, and not obviously applicable to real tax structures. Our conclusion from that, developed in Section 3, is that piecewise linear income taxation systems of the kind universally existing in reality should be at the forefront of the analysis.

The aim of all tax systems is to shift resources out of the ownership of private individuals so that they can be allocated to meet the purposes of government. In a monetary economy this is best done by monetary means, and so setting labour incomes as the tax base is an obvious place to start, even if that leaves a lot more to be said about the full set of possible tax instruments. In analysing how the income of family households should be taxed there are two basic modelling choices to be made: the choice of the behavioural model which specifies how the household responds to taxes and the choice of the income tax system. Here, we survey the theoretical work published over the period from the mid-1980s to the mid-2010s that has applied the main forms of optimal income tax analysis – optimal linear, piecewise linear and non-linear taxation – to family taxation. In the course of doing that we discuss the household models that have mainly been used as the basis for the analysis of the behavioural responses to taxation.

2 Linear Income Taxation

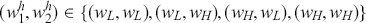

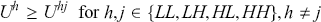

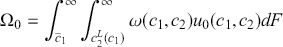

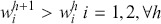

We denote the adult individuals in a given household by ![]() , the primary and second earners respectively,Footnote 4 and the households themselves by

, the primary and second earners respectively,Footnote 4 and the households themselves by ![]() . The tax base consists of the incomes of the wage earners in the households,

. The tax base consists of the incomes of the wage earners in the households, ![]() , where

, where ![]() is labour supply and

is labour supply and ![]() the pretax wage rate. In defining primary and second earners we assume that

the pretax wage rate. In defining primary and second earners we assume that ![]() and

and ![]() implying

implying ![]() . Wage rates are strictly positive and are defined on closed intervals

. Wage rates are strictly positive and are defined on closed intervals

![]()

![]() . In models that ignore household production,Footnote 5 a household type is usually defined by its wage pair

. In models that ignore household production,Footnote 5 a household type is usually defined by its wage pair ![]() . There is at each

. There is at each ![]() a distribution of second earner wage rates conditional on

a distribution of second earner wage rates conditional on ![]() with support

with support ![]()

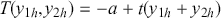

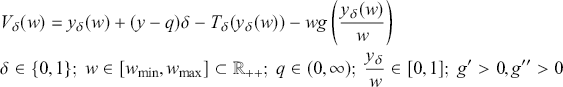

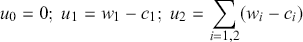

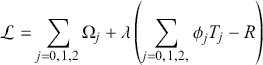

Under a system of linear joint taxation, we represent the household’s tax function as:

(1)

(1)

where ![]() often called the ‘demogrant’, is a lump sum transfer to the household and

often called the ‘demogrant’, is a lump sum transfer to the household and ![]() is the marginal tax rate (MTR). Three obvious properties of linear joint taxation are: first, that the MTRs facing individuals in the household are equalised; second, that the household’s tax burden is strictly increasing in the tax rate and its joint income; and third, that the total tax paid is the same for all households with the same joint income, regardless of the composition of this sum as between the individual incomes, as well as of any other of the household’s characteristics. Note that in tax systems where the tax rate increases with joint income, there is a fourth key property of joint taxation: the tax rate paid by one individual may increase with the income of the other, to an extent dependant on the size of the income difference and the degree of progressivity of the tax rates. This is often referred to as the positive jointness property.

is the marginal tax rate (MTR). Three obvious properties of linear joint taxation are: first, that the MTRs facing individuals in the household are equalised; second, that the household’s tax burden is strictly increasing in the tax rate and its joint income; and third, that the total tax paid is the same for all households with the same joint income, regardless of the composition of this sum as between the individual incomes, as well as of any other of the household’s characteristics. Note that in tax systems where the tax rate increases with joint income, there is a fourth key property of joint taxation: the tax rate paid by one individual may increase with the income of the other, to an extent dependant on the size of the income difference and the degree of progressivity of the tax rates. This is often referred to as the positive jointness property.

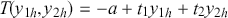

We take as the alternative to joint taxation the case of individual taxation, where the tax base is individual incomes and the tax rates on primary and second earners are allowed to differ. In that case the household’s tax function is:

(2)

(2)

with  The two key properties therefore are that the tax rate of one earner is not directly affected by variations in the tax rate of the other, and that a household may have the same or higher joint income than another but be paying less tax, depending on the tax rates and the composition of the household’s income as between the earnings of the two individuals. A further very important property in tax systems in which the tax rates increase with income is that the tax rate of one individual is unaffected by a change in the income of the other – there is zero jointness.

The two key properties therefore are that the tax rate of one earner is not directly affected by variations in the tax rate of the other, and that a household may have the same or higher joint income than another but be paying less tax, depending on the tax rates and the composition of the household’s income as between the earnings of the two individuals. A further very important property in tax systems in which the tax rates increase with income is that the tax rate of one individual is unaffected by a change in the income of the other – there is zero jointness.

In the early 1970s a debate began in the USA around the question of whether the prevailing system of joint taxation should be replaced by an individual tax system. The main argument of the economistsFootnote 6 in favour of the latter was that the labour supply elasticities for women were much higher than for men and so standard efficiency considerations based on the Ramsey Rule would suggest that women should be taxed at lower rates.

Proponents of joint taxation have on the other hand put forward essentially three arguments. The earliestFootnote 7 asserted that household members share their incomes equally, and therefore the commonly used form of joint taxation known as income splitting, under which the tax base is ![]() puts each member of a two-earner household on the same footing as singles with the same income taxed at the same rate. A problem for this view is however that what evidence there is on the allocation of household income to the individual consumption expenditures of its membersFootnote 8 suggests that a large proportion of total expenditure, around 60–70 per cent, is reported as ‘for the household’. It is tempting to regard this as funding ‘household public goods’, but this does not correctly characterise a lot of this expenditure since the goods concerned, for example food, drink and tobacco, are both rival and excludable. Even if they were public goods in the strict sense, that would still not imply that the household members derive equal well-being from them. The proportions of the shares in the remaining assignable expenditure going to individual earners, even if they do have a mean close to 50 per cent,Footnote 9 has a very large variance across households.

puts each member of a two-earner household on the same footing as singles with the same income taxed at the same rate. A problem for this view is however that what evidence there is on the allocation of household income to the individual consumption expenditures of its membersFootnote 8 suggests that a large proportion of total expenditure, around 60–70 per cent, is reported as ‘for the household’. It is tempting to regard this as funding ‘household public goods’, but this does not correctly characterise a lot of this expenditure since the goods concerned, for example food, drink and tobacco, are both rival and excludable. Even if they were public goods in the strict sense, that would still not imply that the household members derive equal well-being from them. The proportions of the shares in the remaining assignable expenditure going to individual earners, even if they do have a mean close to 50 per cent,Footnote 9 has a very large variance across households.

The second argument is based on the issue of horizontal equity among households (already alluded to in the Introduction). Suppose there is a linear joint income tax system. Household A has two earners working full time and earning $48,000 and $42,000 respectively, household B has only the primary earner in the labour market earning $48,000. If it is assumed that income is shared equally within households and that labour market income is taken as the measure of individual well-being, then the two individuals in A are much better off and therefore should, and in joint taxation systems do, pay more tax. But this is assuming that the second earner in B is making no contribution to household well-being. If however she is engaged in household production she could be producing (untaxed) goods and services, for example child care, which could be at least as valuable to the household as the labour market income earned by the second earner in A. At root, the income splitting argument is ignoring the issues raised by the wide variance in second earner labour supply across households and the significance of household production.

The main general message from the example is that joint labour income is an unreliable index of well-being primarily because across the equilibrium allocations of the population of households, individual well-being and household income may not necessarily show a monotonically increasing relationship.Footnote 10 If we change the example to the case in which the primary earner in household B earns $90,000 a year it is very hard, for the same reason as before, to believe that the households are equally well off. It also suggests that we need to find an explanation of across-household heterogeneity of second earner labour supply that is relevant to the analysis of optimal income taxation.

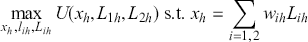

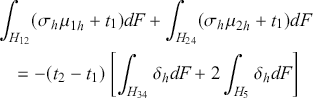

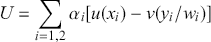

The third argument is equally problematic, and is directed at a supposed advantage of joint over individual taxation in terms of within-household economic efficiency. To discuss this we need a model of the household, so we take the simplest possible one, the so-called ‘unitary model’. Define the household utility maximisation problem as:

(3)

(3)

![]() has all the properties of a standard individual utility function, it treats the household as an individual with two forms of labour supply. The price of the numéraire composite consumption good

has all the properties of a standard individual utility function, it treats the household as an individual with two forms of labour supply. The price of the numéraire composite consumption good ![]() is normalised to 1 so wages are in units of consumption. Then under linear joint taxation the first order conditions (FOC) for this problem, assuming an interior solution with both

is normalised to 1 so wages are in units of consumption. Then under linear joint taxation the first order conditions (FOC) for this problem, assuming an interior solution with both ![]() yield the condition:

yield the condition:

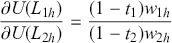

(4)

(4)

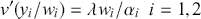

whereas under gender-based taxationFootnote 11 with rates ![]() we would have

we would have

(5)

(5)

which, if ![]() implies that the choice of labour supplies in the household does not satisfy the condition for Pareto efficiency, whereas under joint taxation it does. Thus at any tax revenue requirement joint taxation must imply a smaller deadweight welfare loss. The problem with this argument is that it ignores the well-known Theorem of the Second Best, which tells us that in an economy with an irremovable Pareto inefficient distortion in one sector, in this case in the labour market, it will in general be second best optimal to have compensating distortions in related sectors, in this case the within household labour supply allocations. To find out what really is optimal we have to carry out the optimal tax analysis, allowing tax rates to differ.

implies that the choice of labour supplies in the household does not satisfy the condition for Pareto efficiency, whereas under joint taxation it does. Thus at any tax revenue requirement joint taxation must imply a smaller deadweight welfare loss. The problem with this argument is that it ignores the well-known Theorem of the Second Best, which tells us that in an economy with an irremovable Pareto inefficient distortion in one sector, in this case in the labour market, it will in general be second best optimal to have compensating distortions in related sectors, in this case the within household labour supply allocations. To find out what really is optimal we have to carry out the optimal tax analysis, allowing tax rates to differ.

Boskin and Sheshinski (Reference Boskin and Sheshinski1983) were the first to apply the formal optimal taxation methodology to the issue of family taxation. Their starting point was the intuition suggested by the Ramsey condition, as just noted. They first show in a representative household model that the Ramsey proposition holds under a specific, quite plausible assumption: if the compensated cross elasticities between the primary and second earners’ labour supplies are sufficiently small relative to their own compensated elasticities that they can be set to zero,Footnote 12 then the Ramsey result holds: second earners should have a lower tax rate because of their higher compensated own-elasticity.

However, as we know from the standard analysisFootnote 13 an optimal linear tax system depends on considerations of both efficiency and equity, and their formal optimal tax analysis, which extends optimal linear tax theory to the case of couple households, does not show conclusively that the undeniable efficiency gains in switching from a joint to an individual tax system necessarily outweigh the possibility that on equity grounds it may be optimal to have a higher tax on female labour supply. As Apps and Rees (Reference Apps and Rees1999) show, in a tax reform analysis with a revenue-neutral switch from joint to individual taxation, if the marginal tax rate on second earners falls while that on primary earners rises, households with a high second earner labour supply gain and those with a low-to-zero second earner labour supply may lose. This follows because in a model without household production, as in Boskin and Sheshinski, in equilibrium household utilities across households increase monotonically with joint income, and so single earner households will tend to be among the worst off and therefore may have relatively high social welfare weights. Boskin and Sheshinski’s analysis in fact has the general result that second earner tax rates could optimally be higher or lower than those on primary earners, which at least implies that the case in which tax rates are equalised, that is joint taxation, is a very special case. Their conclusion that the tax rate on second earners should be lower than that on primary earners is based on a numerical version of their model which has standard assumptions on utility and labour supply functions and is calibrated on the then available data. We now discuss these results a little more formally.

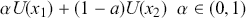

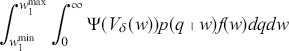

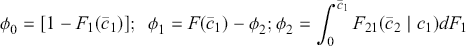

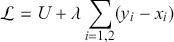

Note first that the solution of the problem in (3) with ![]() yields the standard indirect household utility functions

yields the standard indirect household utility functions ![]() Given a joint density function

Given a joint density function ![]() , strictly positive everywhere on

, strictly positive everywhere on ![]() , the optimal tax problem becomes:

, the optimal tax problem becomes:

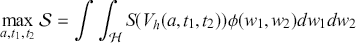

(6)

(6)

subject to:

(7)

(7)

where ![]()

![]() is a per capita revenue requirement.

is a per capita revenue requirement.

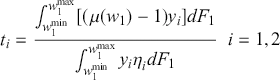

Although the Boskin/Sheshinski paper gives the first order conditions for this problem, such is the level of generality that these do not as they stand add any real insights. They certainly do not at this level of generality allow a proof that an optimum implies ![]() Boskin/Sheshinski therefore make the assumption of perfect assortative matching, with

Boskin/Sheshinski therefore make the assumption of perfect assortative matching, with ![]() and

and ![]() strictly increasing and differentiable. In that case they can reduce the problem to one dimension, with

strictly increasing and differentiable. In that case they can reduce the problem to one dimension, with ![]() and rewrite it as

and rewrite it as

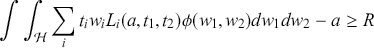

(8)

(8)

where ![]() is the distribution function for

is the distribution function for ![]() with support

with support ![]()

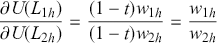

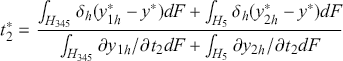

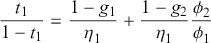

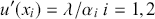

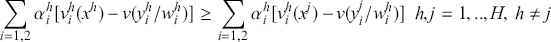

The first order conditions of this problem yield, after replacing the uncompensated derivatives with the corresponding Slutsky equations and rearranging terms:

(9)

(9)

where ![]() is the marginal social utility of income of household

is the marginal social utility of income of household ![]() with a mean value of 1, the

with a mean value of 1, the ![]() are the compensated elasticities of labour supply with respect to the tax rate and the numerator is the covariance of the household’s net marginal social utility of income with income, which on Boskin/Sheshinski’s assumptions is also negative. Although, other things being equal, the ratio

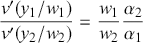

are the compensated elasticities of labour supply with respect to the tax rate and the numerator is the covariance of the household’s net marginal social utility of income with income, which on Boskin/Sheshinski’s assumptions is also negative. Although, other things being equal, the ratio ![]() will be higher the larger the ratio

will be higher the larger the ratio ![]() across the wage distribution, we still have some work to do to understand why we should have

across the wage distribution, we still have some work to do to understand why we should have ![]() . Note that for

. Note that for ![]() the higher absolute value of the deadweight loss term has to be exactly offset by a higher absolute value of the covariance of the marginal social utility of the household income with individual income, so joint taxation is strictly optimal only in a knife-edge case.

the higher absolute value of the deadweight loss term has to be exactly offset by a higher absolute value of the covariance of the marginal social utility of the household income with individual income, so joint taxation is strictly optimal only in a knife-edge case.

In the literature on optimal linear income taxation it is usual to regard the expression in the denominator as a measure of the efficiency effect of the tax, while the numerator can be viewed as measuring the distributional effect. The optimal tax trades off the marginal redistributive power of the tax against its marginal efficiency cost. If the tax on women’s income is both less powerful as a redistributive instrument and more costly, that would pretty well clinch the Boskin/Sheshinski argument. Given their assumption of perfect assortative matching, and the fact that the gender wage gap widens as we move up through the income distribution, we can construct a simple argument that shows just that.

For simplicity, suppose that ![]()

![]() Then we can write:

Then we can write:

(10)

(10)

With ![]() across all households the inequality must then hold. Intuitively, with perfect assortative matching the tax rate

across all households the inequality must then hold. Intuitively, with perfect assortative matching the tax rate ![]() cannot be a sufficiently more powerful instrument of redistribution across households than

cannot be a sufficiently more powerful instrument of redistribution across households than ![]() to offset the higher deadweight loss associated with the latter.

to offset the higher deadweight loss associated with the latter.

We cannot really say more at this point than that the Boskin/Sheshinski analysis, given its assumptions, supports the conjecture that individual taxation is welfare superior to joint taxation, but further work is necessary. In particular, we need to test the robustness of that conclusion by considering tax systems that have structures closer to those of real tax systems. This is the subject of the next section.

3 Piecewise Linear Income Taxation

In most of the countries in the world that have income tax systems, the formal structure of these is piecewise linear. That is, the income tax base is partitioned into tax brackets within each of which there is a given, constant tax rate,Footnote 14 and these usually increase as we move upward through the income distribution (marginal rate progressivity). An individual’s marginal tax rate is that of the highest bracket their income reaches. Income in the lower, intramarginal brackets is taxed at the rates corresponding to those brackets. The main reason for extending the analysis of linear taxation is that, as well as its being more relevant for real-world tax systems, we can now take into account the issue of marginal rate progressivity and the structure of the tax system more generally.

This fairly simple structure is however usually complicated by what are effectively income taxes or subsidies from other parts of the public finance system. For example, in some countries such as the US and UK low wage workers receive supplements to their earned income. More generally, families with children may receive child benefits that are withdrawn as a function of some income measure above a certain level, and social insurance contributions and/or benefits may be related to income and so are in effect part of the income tax system. The complexities in the system are usually caused by the wish to ‘tag’ certain groups of households with readily identifiable characteristics, but this still leaves large groups of people, with varying abilities to earn income, facing the same marginal tax rates. Footnote 15 In the rest of this section, we work with a fairly simple two-bracket piecewise linear system. Here, we continue to focus on the issue of joint vs. individual tax bases.

From the point of view of optimal tax analysis, the essential property of all these systems, however complicated, is that they induce a pooling equilibrium on the set of household types: households with different characteristics that are relevant to their tax treatment, but whose income puts them in the same marginal tax bracket, face the same rate. This is in sharp contrast to the non-linear tax systems studied in the next section, where an essential part of the model structure is a set of incentive compatibility constraints designed to ensure a separating equilibrium of types – each type has in general its own marginal tax rate and lump sum. This creates important differences both in the interpretation and in the empirical applicability of the two types of model. It can be shown that a non-linear tax system is welfare superior to a linear tax system over a given population of wage earners,Footnote 16 but the empirical significance of this difference is unclear in the case of a piecewise linear system with a sufficiently large number of brackets.Footnote 17

As well as the issue of the choice of tax base as between joint and individual incomes, also central is the structure of the rate scale, in particular whether the marginal tax rates applying to successive income brackets should be strictly increasing, or whether over at least some income ranges they should be decreasing. We refer to these as the convex and nonconvex cases respectively, to describe the types of budget sets in the gross income-net income/consumption plane to which they give rise. For the purposes of this Element, we focus on the convex case of a two-bracket piecewise linear system.Footnote 18

By individual taxation we now mean the case in which the individual earners’ incomes are taxed separately but according to the same tax schedule. This differs therefore from tax systems with rate structures that differentiate between primary and second earners, which we term here ‘selective’. The main reason for constraining the rate schedules to be identical under individual taxation is that in practice, piecewise linear tax systems that are not joint are in fact overwhelmingly of this kind. Moreover, if individual taxation yields higher social welfare than joint taxation under realistic assumptions, this result applies a fortiori to selective taxation, since removing the constraint that tax schedules must be identical cannot reduce the maximised value of social welfare and would be expected to increase it.Footnote 19

The approach we adopt is the standard one of characterising the sufficient statistics that determine in general terms the optimal values of the instruments in the taxation system.Footnote 20 These are the marginal social utilities of income and the derivatives of labour supplies or incomes with respect to the tax instruments at the optimal tax system. This allows us to make qualitative statements about the differences between the two systems. To do this, all we need to know about the households’ preferences are their indirect utility functions defined on the variables defining the instruments of tax system, which we denote by ![]() , and a social welfare function of the usual kind

, and a social welfare function of the usual kind ![]() However, it also has to be kept in mind that underlying these derivatives and determining their values, implicitly or, preferably, explicitly, is a behavioural model of the household. In particular, any attempt to provide empirical estimates of the sufficient statistics for a discussion of actual tax policy must be based on such a model, and the one selected will have a crucial impact on the results. We consider this point further after we have set out the optimal tax analysis in the following two subsections.

However, it also has to be kept in mind that underlying these derivatives and determining their values, implicitly or, preferably, explicitly, is a behavioural model of the household. In particular, any attempt to provide empirical estimates of the sufficient statistics for a discussion of actual tax policy must be based on such a model, and the one selected will have a crucial impact on the results. We consider this point further after we have set out the optimal tax analysis in the following two subsections.

3.1 Joint Taxation

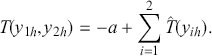

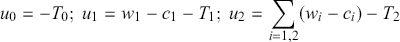

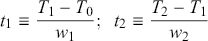

There is a two-bracket piecewise linear taxFootnote 21 on total household labour earnings, defined by the vector ![]() where

where ![]() is the uniform lump sum paid to every household,

is the uniform lump sum paid to every household, ![]() ,

, ![]() are the marginal tax rates in the lower and upper brackets of the tax schedule, and

are the marginal tax rates in the lower and upper brackets of the tax schedule, and ![]() is the value of joint earnings defining the bracket limit. The household tax function is

is the value of joint earnings defining the bracket limit. The household tax function is ![]() with

with ![]() This tax function is given by:

This tax function is given by:

(11)

(11)

(12)

(12)

Given that all households face this identical budget constraint, the optimal income ![]() for any one household must be in one of three possible subsets, which give a partition

for any one household must be in one of three possible subsets, which give a partition ![]() of the set

of the set ![]() defined as follows:

defined as follows:

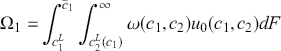

(13)

(13)

(14)

(14)

(15)

(15)

A household’s optimum income may be either in the lower tax bracket, or at the kink in the budget constraint defined by the bracket limit ![]() or in the upper tax bracket. The assumption of a continuum of households and continuity of utility functions implies that there is necessarily ‘bunching’ at the kink, in the sense that a non-empty subset of households is in the position whereby they would increase their labour supply at the tax rate

or in the upper tax bracket. The assumption of a continuum of households and continuity of utility functions implies that there is necessarily ‘bunching’ at the kink, in the sense that a non-empty subset of households is in the position whereby they would increase their labour supply at the tax rate ![]() but do not want to do so at the tax rate

but do not want to do so at the tax rate ![]() In all of what follows we assume that we are dealing with tax systems in which each of these subsets is non-empty. Total household gross and net income are increasing continuously as we move from

In all of what follows we assume that we are dealing with tax systems in which each of these subsets is non-empty. Total household gross and net income are increasing continuously as we move from ![]() to

to ![]() and from

and from ![]() to

to ![]() while they are both constant in

while they are both constant in ![]() (though of course individual incomes in these households may vary across households, as long as they sum to

(though of course individual incomes in these households may vary across households, as long as they sum to ![]() ).

).

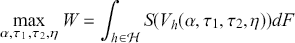

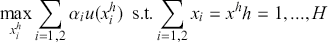

3.1.1 Optimal Tax Analysis

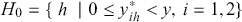

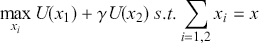

We assume that the household utility functions are quasilinear (though essentially this just simplifies interpretation of the results). Given the household indirect utility functions ![]() the planner solves

the planner solves

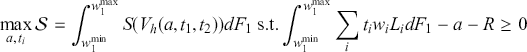

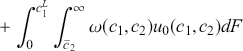

(16)

(16)

subject to the public sector budget constraint

(17)

(17)

where ![]() is a strictly concave and increasing function expressing the planner’s distributional preferences over household utilities. We assume the aim of taxation is purely redistributive. Of course, exactly which households will be in which subsets is determined at the optimum, and depends on the values of the tax parameters. The following discussion characterises the optimal solution given the allocation of households to subsets that obtains at this optimum.

is a strictly concave and increasing function expressing the planner’s distributional preferences over household utilities. We assume the aim of taxation is purely redistributive. Of course, exactly which households will be in which subsets is determined at the optimum, and depends on the values of the tax parameters. The following discussion characterises the optimal solution given the allocation of households to subsets that obtains at this optimum.

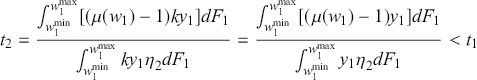

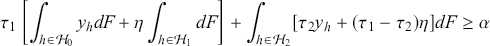

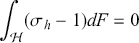

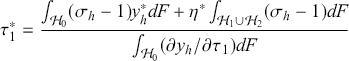

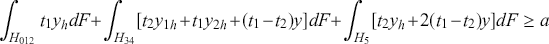

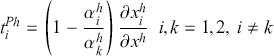

From the first order conditions characterising the optimal tax variables we can derive the conditions:

(18)

(18)

(19)

(19)

(20)

(20)

(21)

(21)

Condition (18) follows from the quasilinearity of the utility functions and is familiar from linear tax theory: with ![]() the shadow price of the government budget constraint,

the shadow price of the government budget constraint, ![]() is the marginal social utility of income to household

is the marginal social utility of income to household ![]() in terms of the numeraire, consumption, and so the optimal lump sum

in terms of the numeraire, consumption, and so the optimal lump sum ![]() equalises the average of the marginal social utilities of household income across the population to the marginal cost of the lump sum, which is 1. The value of the deviation from the average

equalises the average of the marginal social utilities of household income across the population to the marginal cost of the lump sum, which is 1. The value of the deviation from the average ![]() is the distributional characteristic of household

is the distributional characteristic of household ![]()

The strict concavity of ![]() implies that

implies that ![]() is strictly decreasing in

is strictly decreasing in ![]() In the standard income tax model, with

In the standard income tax model, with ![]() and

and ![]() co-monotonic, the lower tax bracket would contain not only the lower incomes but also the lower utilities. But if the household model does not imply this co-monotonicity, the lower tax bracket may contain households with higher utility than households that are assigned, on the basis of joint income, to the higher bracket. The tax system assigns households to tax brackets on the basis of income, not utility, and redistributes accordingly.

co-monotonic, the lower tax bracket would contain not only the lower incomes but also the lower utilities. But if the household model does not imply this co-monotonicity, the lower tax bracket may contain households with higher utility than households that are assigned, on the basis of joint income, to the higher bracket. The tax system assigns households to tax brackets on the basis of income, not utility, and redistributes accordingly.

In the two conditions corresponding to the tax rates ![]() the denominators are the frequency-weighted sums of the compensated derivatives of joint earnings with respect to the tax rates over the relevant subsets, and so are negative and give a measure of the marginal deadweight loss of the tax rate at the optimum, the efficiency cost of the tax, for households in the indicated subsets. The numerators give the equity effects.

the denominators are the frequency-weighted sums of the compensated derivatives of joint earnings with respect to the tax rates over the relevant subsets, and so are negative and give a measure of the marginal deadweight loss of the tax rate at the optimum, the efficiency cost of the tax, for households in the indicated subsets. The numerators give the equity effects.

The two terms in the numerator of (19) correspond to the two ways in which the lower bracket tax rate affects the contributions households make to funding the lump sum payment ![]() It is the interaction of these two terms which can lead to the nonconvex case in which the upper bracket tax rate is optimally lower than that in the lower bracket, as in Slemrod et al. (Reference Slemrod, Yitzhaki, Mayshar and Lundholm1994).Footnote 22

It is the interaction of these two terms which can lead to the nonconvex case in which the upper bracket tax rate is optimally lower than that in the lower bracket, as in Slemrod et al. (Reference Slemrod, Yitzhaki, Mayshar and Lundholm1994).Footnote 22

Given their optimal household earnings ![]() the first term gives the sum of the effects of a marginal tax rate change on utility, weighted by the distributional characteristic, over subset

the first term gives the sum of the effects of a marginal tax rate change on utility, weighted by the distributional characteristic, over subset ![]() The second term reflects the fact that the lower bracket tax rate is effectively a lump sum tax on income earned by the two higher income brackets,

The second term reflects the fact that the lower bracket tax rate is effectively a lump sum tax on income earned by the two higher income brackets, ![]() and

and ![]() since a change in this tax rate has only an intramarginal effect, changing the tax they pay at a rate

since a change in this tax rate has only an intramarginal effect, changing the tax they pay at a rate ![]() while leaving their (compensated) labour supply unchanged.

while leaving their (compensated) labour supply unchanged.

Although the interpretation of the results owes more to the theory of linear taxation than that of nonliner taxation (see Section 4) in this respect the two theories are similar. This is not to claim that if we were to let the bracket width go to zero we would obtain the optimal non-linear function since here we have no incentive compatibility constraint. On the other hand, faced with this tax system the households do ‘honestly’ reveal their types.

Only the first of these two effects is present in the condition (20) corresponding to the higher tax rate, simply because there is no higher tax bracket. The portion of the income of a household in the higher tax bracket that is taxed at the rate ![]() is

is ![]() and this is weighted by its distributional characteristic. Note that, unlike the case of linear income taxation, these numerator terms are not covariances, since the mean of

and this is weighted by its distributional characteristic. Note that, unlike the case of linear income taxation, these numerator terms are not covariances, since the mean of ![]() over each of the subsets is not 1. We can still interpret them however as expressing the power of the tax instrument to redistribute utility by redistributing income within the bracket concerned.

over each of the subsets is not 1. We can still interpret them however as expressing the power of the tax instrument to redistribute utility by redistributing income within the bracket concerned.

Note also that, other things equal, the more sharply ![]() increases across households in the upper bracket the greater will be the tax rate

increases across households in the upper bracket the greater will be the tax rate ![]() implying that tax rates are sensitive to growing inequality in the form of sharp increases in top incomes.Footnote 23

implying that tax rates are sensitive to growing inequality in the form of sharp increases in top incomes.Footnote 23

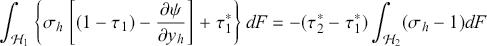

Condition (21), corresponding to the optimal bracket limit ![]() has the following interpretation. The left-hand side represents the marginal social benefit of a relaxation of the bracket limit. This consists first of the gain to all those households that are effectively constrained at

has the following interpretation. The left-hand side represents the marginal social benefit of a relaxation of the bracket limit. This consists first of the gain to all those households that are effectively constrained at ![]() in the sense that they are prepared to increase earnings if these are taxed at

in the sense that they are prepared to increase earnings if these are taxed at ![]() but not at

but not at ![]() : the return to additional labour supply at

: the return to additional labour supply at ![]() but not

but not ![]() exceeds its marginal utility cost. The first term in brackets on the left hand side is the net marginal benefit to these consumers, weighted by their distributional characteristics. The second term is the rate at which tax revenue increases given the increase in gross income resulting from the relaxation of the bracket limit.

exceeds its marginal utility cost. The first term in brackets on the left hand side is the net marginal benefit to these consumers, weighted by their distributional characteristics. The second term is the rate at which tax revenue increases given the increase in gross income resulting from the relaxation of the bracket limit.

The right hand side gives the marginal social cost of the relaxation. Since ![]() by assumption, all households

by assumption, all households ![]() receive a lump sum income increase at this rate and this is weighted by the distributional characteristic of these households. As long as the sum of these deviations, weighted by the densities of the household types, is negative, the marginal cost of the bracket limit increase is a worsening in the equity of the income distribution. The condition then trades off the marginal social value of the gain to households in

receive a lump sum income increase at this rate and this is weighted by the distributional characteristic of these households. As long as the sum of these deviations, weighted by the densities of the household types, is negative, the marginal cost of the bracket limit increase is a worsening in the equity of the income distribution. The condition then trades off the marginal social value of the gain to households in ![]() against the marginal social cost of making households in

against the marginal social cost of making households in ![]() better off. Of course, an important but unspecified determinant of these results is the density function of household types. Just as in the Boskin/Sheshinski model, this restricts the conclusions we can draw in general and makes empirical work on these models essential.

better off. Of course, an important but unspecified determinant of these results is the density function of household types. Just as in the Boskin/Sheshinski model, this restricts the conclusions we can draw in general and makes empirical work on these models essential.

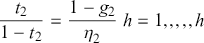

3.2 Individual Taxation

Under individual taxation there is a two-bracket piecewise linear tax system now applied to individual labour earnings, defined by the vector ![]() where

where ![]() is again a uniform lump sum paid to every household, (it would also be of interest to assume that demogrants could be paid separately to each individual in the household),

is again a uniform lump sum paid to every household, (it would also be of interest to assume that demogrants could be paid separately to each individual in the household), ![]() ,

, ![]() are the marginal tax rates in the lower and upper brackets respectively, and

are the marginal tax rates in the lower and upper brackets respectively, and ![]() is the value of individual earnings defining the bracket. Thus the individual tax function

is the value of individual earnings defining the bracket. Thus the individual tax function ![]() is defined by:

is defined by:

(22)

(22)

(23)

(23)

and the household tax function is

(24)

(24)

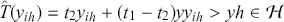

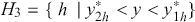

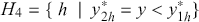

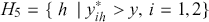

Given that, by definition, ![]() for every household, and that under individual taxation everyone faces the same tax schedule, there are now six possible subsets of households which form a partition

for every household, and that under individual taxation everyone faces the same tax schedule, there are now six possible subsets of households which form a partition ![]() of the index set

of the index set ![]() defined by

defined by

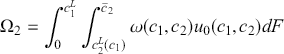

(25)

(25)

(26)

(26)

(27)

(27)

(28)

(28)

(29)

(29)

(30)

(30)

In ![]() ,

, ![]() both individuals face the lower marginal tax rate, in

both individuals face the lower marginal tax rate, in ![]() and

and ![]() the primary earner alone faces the higher marginal tax rate while the second earner pays the lower tax rate, and in

the primary earner alone faces the higher marginal tax rate while the second earner pays the lower tax rate, and in ![]() both face the higher rate.

both face the higher rate.

From this, it is easy to see that increasing the number of tax brackets just increases the number of subsets that have to be defined, but nothing changes the underlying principle. For the extension to more than two tax brackets see Andrienko et al. (Reference Andrienko, Apps and Rees2016).

To shorten notation we denote the subset ![]() by

by ![]() , and

, and ![]() by

by ![]() ,

, ![]()

![]()

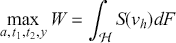

![]() . The planner solves

. The planner solves

subject now to the public sector budget constraint

(31)

(31)

where again ![]()

In what follows it will be useful to denote by ![]() the value of a relaxation of the bracket limit to an individual at the kink in the budget constraint. Also, to shorten notation we denote

the value of a relaxation of the bracket limit to an individual at the kink in the budget constraint. Also, to shorten notation we denote ![]() by

by ![]() Then

Then ![]() according as household

according as household ![]() is relatively worse (better) off in utility terms than the subset of households for which

is relatively worse (better) off in utility terms than the subset of households for which ![]() .

.

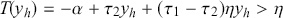

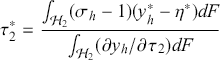

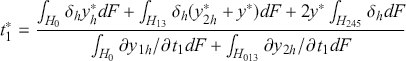

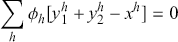

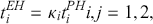

From the first order conditions for an optimal solution we derive:

(32)

(32)

(33)

(33)

(34)

(34)

(35)

(35)

The first condition, since it involves the entire population, is exactly as for joint taxation, though of course the distribution of marginal social utilities will in general differ. The remaining three conditions have basically the same interpretation as before, but of course the relevant integrals are now over subsets of individuals reflecting the partition defined in (25)–(30).

To begin an analysis of the differences in social welfare under the two systems, we carry out the following thought experiment. We make the unrealistic assumptions that with joint taxation the bracket limit is ![]() , while under individual taxation it is

, while under individual taxation it is ![]() and also that marginal tax rates are the same in both cases. It is very unlikely to be true of the optimal individual tax system because of the effects on labour supply choices of a switch between systems. Nonetheless it is useful in clarifying some ideas.

and also that marginal tax rates are the same in both cases. It is very unlikely to be true of the optimal individual tax system because of the effects on labour supply choices of a switch between systems. Nonetheless it is useful in clarifying some ideas.

We can think of any tax system as specifying a rule for assigning individuals and households to tax brackets, and the basic question we now address is: what are the implications of the respective assignment rules specified by the two systems here for the efficiency and equity of taxation?

First, consider only the difference in the equity effects of the two systems. On the given assumptions:

∙ Households in which both earners face the lower tax rate are equally well off under the two systems, they face the same tax rates as before.

∙ Under individual taxation, the primary earners in households where the higher earner only is in the higher bracket, in the subset of incomes

, now pay the higher tax rate while the second earners pay the lower tax rate just as before, so these households become worse off than under joint taxation. Essentially, the primary earners lose the advantage of income splitting.

, now pay the higher tax rate while the second earners pay the lower tax rate just as before, so these households become worse off than under joint taxation. Essentially, the primary earners lose the advantage of income splitting.∙ Under individual taxation, primary earners with incomes higher than

again pay the higher tax rate but second earners with incomes below pay the lower tax rate instead of the higher one, so these households may become better or worse off than under joint taxation, depending on their levels of second income. The higher the second income, the more likely it is that the household is better off.

again pay the higher tax rate but second earners with incomes below pay the lower tax rate instead of the higher one, so these households may become better or worse off than under joint taxation, depending on their levels of second income. The higher the second income, the more likely it is that the household is better off.∙ Under individual taxation, households where the higher income primary earners have incomes higher than

and therefore paid the higher tax rate under joint taxation, but whose second earners have incomes lower than

and therefore paid the higher tax rate under joint taxation, but whose second earners have incomes lower than  so that they now pay the lower tax rate, become strictly better off.

so that they now pay the lower tax rate, become strictly better off.∙ Finally, in households in which both earners still pay the higher tax rate, as they did under joint taxation, they are just as well off as before.

Clearly there are losers and gainers as we move between the two systems. The point to emphasise however is that the overall evaluation from the viewpoint of social welfare depends not only on the joint distribution function of income pairs but also on the role played by household production.

As mentioned earlier, if household well-being is monotonically increasing with household income then from the equity point of view some households that gain will have higher incomes than some households that lose when the primary earner loses the income splitting advantage. Thus, although, given the standard elasticity assumptions, there is an unambiguous reduction in deadweight losses, on equity grounds one might oppose the change. Suppose, on the other hand, that at any given primary income the inverse relationship between market income and the value of household production is such as to at least broadly equalise household GDP, the sum of household labour market earnings and the value of household production. Then, whereas the ‘assignment rule’ under joint taxation is to put households with higher joint market earnings into the higher tax bracket, the assignment rule under individual taxation is to put households with higher primary earner income into the higher bracket. If, then, we assume that the household GDP increases with primary income, we can view individual taxation as providing an implicit tax on the value of household production, and the equity effects of the switch to individual taxation are far less adverse.

Though it can give useful insights, this example does not allow us to make a full comparison of the differences between the two optimal tax systems since it excludes labour supply effects. We can take the interpretation further however with a pairwise comparison of each of the optimality conditions (19)–(21) and (33)–(35) in the two tax systems from the point of view of their efficiency effects.

The numerators of the conditions for the marginal tax rates ![]() and

and ![]() have the same general structure, with one component based on the incomes of individuals in the lower tax bracket weighted by the distributional terms, the other reflecting the lump sum tax effects on individuals at the kink and in the higher brackets, similarly weighted by distributional terms. The numerators in the conditions for

have the same general structure, with one component based on the incomes of individuals in the lower tax bracket weighted by the distributional terms, the other reflecting the lump sum tax effects on individuals at the kink and in the higher brackets, similarly weighted by distributional terms. The numerators in the conditions for ![]() and

and ![]() do not contain the second component. However, the similarities end there. The compositions of the subsets over which the weighted sums are taken will be very different. First note that the denominator in the expression for

do not contain the second component. However, the similarities end there. The compositions of the subsets over which the weighted sums are taken will be very different. First note that the denominator in the expression for ![]() will tend to contain more lower income second earners, since the subset

will tend to contain more lower income second earners, since the subset ![]() contains second earners who, because they are in households with high wage primary earners, would under joint taxation be in the upper tax bracket. The subset

contains second earners who, because they are in households with high wage primary earners, would under joint taxation be in the upper tax bracket. The subset ![]() in the denominator for

in the denominator for ![]() will tend to include more high wage primary earners, who have lost the income-splitting advantage they obtain under joint taxation. Other things equal therefore, this would lead us to expect a greater difference between the two tax rates, or higher marginal rate progressivity, in the case of individual taxation, given the stylised fact that labour supply elasticities are lower for primary than for second earners.

will tend to include more high wage primary earners, who have lost the income-splitting advantage they obtain under joint taxation. Other things equal therefore, this would lead us to expect a greater difference between the two tax rates, or higher marginal rate progressivity, in the case of individual taxation, given the stylised fact that labour supply elasticities are lower for primary than for second earners.

We should note that the empirical estimates of elasticities are gender-based – female labour supply elasticities are higher than male – whereas the distinction here between primary and second earners is on the basis of earned income rather than gender. We would argue however that the high female elasticities are based on role rather than gender. Also, as pointed out earlier, it is still the case that the large majority of second earners are women. For insightful empirical work on this, see McClelland et al. (Reference McClelland, Mok and Pierce2014).

The approach to the tax analysis based on the sufficient statistics methodology is useful in allowing the characteristics of the optimal tax system to be derived in a general sense, but cannot itself tell us which would be better in terms of the value of some specified Social Welfare Function. For this we would also have to specify the model of household behaviour that underlies the tax analysis. Moreover, since qualitative differences might be very difficult to identify, we would need to parametrise this model and estimate values of the numerical differences in the outcomes of the two systems.

Apps and Rees (Reference Apps and Rees2018) do this by setting up a model and calibrating it with Australian labour market data. An important feature of the individual utility functions in the household model is that they depend not only on the consumption of a market good and leisure, but also on household production in the form of child care. Moreover, the parameters determining the implicit prices of the household good may vary across households. In particular, productivities in household production increase with household wage rates, reflecting the effects both of parental human capital and higher household income.

The results of the model simulations show that individual taxation welfare-dominates joint taxation over a wide range of empirically reasonable parameter values. This is due not only to the efficiency gain from individual taxation; there is also a gain in the equity of the welfare distribution. An important reason for this is the high degree of inequality at the top of the empirical primary earner wage distribution, which allows high income primary earners to benefit substantially from income splitting in a joint taxation system. Taking account of household production also helps to correct the bias, in the welfare ranking that is created by a tax system based on joint income, against lower wage households with both earners working full time.

4 Optimal Non-linear Taxation of Couples

In the theory of optimal non-linear income taxation developed for singles, inaugurated by James Mirrlees (Reference Mirrlees1971), there is a given set of individual workers/consumers who differ along a single dimension, their innate ‘ability’ or more concretely productivity in market work, which is often identified with their wage. If planners could identify the innate ability type of each worker they could use purely lump sum taxation to achieve the desired redistribution without distorting labour supplies at the margin: the conditions for Pareto efficiency remain satisfied, the economy moves costlessly around its aggregate utility frontier. However, when productivity type is not verifiably observable, they have to resort to distortionary income taxation, which moves the economy inside its utility frontier. The theory then seeks to explore the trade-off between the benefit from taxation, often assumed to be purely in the form of income redistribution, and the cost, in terms of the deadweight loss from tax distortions, the ‘limit to redistribution’, that results.

It is often pointed out that an optimal income tax should not, as is the case in optimal linear taxation, constrain the set of possible solutions by specifying a priori a fixed structure for the optimal tax functions. An optimal tax should determine this structure endogenously as an outcome of the analysis. Though it is difficult to dispute the logic of this approach, this results, as we shall see, in a significant loss in tractability of the analysis and is prone to produce results that bear little resemblance to real tax systems. This in itself may be no bad thing but it can make it difficult to relate the results to real-world policy debates. One also needs to be confident that the underlying behavioural model does successfully take into account all the key aspects of the real situation. Considerations of tractability tend to obscure this point.

Given the assumption of information asymmetry that characterises the non-linear approach, the Revelation Principle tells us that, under the assumptions of the model, the planner can do nothing better than to offer a menu of tax pairs consisting of a lump sum tax or subsidy and a marginal tax rate. This menu is constructed in such a way that the pair designed for each ability (wage) type will actually be selected by that type. An alternative but equivalent description of the process is to say that individuals declare an income to the planner who then gives them a tax pair, and an incentive-compatible system is one which induces them to report the income that corresponds under the tax system to their true type. Hence the constraints are sometimes called ‘truth-telling’ constraints and deviating from that is often referred to as ‘mimicking’ a different type. That is, the optimal tax structure is determined as a separating equilibrium solution to a mechanism design problem. This leads to a relatively tractable set of analytical procedures for deriving and characterising the optimal tax system: Find, within the set of tax systems that satisfy this ‘self-selection’ or ‘incentive compatibility’ (![]() ) condition, that system which maximises the social welfare function subject to the government budget constraint. This constraint plays the role of the participation constraint in standard principal/agent problems, though of course in the case of the tax system participation is mandatory. An additional

) condition, that system which maximises the social welfare function subject to the government budget constraint. This constraint plays the role of the participation constraint in standard principal/agent problems, though of course in the case of the tax system participation is mandatory. An additional ![]() constraint then creates a second-best tax problem. Boadway (Reference Boadway1988) shows in this setting that solving this problem gives a higher social welfare level than an optimal linear tax.

constraint then creates a second-best tax problem. Boadway (Reference Boadway1988) shows in this setting that solving this problem gives a higher social welfare level than an optimal linear tax.

If we now recognise that households consist of two earners, the extension of this approach seems rather obvious. We simply add a second wage-earner to the household. Her innate productivity is likewise private information. We then proceed with the analysis just as before.Footnote 24 In the language of the mechanism design literature, we formulate the optimal tax problem now as a two-dimensional screening problem. Unfortunately however, in contrast to many areas of economic theory where an increase in dimensionality simply involves a change in notation, an increase in the number of dimensions of private information in this mechanism design problem raises substantive issues.

The properties of the optimal taxation model for singles, with two wage types and one dimension of private information, are well understood and give a great deal of insight into the results of the more general case of ![]() types, where

types, where ![]() is arbitrarily large and may be defined on a continuum. The main limitations of the two-type case are: it cannot say anything about the shape of the optimal tax function, because only one type is subject to a positive MTR; it rules out the possibility of ‘bunching’, where more than one type receives the same allocation of consumption and income; and it gives undue prominence to the ‘no distortion at the top’ result, which says that the MTR on the highest wage type is optimally zero, while not allowing consideration of the ‘no distortion at the bottom’ result which can also arise in the more general model.

is arbitrarily large and may be defined on a continuum. The main limitations of the two-type case are: it cannot say anything about the shape of the optimal tax function, because only one type is subject to a positive MTR; it rules out the possibility of ‘bunching’, where more than one type receives the same allocation of consumption and income; and it gives undue prominence to the ‘no distortion at the top’ result, which says that the MTR on the highest wage type is optimally zero, while not allowing consideration of the ‘no distortion at the bottom’ result which can also arise in the more general model.

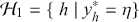

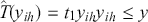

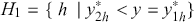

The model closest to the two-type case has two persons in a household, each of whom may have one of two possible wage rates, implying that there are four possible household types. A number of authors have analysed versions of this model.Footnote 25 Here we summarise the model and results of the most comprehensive of these, that of Brett (Reference Brett2007).

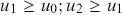

4.1 Couples with Two Wage Types

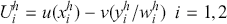

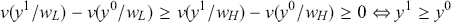

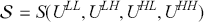

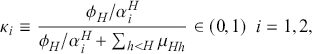

The two wage earners ![]() in a household are identified as male and female and have wages drawn from the set

in a household are identified as male and female and have wages drawn from the set ![]() with

with ![]() , and so a household of type

, and so a household of type ![]() is now defined respectively by the pair

is now defined respectively by the pair

(36)

(36)

Each of the four household types has the additively separable utility function:

(37)

(37)

where ![]() and

and ![]() are respectively strictly concave and convex and identical for all

are respectively strictly concave and convex and identical for all ![]() . Here we formulate the model as if the planner allocates consumption and income quantities, but this is for analytical convenience. Underlying it is the fact that the planner can, on the assumptions of the model, induce a household to choose the optimal values of these variables by appropriate choice of the tax system. We also assume that the planner can identify to which household each individual belongs. The proportion of

. Here we formulate the model as if the planner allocates consumption and income quantities, but this is for analytical convenience. Underlying it is the fact that the planner can, on the assumptions of the model, induce a household to choose the optimal values of these variables by appropriate choice of the tax system. We also assume that the planner can identify to which household each individual belongs. The proportion of ![]() -households in the economy is

-households in the economy is ![]() and

and ![]()

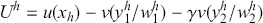

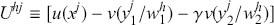

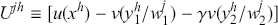

Brett assumes that the household utility function is given by the ‘collective’ form:

(38)

(38)

where ![]() is commonly interpreted as a measure of relative bargaining power, assumed exogenously fixed, equal for all households and known to the planner. Needless to say, this is a very strong assumption, though of course no stronger than the assumption that the planner also knows the utility function. In empirical family economics the household sharing rule which is equivalent to the value of

is commonly interpreted as a measure of relative bargaining power, assumed exogenously fixed, equal for all households and known to the planner. Needless to say, this is a very strong assumption, though of course no stronger than the assumption that the planner also knows the utility function. In empirical family economics the household sharing rule which is equivalent to the value of ![]() is a holy grail the search for which has generated a large literature. It appears that in only three countries, Denmark, the Netherlands and Japan, is data collected on within-household consumption allocations. See Browning and Gøtze (Reference Browning and Gørtz2012), Cherchye et al. (Reference Cherchye, De Bock and Vermeulen2012) and Lise and Yamada (Reference Lise and Yamada2019). The assumption of additive separability in consumption and effort is standard in this type of adverse selection model, as is the assumption that both

is a holy grail the search for which has generated a large literature. It appears that in only three countries, Denmark, the Netherlands and Japan, is data collected on within-household consumption allocations. See Browning and Gøtze (Reference Browning and Gørtz2012), Cherchye et al. (Reference Cherchye, De Bock and Vermeulen2012) and Lise and Yamada (Reference Lise and Yamada2019). The assumption of additive separability in consumption and effort is standard in this type of adverse selection model, as is the assumption that both ![]() and