1 Introduction

Auctions remain an important mechanism of government procurement, contracting, and natural resource allocation. Government auctions often produce new sales records: for instance, the 5G spectrum auctions in the United States generated a revenue of more than $50 billion. Auction theory and mechanism design are important tools for creating optimal and efficient mechanisms for public goods allocation. We now know that the optimal (and/or efficient) auction format heavily depends on many attributes of the allocation problem such as the goal of the auctioneer, specifics of the goods to be sold, value dependencies, and buyer characteristics.

One crucial consideration is the presence of budget constraints. If bidders have limited financial resources, many benchmark predictions such as revenue equivalence no longer hold (Che et al., Reference Che, Gale and Kim2012). While there is a lack of empirical research on the impact of financial constraints, they are common in business practice and are sometimes public knowledge. Consider this example from a radio spectrum auction (Wall Street Journal, 22 Jan. 2015): “AT&T Inc. said Thursday that it has entered into two credit pacts worth a total of more than $11 billion as the company beefs up its balance sheet to fund its bids for U.S. wireless spectrum.”

Financial constraints can lead to new strategic considerations that might have potentially undesired consequences for the auctioneer. One prominent example is the order of sale. In absence of buyers’ budget constraints, the order of sale is typically not important for the seller. However, Benoit and Krishna (Reference Benoit and Krishna2001) show that the seller’s revenue can vary drastically even in a basic setting of complete information with two items that are sold sequentially. Specifically, if the items have different values, the bidder with the highest budget might have an incentive to bid aggressively on the first item, letting the bidder with a smaller budget win that item, and deplete his budget. She can then pick up the higher-value item in the second auction against weaker opposition.

To illustrate this point, consider the following example. Three bidders (1, 2, and 3) have respective budgets of $70M, $40M, and $20M. They are competing for 2 items, Item A worth $60M and Item B worth $30M. The seller is using a simple English (increasing bid) auction and can choose whether to sell Item A first (Order AB) or Item B first (Order BA). All ties are resolved randomly. In Order AB, Bidder 1 gets Item A for $40 M, leaving a budget of $30M for the second round. Bidder 2 then wins Item B for $30M, with the seller earning $70M.

In Order BA, Bidder 1 could try to bid up to the value of Item B ($30M) and take a chance with a random allocation. She, however, is better off by only bidding up to $20M, letting Bidder 2 win Item B and reduce his remaining budget to $20M. Bidder 1 then wins Item A for just $20M in the second auction. The seller earns only $40M from selling the items.

One could argue that common knowledge of budgets is an unrealistic assumption. There are two potential considerations here. First, in some settings such as the FCC auctions mentioned above, bidders do have a public estimate of each other’s budget. Second, we use this setup as a starting point to study behavior in budget-constrained settings in order to understand behavioral mechanisms underlying bidding choices that respond to variations in other bidders’ budgets (which would be not the case for private budgets).

In this paper, we use a laboratory experiment to pursue two goals. First, we test the predictions of Benoit and Krishna (Reference Benoit and Krishna2001) using two popular auction formats: the English clock auction (EC, a version of an ascending bid auction) and a first-price sealed bid (FP) auction. In a between-subject design, we explore the optimality of these formats in several value/budget settings and two orders of sale (Order AB vs. Order BA). Second, we analyze the behavioral considerations and learning mechanisms underlying bidding strategies in both formats.

Empirical evidence on the effects of budget constraints in auctions is lacking, given that budget constraints are often unobservable to the researcher. A laboratory experiment thus has a few important advantages. We can easily control the values and budgets, as well as information available to the bidders, and compute specific predictions in a simplified setting. Additionally, we can estimate counterfactual predictions under different orders of sale and auction formats for the same value and budget settings.

We find robust empirical support for the theoretical predictions, with the revenue in Order AB clearly dominating the revenue in Order BA. Specifically, in Order AB, the seller earns 15% more on average than in Order BA. We find that individuals indeed recognize the strategic effects of budget depletion, with 94% of subjects at least once demonstrating strategic behavior in the role of the strongest bidder. However, the aggregate behavior deviates from theoretical predictions; only 27% of auction outcomes can be classified as fully consistent with theory. We find that the resulting revenues can be explained by a mixture of rational predictions and a naive bidding model motivated by limited foresight frameworks. We observe that the revenue gap between the two orders of sale increases as subjects gain more experience in the experiment.

We also demonstrate that the sealed-bid auction yields a higher average revenue compared to the English auction. We find that this effect is linked to differences in the speed of learning and the feedback induced by the two auction formats: in the English auction, subjects are significantly more likely to learn the benefits of playing the equilibrium strategy by the end of the experiment compared to the sealed-bid first price auction where opponents’ bids are often unobservable to the subjects.

To summarize, our results confirm the general comparative statics predictions of Benoit and Krishna’s model and additionally highlight the importance of behavioral effects related to the information environment induced by the auction format.

The rest of the paper follows the standard structure. Section 1 reviews related literature; Sect. 2 presents the theoretical model and hypotheses; Sect. 3 lays out the experimental design and methods; Sect. 4 presents the results.

2 Related literature

Theory. We directly test the predictions of the model introduced by Benoit and Krishna (Reference Benoit and Krishna2001). Following their paper, our main goal is to identify the auction design most beneficial to the seller. We use the standard English clock auction as a faster, simpler alternative to the ascending auction described in the original paper (Kagel & Levin, Reference Kagel and Levin2014).

Auction formats. Additionally, we explore another auction format that could potentially increase the revenue of the seller: the first-price sealed bid (FP) auction, which has been shown to yield revenue higher than the ascending (English) auction in many different settings. Overbidding in sealed-bid and first-price auctions compared to English auctions in the lab is a common result in the literature; a number of explanations have been suggested over the years: competitiveness (Kagel & Levin, Reference Kagel and Levin1993, Reference Kagel and Levin1986), risk aversion (Cox et al., Reference Cox, Smith and Walker1988), joy of winning (Goeree et al., Reference Goeree, Holt and Palfrey2002), fear of losing (Cramton et al., Reference Cramton, Filiz-Ozbay, Ozbay and Sujarittanonta2012a, Reference Cramton, Filiz-Ozbay, Ozbay and Sujarittanontab; Delgado et al., Reference Delgado, Schotter, Ozbay and Phelps2008), regret (Filiz-Ozbay & Ozbay, Reference Filiz-Ozbay and Ozbay2007), cognitive ability (Crawford & Iriberri, Reference Crawford and Iriberri2007), and simplicity of the mechanism (Li, Reference Li2017).Footnote 1 Budget considerations add additional complexity to bidders’ strategies. Weaker informational feedback in the first-price auction can thus provide foundations for a new behavioral mechanism that leads to higher seller revenues.

It is worth noting that Benoit and Krishna (Reference Benoit and Krishna2001) also introduce a hybrid ascending auction format that is based on the standard sequential auction. In the hybrid auction, both objects are simultaneously on sale in multiple rounds of bidding, and in each round, a bidder can either outbid the highest bid on one of the objects (by posting/announcing their new bid) or pass. If there were no bid changes in the last two rounds, then the expensive item is sold for the current highest bid, and the auction for the cheaper item continues.

While this format might have interesting empirical implications, our pilot sessions revealed two unintended consequences that prevented us from running a full treatment with the hybrid design. First, many subjects found the rules of the hybrid auction confusing. Second, and most importantly, subjects often engaged in very long bid wars, where each subject would only increase their previous bid by 1 ECU, with the other subject following suit, repeating the same pattern over and over again. As this happened in almost every auction, this design resulted in unreasonably long session times. We thus decided to focus on a much faster English clock auction and not pursue the hybrid design. However, it still remains a potentially interesting subject for future studies (as well as other formats such as the Dutch auction or the all-pay auction).

Budget constraints in the laboratory. Although various forms of auctions with budget constraints have been extensively studied in the theoretical literature (Che et al., Reference Che, Gale and Kim2012; Che & Gale, Reference Che and Gale1999; Laffont & Robert, Reference Laffont and Robert1996; Malakhov & Vohra, Reference Malakhov and Vohra2008; Pai & Vohra, Reference Pai and Vohra2014; Pitchik, Reference Pitchik2009; Fang & Parreiras, Reference Fang and Parreiras2002; Dobzinski et al., Reference Dobzinski, Lavi and Nisan2012; Pai & Vohra, Reference Pai and Vohra2014; Kotowski, Reference Kotowski2020; Bobkova, Reference Bobkova2020), experimental evidence on behavior in such settings remains limited.

The closest study to our design is Pitchik and Schotter (Reference Pitchik and Schotter1988). The setup of their experiment is similar to Benoit and Krishna (Reference Benoit and Krishna2001). One of the treatments investigates the role of order of sale. Pitchik and Schotter (Reference Pitchik and Schotter1988) find that selling a more expensive item first to two bidders with equal budgets yields a higher revenue to the seller. We extend this approach substantially by analyzing multiple value and budget settings, and considering two separate auction formats (the English clock auction and first-price sealed bid auction).

Ausubel et al. (Reference Ausubel, Burkett and Filiz-Ozbay2017) study auctions with endogenous budget constraints, where a principal imposes a budget limit on a bidder in response to a principal-agent problem. The study shows that the empirical revenue difference between the first- and second-price auction seems to be persisting with and without budget constraints. Bae & Kagel (Reference Bae and Kagel2021) compare a proportional auction and a first-price auction for the case of budget-constrained bidders and a single item, reporting that the proportional auction is revenue-maximizing under strong budget constraints.

Order of sale. A number of studies analyze the “order-of-sale” effect and price trends in sequential auctions, both in the field (Deltas & Kosmopoulou, Reference Deltas and Kosmopoulou2004; Ashenfelter, Reference Ashenfelter1989; Raviv, Reference Raviv2006; Hong et al., Reference Hong, Kremer, Kubik, Mei and Moses2015) and in the lab (Pitchik & Schotter, Reference Pitchik and Schotter1988; Estenson, Reference Estenson1994; Keser & Olson, Reference Keser and Olson1996). It is typical for prices in sequential auctions for identical items to decrease, producing a so-called “declining price anomaly”, although the evidence is mixed (Raviv, Reference Raviv2006; Deltas & Kosmopoulou, Reference Deltas and Kosmopoulou2004). Note that we are considering the case of items of different values, however, the same (psychological) mechanisms might lead to a price decrease in this case.

Looking at bidders with budget constraints in fantasy football auctions, Boudreau and Shunda (Reference Boudreau and Shunda2016) show that individuals often tend to overbid early, irrespective of the underlying value of the item(s); they then switch to underbidding, and finish overbidding again. There are many behavioral explanations for initial overbidding suggesting that it is caused by behavioral effects in the first rounds of the auction (reflecting “warming up”, or competitive behavior, or familiarizing oneself with the rules of the auction) and is not caused by equilibrium strategic behavior (however, also see Huang et al. (Reference Huang, Devanur and Malec2012) for a theoretical treatment of the declining price phenomenon). Our results do not directly correspond to these observations. In each auction, we have only 2 items for sale, with known and observable values, and our subjects experience these two-stage auctions repeatedly.

3 Theoretical framework

3.1 Setup

Our theoretical framework follows the setup in Benoit and Krishna (Reference Benoit and Krishna2001). Three bidders with budgets

![]() compete to purchase two items,

compete to purchase two items,

![]() and

and

![]() . The items have common values

. The items have common values

![]() , and there are no synergies between

, and there are no synergies between

![]() and

and

![]() , implying that the value of the bundle of both items is

, implying that the value of the bundle of both items is

![]() . All values and budgets are common knowledge. The items are sold sequentially, one after another. If a bidder wins the first item, their budget for the second auction is decreased by the price of that item.

. All values and budgets are common knowledge. The items are sold sequentially, one after another. If a bidder wins the first item, their budget for the second auction is decreased by the price of that item.

We consider two popular auction formats. In the English clock auction (EC, a version of the ascending second price auction), the item price increases by one currency unit each time period (in our case, one second), and bidders can drop out at any point in time (including simultaneously). When only one bidder remains, she receives the item at the price at which her last competitor dropped out. If the price reaches the bidder’s budget, she is forced to drop out.

In the first price sealed bid auction (FP), bidders submit sealed bids for each item. Their bids cannot exceed their current budget. The bidder who submits the highest bid wins the item.

In both formats, the winner of an auction for an item of value

![]() pays a price

pays a price

![]() and receives a net utility of

and receives a net utility of

![]() . In the case of multiple bidders submitting the same bid (in the English auction, leaving the auction at the same time), the winner is determined through a random draw between all potential winners.

. In the case of multiple bidders submitting the same bid (in the English auction, leaving the auction at the same time), the winner is determined through a random draw between all potential winners.

3.2 Equilibrium concept

For the English auction, we follow Benoit & Krishna (Reference Benoit and Krishna2001) and constrain the set of equilibria to Nash equilibria in weakly undominated strategies. In the English auction, this implies that all bidders bid the minimum of their remaining budget and the valuation for the item in the second stage, simplifying the solution procedure considerably. The predictions do not depend on the order of elimination. Note also that this assumption rules out tacit collusion (however, once the first stage is over, the collusion promise might not be credible).

For both auction formats, we assume subgame perfection. Again, this simplifies the analysis and allows us to pin down distributional predictions. Specifically, it allows us to (1) use backward induction in the English auction and to pin down unique SPNE payoffs and revenues for each experimental setting and (2) constrain the set of equilibria in the first-price auction by eliminating non-credible threats off the equilibrium path.

3.3 Experimental settings

For the purposes of the experiment, we select several value and price settings inspired by Benoit and Krishna (Reference Benoit and Krishna2001). We use a fixed set of numbers (30, 40, 60, and 70 experimental currency units, or ECUs) and consider all their permutations as value and price amounts. Out of those permutations, we select those that satisfy

![]() . Bidder 2’s budget is chosen so that she is always financially constrained (

. Bidder 2’s budget is chosen so that she is always financially constrained (

![]() ) in all settings (in addition, in Setting 3

) in all settings (in addition, in Setting 3

![]() ). Bidder 3’s budget is always set to 20 and thus was lower than the value of either item (

). Bidder 3’s budget is always set to 20 and thus was lower than the value of either item (

![]() ). We use the resulting six combinations as the settings in the experiment (Table 1).

). We use the resulting six combinations as the settings in the experiment (Table 1).

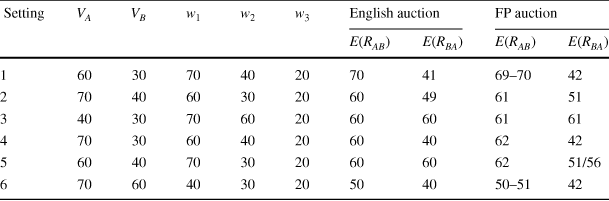

For each setting, we derive equilibrium predictions for the English and first price auctions (see Table 1 for the revenue predictions). While these equilibria can still be calculated by hand in some cases, in many others (specifically in the first price auction) they are too cumbersome to derive analytically (given the potential number of subgames and the size of normal form games within the subgames, under all value settings). We therefore apply an automated algorithm to derive equilibrium predictions computationally. For a detailed description of the equilibrium calculation procedure, see Appendix B. All data and code used to generate the equilibrium predictions are available through Open Science Framework.Footnote 2

Table 1 Value and budget settings used in the experiment

|

Setting |

|

|

|

|

|

English auction |

FP auction |

||

|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

||||||

|

1 |

60 |

30 |

70 |

40 |

20 |

70 |

41 |

69–70 |

42 |

|

2 |

70 |

40 |

60 |

30 |

20 |

60 |

49 |

61 |

51 |

|

3 |

40 |

30 |

70 |

60 |

20 |

60 |

60 |

61 |

61 |

|

4 |

70 |

30 |

60 |

40 |

20 |

60 |

40 |

62 |

42 |

|

5 |

60 |

40 |

70 |

30 |

20 |

60 |

60 |

62 |

51/56 |

|

6 |

70 |

60 |

40 |

30 |

20 |

50 |

40 |

50–51 |

42 |

![]() are the values of items A and B,

are the values of items A and B,

![]() are the budgets of bidders 1, 2, and 3. E(R) show the predicted theoretical revenue of the seller

are the budgets of bidders 1, 2, and 3. E(R) show the predicted theoretical revenue of the seller

3.4 Hypotheses

Order of sale. Theory predicts that expected revenues in Order AB weakly dominate Order BA. Most differences are strict, and Order AB is predicted to generate a larger revenue in four (five) out of the six experimental settings in the English (first-price) auction format. This is formalized in Hypothesis Footnote 1.

Hypothesis 1

The revenue to the seller from selling the items sequentially in Order AB is at least as great as the revenue from selling them in Order BA. For some value-budget settings, the inequality is strict.

For a formal proof in a general setting, see Benoit and Krishna (Reference Benoit and Krishna2001). The predicted revenues for all six value settings are shown in Table 1. In most cases, both auction formats are predicted to preserve the optimality ranking (Order AB > Order BA). In one case, the revenues are predicted to be equal.

In equilibrium, in most BA settings, it is more profitable for the bidder with the highest budget (Bidder 1) to let Bidder 2 win the low value Item B, in order to deplete his budget and lower the competition for the higher value Item A. This effect is the primary driver of the revenue gap between the AB and BA Orders and is formalized in Hypothesis Footnote 2.

Hypothesis 2

In Order BA, Bidder 1 is more likely to lose the first auction to Bidder 2 than in Order AB.

Bounded rationality considerations What happens if Bidder 1 does not realize she should let Bidder 2 win Item B in Order BA? As an alternative to the rational predictions, we consider a “naive” benchmark motivated by models of backward induction failure in extensive form games (Jehiel, Reference Jehiel2001; Johnson et al., Reference Johnson, Camerer, Sen and Rymon2002; Gabaix et al., Reference Gabaix, Laibson, Moloche and Weinberg2006; Mantovani, Reference Mantovani2015; Ke, Reference Ke2019; Rampal, Reference Rampal2022). For this prediction, we assume that individuals have limited foresight, meaning they do not consider the effect of their current action on future subgames (the second auction) and always bid up to the minimum of their budget and the value of the item (in the first-price auction, this also includes the budget of the other bidder). Such behavior changes the predictions for the first stage of the auction.

In two out of six experimental settings (1 and 4) this benchmark still predicts a higher expected revenue for the seller in AB Order relative to BAFootnote 3. Bidder 1 is predicted to win Item B in three out of six settings and draw it with Bidder 2 in the other three (Fig. 2b). We formalize this prediction as the following alternative to Hypotheses 1 and 2.

Hypothesis 3

With limited foresight, bidders do not consider the second stage when forming their strategies. The seller’s revenue is equal between orders AB and BA in four out of six settings (2, 3, 5, 6) while AB dominates BA in the other two (settings 1 and 4). Bidder 1 always wins or ties for Item B in BA auctions.

Auction format In most settings, our equilibrium predictions produce only a small technical difference between the English and FP auctions, driven by the minimum increment size of 1 ECU.Footnote 4 Overall, revenues in Order AB should weakly dominate Order BA in both auction formats (Table 1). As discussed in Sect. 1, English auctions often elicit behavior more consistent with equilibrium predictions relative to sealed bid auctions (one such effect is overbidding in the sealed bid formats driven by psychological joy of bidding or risk aversion). In repeated settings, such discrepancies can be caused by faster learning given immediate feedback on others’ behavior (Kagel et al., Reference Kagel, Levin and Harstad1995; Kagel & Levin, Reference Kagel and Levin1993). Given a diverse body of empirical evidence, we did not formulate an apriori hypothesis and investigated the differences in bidding and learning across the two auction formats post hoc.

4 Experimental design

4.1 General design

Our experiment follows the setup of the theoretical model. In each session, subjects participate in 18 separate periods. In each period, three bidders compete for two items,

![]() and

and

![]() (labeled as such here for convenience, no labels were presented to the subjects) in sequential auctions. Experimental subjects are randomly assigned the roles of Bidders 1 and 2, while Bidder 3 is an automated, computerized player which always bid its full budget.Footnote 5 The role of the computer as well as all values and budget are public knowledge. Subjects are randomly rematched between periods (stranger matching).

(labeled as such here for convenience, no labels were presented to the subjects) in sequential auctions. Experimental subjects are randomly assigned the roles of Bidders 1 and 2, while Bidder 3 is an automated, computerized player which always bid its full budget.Footnote 5 The role of the computer as well as all values and budget are public knowledge. Subjects are randomly rematched between periods (stranger matching).

The experiment features 6 distinct value settings as shown in Table 1 with each setting reshuffling the same set of numbers (20, 30, 40, 60, and 70 experimental currency units, or ECUs). Each setting is repeated 3 times in each session in a pseudo-random order (periods 1–6: first repetition, periods 7–12: second repetition, periods 13–18: third repetition; the order of settings in each repetition is randomized but preserved across sale orders and auction formats). For each period, subjects receive profits equal to the value(s) of the obtained item(s) minus the paid price(s). If a subject receives no items, they receive zero profits. At the end of the experiment, the profits of all periods are summed up and converted from ECU into USD and paid out to subjects.Footnote 6

4.2 Experimental subjects

The experiment involved 176 subjects, primarily undergraduate students from the experimental economics subject pool at the Ohio State University (OSU). The four conditions (EC-AB, EC-BA, FP-AB, FP-BA) included 46, 42, 42, and 46 subjects each. The data in each condition was collected across 3 experimental sessions to minimize session effects (Frechette, Reference Frechette2012). All subjects provided written informed consent, and the study was approved by OSU Internal Review Board. We programmed the experiment in z-Tree (Fischbacher, Reference Fischbacher2007) and recruited subjects via ORSEE (Greiner, Reference Greiner2015). Each session lasted about an hour and a half, and subjects earned $14 on average, including a $5 show-up fee. The instructions are included in Appendix C.

4.3 Experimental treatments

Combinations of the sale order

![]() and auction format

and auction format

![]() provided a

provided a

![]() treatment design on the session level (between subject design) resulting in 4 experimental treatments: EC-AB, EC-BA, FP-AB, and FP-BA (EC-AB: English clock auction, Order AB; EC-BA: English clock auction, Order BA; FP-AB: first-price sealed bid auction, Order AB; FP-BA: first-price sealed bid auction, Order BA).

treatment design on the session level (between subject design) resulting in 4 experimental treatments: EC-AB, EC-BA, FP-AB, and FP-BA (EC-AB: English clock auction, Order AB; EC-BA: English clock auction, Order BA; FP-AB: first-price sealed bid auction, Order AB; FP-BA: first-price sealed bid auction, Order BA).

4.3.1 Order of sale

The order of sale treatment determines the order in which the high-value Item A and low-value Item B are sold. In Order AB, the high-value Item A is sold first. In both treatments, subjects receive identical instructions.

4.3.2 Auction formats

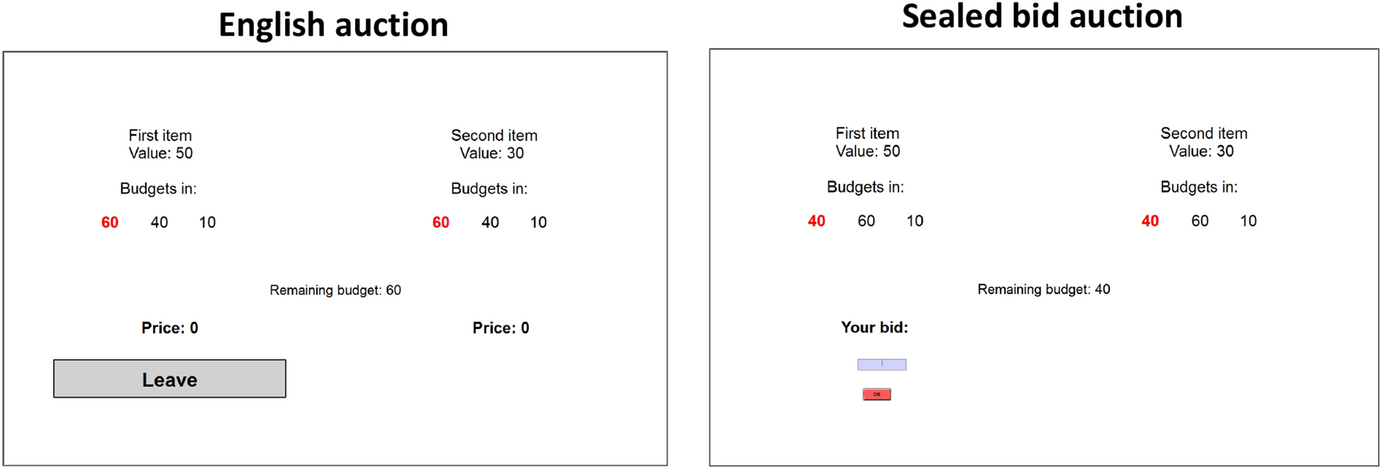

Fig. 1 Experimental interface: English clock auction (left panel) and first-price sealed bid auction (right panel). The first item is displayed on the left, the second item is displayed on the right. The remaining budgets are shown underneath the currently auctioned item. If a bidder leaves the auction, their budget is removed from the screen. The subject’s own budget is displayed in bold red color. In the center of the screen, the subject can see their own remaining budget

English clock auction (EC) In these treatments, each item is sold via an ascending (English) clock auction. On the screen, subjects see a price clock for the current item. The clock starts at 0 and increases up to the item’s value at the rate of 1 ECU per second. Subjects can leave the auction at any time by clicking on an on-screen button (Fig. 1). If the price clock reaches a bidder’s budget, the bidder is forced to drop out of the bidding. If 2 out of 3 bidders leave the auction, the remaining bidder receives the item at the price at which the last bidder left.

First-price sealed-bid auction (FP) In these treatments, subjects submit a single sealed bid for each item by entering a number and clicking on a button. Bids are enforced to not exceed an item’s value or a subject’s budget. The bidder with the highest bid wins the item for a price equal to their bid.

In both formats, subjects can see the values of both items and the remaining budgets of all bidders at any time during the bidding period (see Fig. 1). All ties (bidders leaving the auction at the same price in EC or bidding the same amount in FP) are resolved randomly. The price of the first item is subtracted from the budget of a winner for the second auction. Budgets do not carry over across periods.

5 Results

To preview the results: as predicted by theory in Hypothesis Footnote 1, we observe a higher seller’s revenue when the high value Item A is sold first in Order AB compared to Order BA in five out of six settings. The seller (in our case, the experimenter) earns 14.8% more [7.5 additional experimental currency units (ECUs)] in Order AB versus Order BA per auction (see Fig. 2, Table 2). We also observe a higher revenue in the first price auction compared to the English auction (5.6 ECUs on average), controlling for the order of sale. We find that 94% of subjects indeed recognize the strategic effect of losing the first auction at least once; however, only 27% of auction outcomes can be classified as perfectly consistent with theoretical predictions. Subjects in the role of Bidder 1 do not lose the auction on Item B in Order BA as often as theory predicts implying a significant utility loss. Investigating changes in behavior over time, we find that subjects are more likely to use feedback from the previous period and learn the value of intentional losing of the first item in Order BA in the English auction compared to the FP auction. However, with more experience, subjects in the role of Bidder 1 often move from not losing enough to dropping out too early compared to the equilibrium predictions.

5.1 Order of sale

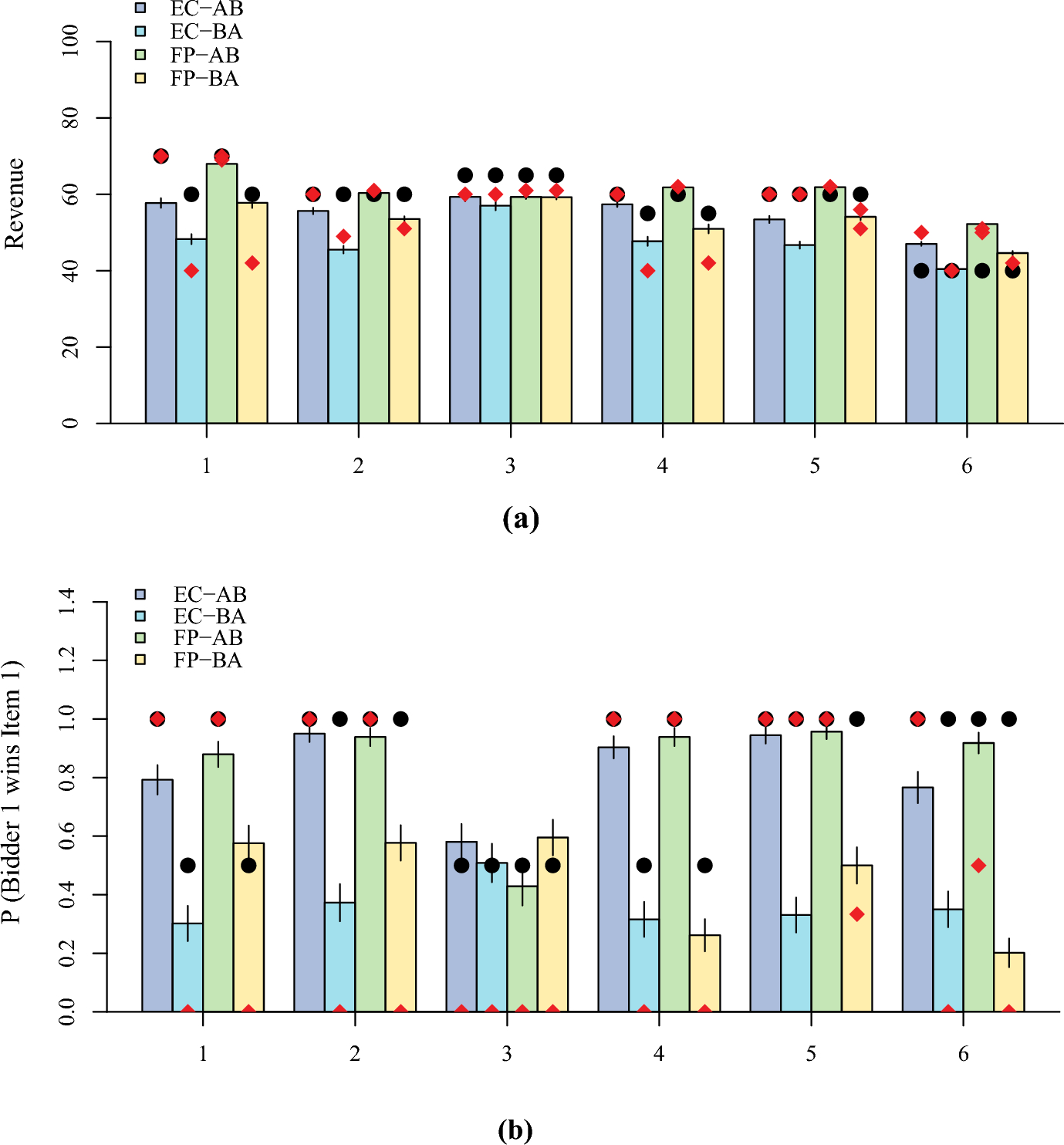

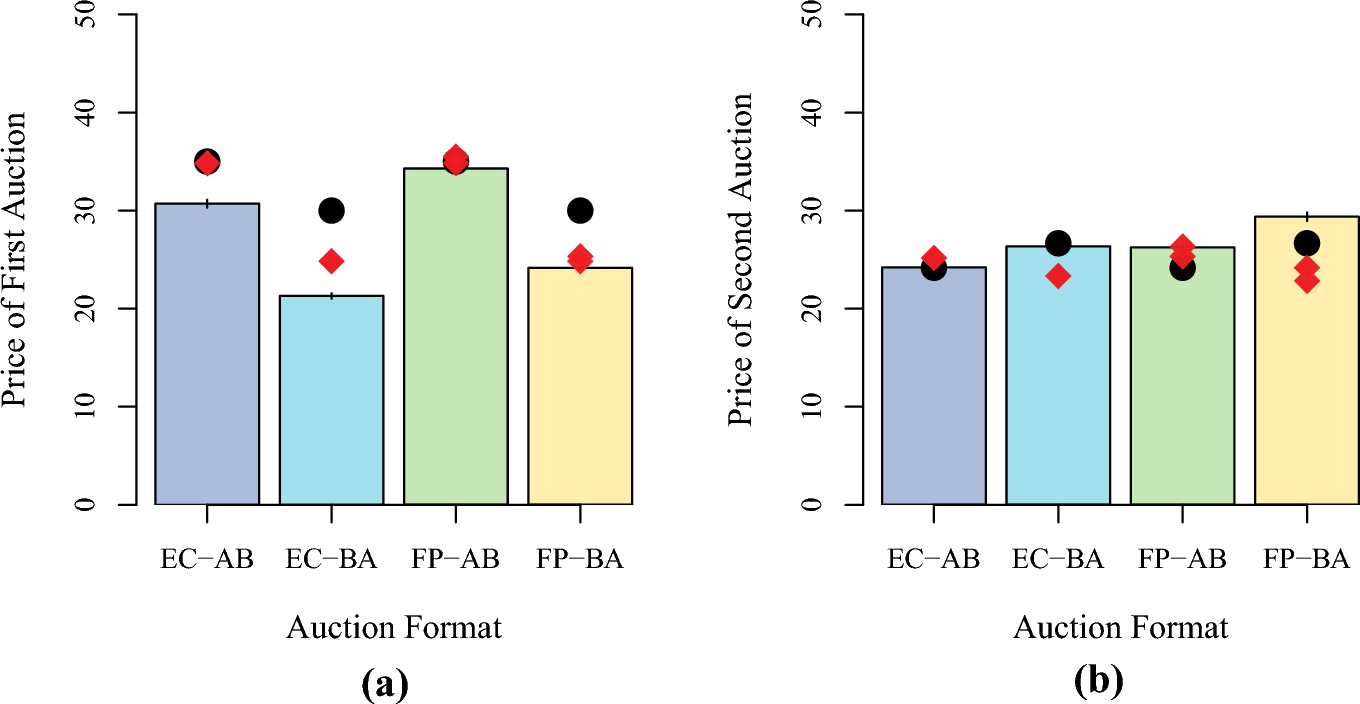

Fig. 2 Main results. All plots show the averages across four auction formats and six value-budget settings (EC-AB: English clock auction, Order AB; EC-BA: English clock auction, Order BA; FP-AB: first-price sealed bid auction, Order AB; FP-BA: first-price sealed bid auction, Order BA). b Probability of Bidder 1 (with the highest budget) winning the first auction, split by auction formats and settings. In both panels, error bars represent s.e.m. at the subject level. The red diamonds show the theoretical predictions. The black circles show bounded rationality predictions

5.1.1 Revenue

Our main research question is whether the revenue for the seller is higher when selling both goods in a decreasing order of value (Order AB) compared to an increasing order of value (Order BA) when the same bidders participate in both auction and are budget-constrained. Equilibrium predictions suggest that selling the highest value good first yields a weakly higher expected revenue for the seller. This is formalized in Hypothesis Footnote 1.

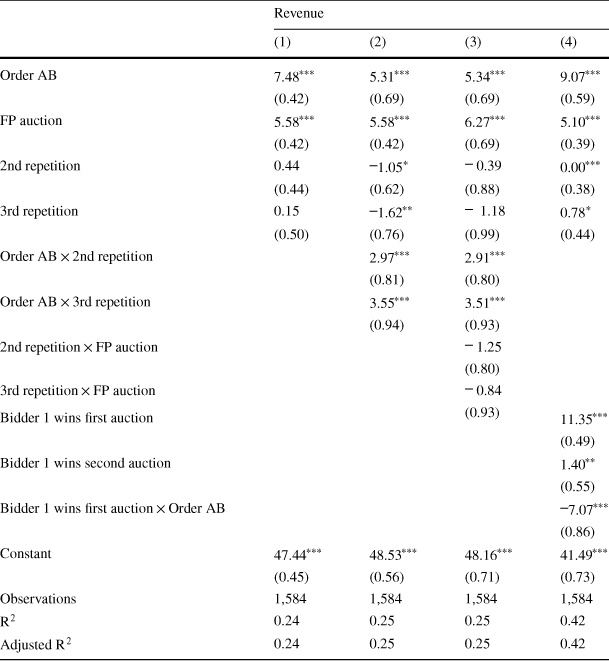

To test this, we use an OLS regression as shown in Table 2. In the main regression [Column (1)], we regress the seller’s revenue on the order of sales (Order AB) and the auction format (FP Auction) as well as dummy variables that capture changes in revenue over the duration of the experiment (2nd Repetition, 3rd Repetition).

We find that Order AB increases the seller’s average revenue by 7.48 ECUs (14.79%) compared to Order BA (coefficient for Order AB). This is formalized in Result Footnote 1, which supports Hypothesis Footnote 1 and confirms the predictions of Benoit and Krishna (Reference Benoit and Krishna2001).

Result 1

The revenue to the seller from selling the items sequentially in Order AB is greater than the revenue from selling them in Order BA.

This result holds for all value-budget settings where the seller’s revenue is predicted to be higher in Order AB (EC: Settings 1, 2, 4, 6; FP: Settings 1, 2, 4, 5, 6) as presented in Table 1. Interestingly, it also holds for Setting 5 in the English clock auction even though theory does not predict a revenue difference between orders of sale here. Figure 2a shows the results for all settings, splitting sellers’ revenues by the order of sale (Order AB vs Order BA) and auction formats [first-price sealed bid (FP) vs English clock (EC)].

Table 2 OLS fits of seller’s revenue using treatment (sale order and auction format), setting repetition, and winner’s identity as predictors

|

Revenue |

||||

|---|---|---|---|---|

|

(1) |

(2) |

(3) |

(4) |

|

|

Order AB |

7.48

|

5.31

|

5.34

|

9.07

|

|

(0.42) |

(0.69) |

(0.69) |

(0.59) |

|

|

FP auction |

5.58

|

5.58

|

6.27

|

5.10

|

|

(0.42) |

(0.42) |

(0.69) |

(0.39) |

|

|

2nd repetition |

0.44 |

|

|

0.00

|

|

(0.44) |

(0.62) |

(0.88) |

(0.38) |

|

|

3rd repetition |

0.15 |

|

|

0.78

|

|

(0.50) |

(0.76) |

(0.99) |

(0.44) |

|

|

Order AB

|

2.97

|

2.91

|

||

|

(0.81) |

(0.80) |

|||

|

Order AB

|

3.55

|

3.51

|

||

|

(0.94) |

(0.93) |

|||

|

2nd repetition

|

|

|||

|

(0.80) |

||||

|

3rd repetition

|

|

|||

|

(0.93) |

||||

|

Bidder 1 wins first auction |

11.35

|

|||

|

(0.49) |

||||

|

Bidder 1 wins second auction |

1.40

|

|||

|

(0.55) |

||||

|

Bidder 1 wins first auction

|

|

|||

|

(0.86) |

||||

|

Constant |

47.44

|

48.53

|

48.16

|

41.49

|

|

(0.45) |

(0.56) |

(0.71) |

(0.73) |

|

|

Observations |

1,584 |

1,584 |

1,584 |

1,584 |

|

R

|

0.24 |

0.25 |

0.25 |

0.42 |

|

Adjusted R

|

0.24 |

0.25 |

0.25 |

0.42 |

Clustered (Subject 1 & Subject 2) standard-errors in parentheses

Signif. Codes: ***0.01, **0.05, *0.1

5.1.2 Strategic behavior

Next, we turn our attention to the mechanism through which order of sale influences the expected revenue of the seller. Our equilibrium predictions suggest that in most settings of Order BA (9 of 12 across the two auction formats), it is optimal for Bidder 1 to let Bidder 2 win the first, low-value item for a price which depletes Bidder 2’s budget. Losing the first auction allows Bidder 1 to get the high-value item in the second auction against weaker competition (i.e., the automated Bidder 3 who always bids up to its maximal budget of 20) for a significantly lower price. This is formalized in Hypothesis Footnote 2.

Indeed, we find that the average probability that Bidder 1 wins the first item is lower in Order BA (41%) versus Order AB (83.5%) across all settings and auction formats. This difference is highly statistically significant (Wilcoxon signed rank test

![]() ). We formalize this in Result Footnote 2 which supports Hypothesis Footnote 2.

). We formalize this in Result Footnote 2 which supports Hypothesis Footnote 2.

Result 2

In Order BA, Bidder 1 is significantly more likely to lose the first auction relative to Order AB (Fig. 2b,

![]() , Wilcoxon signed rank test).

, Wilcoxon signed rank test).

Next, we link Results 1 and 2 using Regression 4 in Table 2. This regression augments Regression 1 by adding dummy variables which capture winner identity in the first stage (Bidder 1 Wins First Auction), the second stage (Bidder 1 Wins Second Auction), and an interaction term (Bidder 1 Wins First Auction

![]() Order AB).

Order AB).

We find that Bidder 1 winning the first item in Order BA increases the seller’s revenue by 11.35 ECU (coefficient for Bidder 1 Wins First Auction,

![]() ), while in the order AB this effect is only 4.28 ECU (11.35–7.07). This result suggests that a large proportion of the order effect on expected revenues is driven through Bidder 1’s losing the first-stage auction in order BA.

), while in the order AB this effect is only 4.28 ECU (11.35–7.07). This result suggests that a large proportion of the order effect on expected revenues is driven through Bidder 1’s losing the first-stage auction in order BA.

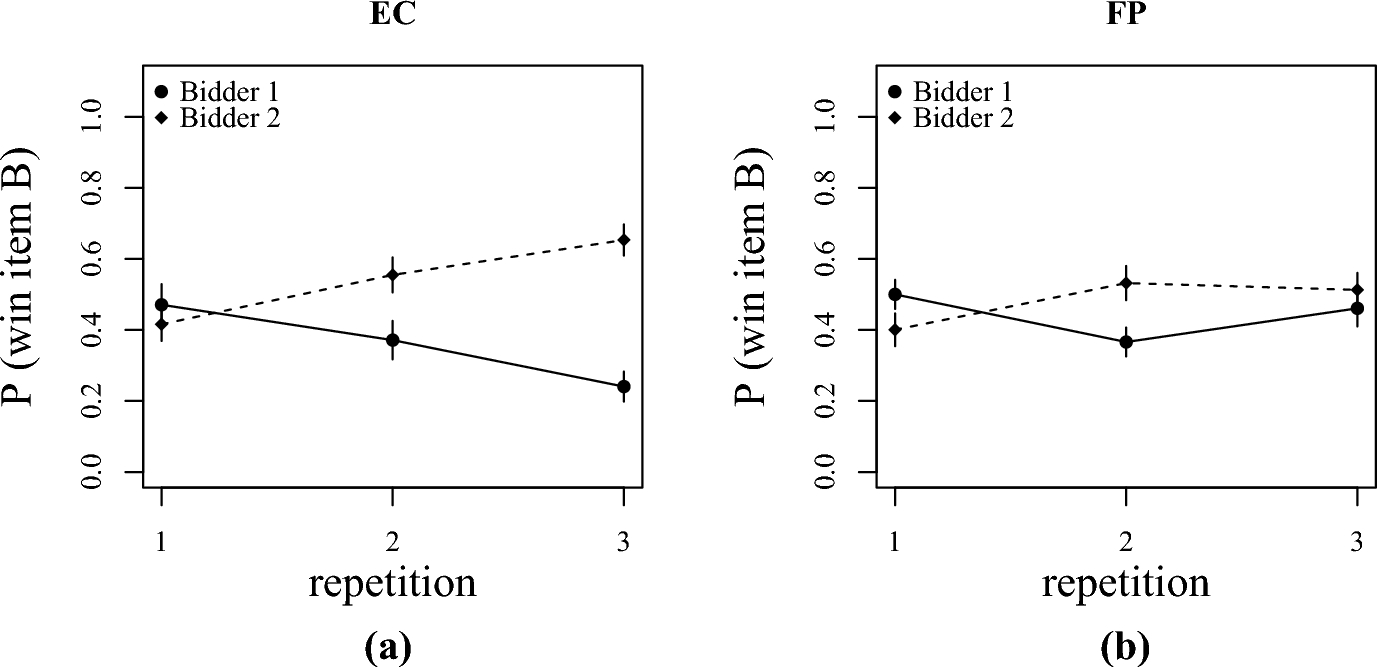

We then further investigate the selling price of the first item in Order BA. Theory predicts that Bidder 1 should either remain in the auction long enough to deplete Bidder 2’s budget (in the English auction), or submit a sealed bid high enough that Bidder 2 is forced to beat it (in the first price sealed bid auction). In the data, we observe underbidding compared to these predictions. Restricting our analysis to Order BA and the seller’s revenue from the first item, we compare empirical prices to the equilibrium point predictions. In Order BA, the average price of Item B was 21.3 ECU in the English auction, and 24 ECU in the first-price auction (closer to the equilibrium prediction of 25 ECU) (Fig. 3a).

Result 3

The price of the first item in Order BA (pooling across both auction formats) is lower than the equilibrium predictions (all p < 0.001, Fig. 3a, Wilcoxon signed rank test).

Fig. 3 Prices. All plots show the averages across four auction formats (EC-AB: English clock auction, Order AB; EC-BA: English clock auction, Order BA; FP-AB: first-price sealed bid auction, Order AB; FP-BA: first-price sealed bid auction, Order BA), with the error bars representing s.e.m. The red diamonds show the theoretical predictions. The black circles represent bounded rationality predictions. a Price of the first sold item. b Price of the second sold item. See Appendix A.1 for the same plots split by 6 auction settings

These low prices are primarily driven by sub-optimal subject behavior. While subjects in the role of Bidder 1 can recognize they should drop out of the bidding, they often drop out too early, decreasing the price of the first item and leaving Bidder with a higher budget for the second item. One plausible explanation for early drop outs (under Bidder 3’s budget equal to 20 ECU) is collusion signaling by Bidder 1, however such an offer might not be credible as Bidder 2 does not have to respect collusion in the second stage. We observe that subjects in the role of Bidder 1 are overwhelmingly more likely to drop out early (under 20 ECU) in Order BA (EC-BA: 36% of cases, FP-BA: 30% of cases) compared to Order AB (EC-AB: 3% of cases, FP-AB: 1.6% of cases).

5.2 Auction format

Next, we estimate the effect of the auction format on the seller’s revenue. In equilibrium, there is only a small gap between revenues in the English and FP auctions (see Table 2), driven primarily by the minimal increment of 1 ECU (the difference between the first- and second-price auctions, as in the former the winner has to outbid their opposition by 1 ECU) and the tie-breaking rule. On average, we expect the first price auction to generate only a slightly larger revenue increase of 0.33–0.92 ECU per auction across all 6 settings and 2 orders of sale, depending on the resolution of tied bids.

In the data, we find a significantly larger revenue discrepancy between the two formats (Fig. 2a). Returning to our main regression, we find that the seller earns an extra 5.6 ECU on average per auction in the FP auction compared to the English auction (Table 2, column (1), coefficient for FP auction), controlling for the order of sale. This is formalized in Result Footnote 4.

Result 4

The revenue to the seller from selling the items in the first-price sealed bid auction is significantly higher than the revenue in the English auction, independent of the order of sale.

To verify that this effect is not driven by one of the sale orders, we also run the regression of revenue on the auction format dummy in both AB and BA Orders of sale separately (both p < 0.001), and a regression that includes the interaction between the order of sale and auction format, which was not significant (p = 0.74).

In terms of specific auction settings, in equilibrium, only 2 settings out of 12 (6 value settings × 2 orders of sale) are expected to have a lower revenue in the FP auction. In our data, the revenue in the FP auction is higher in both settings.

5.3 Learning with experience

While the effects of the order of sale and auction format are clearly significant on average, there was clear heterogeneity in subjects’ behavior. In Order BA, when Bidder 1 should drop out, 77 out of 78 subjects do it at least once, however it only happens in 59.5% of auctions.

One possible driver of sub-optimal behavior is the lack of experience with the game. Given that each setting is repeated 3 times, we run a model which augments our main OLS specification with an interaction term between the coefficient for order of sale and the number of repetition dummies (Table 2, column (2)) to investigate the development in revenue differences between Order AB and BA over time. We find that the revenue gap between the AB and BA Orders increases with subjects’ experience (+2.97 ECUs (p < 0.001) in the second repetition compared to the first 6 periods, and +3.55 ECUs (p< 0.001) in the third repetition (Table 2), column (2), Order AB

![]() Repetition).

Repetition).

Next, we investigate if the large difference in revenue between the first price and English clock auction formats shrinks over time approaching equilibrium predictions. To do so, we augment the previous model with additional interaction terms between the auction format and the repetition dummies (Table 2, column (3)). We observe a small decrease in the auction-format revenue gap across the second and third repetitions of the game, however they are not large enough to offset the overall large difference in revenues and are not statistically significant (

![]() 1.3 and

1.3 and

![]() 0.8 ECU, respectively; p = 0.11 and p = 0.33; Table 2, column (3), coefficients for Repetition

0.8 ECU, respectively; p = 0.11 and p = 0.33; Table 2, column (3), coefficients for Repetition

![]() FP Auction).

FP Auction).

Fig. 4 Learning in Order BA. Probability of winning Item B between two bidders, across three repetitions. a English clock auction (EC). b First price sealed bid auction (FP). Error bars represent s.e.m

To analyze the underlying behavior, we now turn to bidding strategies. We find that subjects in the role of Bidder 1 are less likely to bid low (under 20 ECU, or computerized Bidder 3’s budget) in the FP auction, which causes higher winning rates for Item 1 (Fig. 2b). In 64% of auctions in the EC-BA treatment, the first item is sold for 20 ECUs or less. This is only the case for about 17% of auctions in the EC-AB treatment. In the FP auction, these cases are rarer: 18% in FP-BA and 0% in Order FP-AB. This suggests that in the FP auction, subjects in the role of Bidder 1 are less likely to realize they need to let their opponent win. This leads to consistently higher prices of Item B in the FP auction in the BA Order.

We also observe that the price of the first item never drops below 20 ECU in the EC-AB treatment (when both bidders drop out under 20 ECU). In the EC-BA treatment, however, we observe Bidder 1 dropping out below 20 more often over time (in 49% of cases in the third repetition of the game comparing to 26% during the first repetition), while Bidder 2 drops out less often (only in 15% cases during the third repetition comparing to 24% of cases in the first repetition). This behavior leads to a decrease in cases where the price of the first item is below 20 ECU (14% in the first repetition, 9.5% in the third repetition).

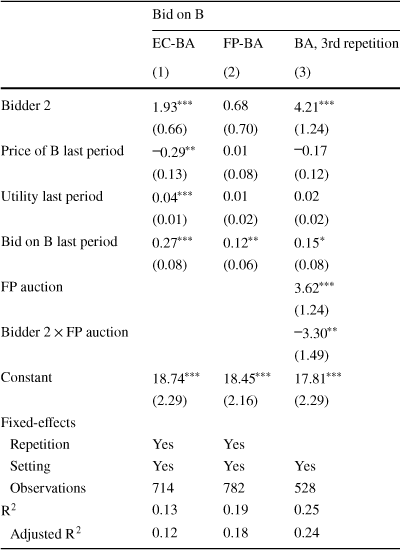

Table 3 OLS fits of bids for Item B in Order BA, with the data split by the treatment using the following predictors: bidder identity, price of Item B in the previous period, utility earned in the previous period, bid on Item B in the last period, auction type, interaction between bidder identity and auction type, repetition (in columns 1 and 2), and auction settings. In the FP auction, bids are defined as submitted bids. In the English auction, bids are defined as drop out values, unless the bidder never dropped out; in that case the bid is defined as the price paid

|

Bid on B |

|||

|---|---|---|---|

|

EC-BA |

FP-BA |

BA, 3rd repetition |

|

|

(1) |

(2) |

(3) |

|

|

Bidder 2 |

1.93

|

0.68 |

4.21

|

|

(0.66) |

(0.70) |

(1.24) |

|

|

Price of B last period |

|

0.01 |

|

|

(0.13) |

(0.08) |

(0.12) |

|

|

Utility last period |

0.04

|

0.01 |

0.02 |

|

(0.01) |

(0.02) |

(0.02) |

|

|

Bid on B last period |

0.27

|

0.12

|

0.15

|

|

(0.08) |

(0.06) |

(0.08) |

|

|

FP auction |

3.62

|

||

|

(1.24) |

|||

|

Bidder 2

|

|

||

|

(1.49) |

|||

|

Constant |

18.74

|

18.45

|

17.81

|

|

(2.29) |

(2.16) |

(2.29) |

|

|

Fixed-effects |

|||

|

Repetition |

Yes |

Yes |

|

|

Setting |

Yes |

Yes |

Yes |

|

Observations |

714 |

782 |

528 |

|

R

|

0.13 |

0.19 |

0.25 |

|

Adjusted R

|

0.12 |

0.18 |

0.24 |

Clustered (Subject) standard-errors in parentheses

Signif. Codes: ***0.01, **0.05, *0.1

Based on these observations, we investigated the changes in subject bidding behavior over time, focusing on Order BA. Figure 4 shows the probability of winning Item B in Order BA for Bidders 1 and 2, split by the auction format. We observe a clear learning pattern in the English auction where, with more experience, Bidders 1 lose the low value Item B more often and Bidders 2 win it more often (Fig. 4, panel (a)). In the FP auction, winning probabilities do not significantly change over time (Fig. 4, panel (b)).

To analyze the bidding behavior leading to this effect, we restrict the data set to the third repetition of Order BA and run a regression of the current period bid on Item B on the player identity dummy (Bidder 2 = 1), the price of Item B in the last period for the specific subject, their profit in the last period, their bid on B in the last period, the auction format dummy (FP Auction = 1 if first-price auction), and the interaction between Bidder 2 and FP Auction (Table 3, column (3)). The interaction coefficient is statistically significant (p = 0.03, interaction between Bidder 2 and FP Auction, Table 3, column (3)).

Result 5

In the third repetition of Order BA, subjects in the role of Bidder 2 bid significantly more on Item B in the English clock auction compared to the FP auction. As a result, with more experience they are more likely to win Item B in Order BA in the English auction relative to the FP auction.

Differences in learning between the two formats can be explained by differences in the information environment (Kagel et al., Reference Kagel, Levin and Harstad1995; Kagel & Levin, Reference Kagel and Levin1993). Subjects in the English auction receive immediate feedback on the opponents’ behavior, while opposing bids in the FP auction remain undisclosed. Such feedback can influence their future behavior and facilitate learning.

To confirm that subjects’ behavior is influenced by the outcomes in the previous period, we extend the analysis underlying Result Footnote 5 and run a regression of the second bid on a player identity dummy (Bidder 2 = 1), the price of Item B in the last period for the respective subject, and their profit in the last period separately for each auction format [Table 3, columns (1) and (2)]. We find that subjects’ bids are significantly influenced by all variables in the EC-BA treatment [all

![]() , Table 3, column (1)]. In the FP-BA treatment only the previous bid on Item B is a significant predictor for the bid on Item B in the current period (

, Table 3, column (1)]. In the FP-BA treatment only the previous bid on Item B is a significant predictor for the bid on Item B in the current period (

![]() , Table 3, column (2)). This result indicates that subjects are more likely to adjust their behavior based on previous outcomes in the English auction, which facilitates their learning of equilibrium behavior.

, Table 3, column (2)). This result indicates that subjects are more likely to adjust their behavior based on previous outcomes in the English auction, which facilitates their learning of equilibrium behavior.

5.4 Bounded rationality

To explore a strategically simpler alternative to the fully rational prediction, we include a bounded rationality benchmark (see Hypothesis Footnote 3). In this framework, subjects have limited foresight and ignore the influence of their action in the first stage on the second stage auction. The resulting behavior follows a simple “all-in” strategy, always bidding (up to) the minimum of their own budget and the value of the item (in the first-price auction, also not exceeding the budget of the other bidder by more than 1). In Figs. 2 and 3, these predictions are shown as black circles.

In Order AB where strategic considerations are weak, the bounded and rational predictions often coincide. In Order BA, this is drastically different when it is sub-optimal for Bidder 1 to bid aggressively and win the first auction.

The results presented so far provide evidence for Hypotheses 1 and 2 but do not support Hypothesis Footnote 3. We do, however, observe significant heterogeneity across auctions in terms of outcomes. To quantify this heterogeneity and compare the predictive power of the equilibrium and naive predictions, we run models in which we regress experimental outcomes on both rational and bounded predictions. We cluster observations at the subject pair level to be able to make meaningful comparisons between the two auction formats, given that in the English auction subjects’ strategies are not fully observable (if a subject is planning to bid up to 40, but the opponent leaves at 30, we cannot observe the subject’s original intentions).

First, we use OLS and regress empirical revenues rational and naive revenue predictions (Table A.2.1). We find that both theoretical (

![]() = 0.527, p < 0.001) and naive predictions (

= 0.527, p < 0.001) and naive predictions (

![]() = 0.522, p < 0.001) are similarly strong predictors when regressed on each individually [Table A.2.1, columns (1) and (2)]. When including both into a single regression, the rational prediction performs better (

= 0.522, p < 0.001) are similarly strong predictors when regressed on each individually [Table A.2.1, columns (1) and (2)]. When including both into a single regression, the rational prediction performs better (

![]() = 0.36, p < 0.001) than the naive one (

= 0.36, p < 0.001) than the naive one (

![]() = 0.28, p < 0.001) [Table A.2.1, column (3)].

= 0.28, p < 0.001) [Table A.2.1, column (3)].

Next, we use a finite mixture model (FMM) unsupervised learning approach (McLachlan et al., Reference McLachlan, Lee and Rathnayake2019; Leisch, Reference Leisch2004) to find heterogenous clusters of subject pairs according to the degree in which they follow either rational or naive bidding predictions (see Appendix A for more details).

This analysis reveals two separate clusters of observations. Roughly a quarter of auctions follow the theoretical model very closely (Table A.2.4, cluster 1), while the remaining auctions are best described by a mixed and relatively weak combination of both predictions (Table A.2.4 cluster 2). Specifically, cluster 1 unifies 26.9% of observations which follow the theoretical prediction almost perfectly (

![]() ), while also showing a much smaller and negative correlation with the native benchmark (

), while also showing a much smaller and negative correlation with the native benchmark (

![]() ). Cluster 2 includes the remaining observations (73.1%), which show a positive correlation with both the theoretical (

). Cluster 2 includes the remaining observations (73.1%), which show a positive correlation with both the theoretical (

![]() ) and the naive prediction (

) and the naive prediction (

![]() ).

).

To analyze potential learning behavior over time, we repeat this exercise separately only for the first (see Table A.2.3) and the last (see Table A.2.4) repetition. While the cluster of rational auctions does not significantly increase in size over time (cluster sizes of 28% and 31% of subject pairs respectively), we find that the relatively irrational cluster becomes significantly more rational over time, starting with a negative correlation with rationally predicted revenues and ending up with one that is larger in absolute terms (though not significantly) than the correlation with the naive prediction (first repetition:

![]() and

and

![]() , last repetition:

, last repetition:

![]() and

and

![]() ).

).

6 Discussion

Order of sale matters when bidders are financially constrained. As predicted by theory, we find that sellers are better off selling two items in a descending value order (Order AB). Subjects in our experiment recognize the importance of strategically losing the low-value item in the first auction in order to deplete the opponent’s budget and win the high-value item for a smaller price, especially in the English clock auction, but do so sub-optimally (underbidding too strongly).

Overall, our results suggest that bidding strategies in Order AB are more intuitive to subjects resulting in first-stage bids closer to equilibrium play. Despite these considerations, our results suggest that most subjects exhibit behavior consistent with a mixture of rational and naive play. As a result, subjects earn higher profits in Order BA than purely naive behavior would yield, however significantly lower than theory predicts.

We do not consider some important modifications to the auction setup. First, items can have complementarities (the bundle of 2 items being worth more or less to bidders than the sum of individual values). While theory predicts that this should not affect the AB-BA Order dominance, it might produce additional behavioral effects.

Second, a promising (and more realistic) extension of our experiment is the introduction of privately known values or private budgets. Since budget constraints are typically private in practice, one promising future direction of research is relaxing the common knowledge assumption. While the theoretical equilibrium cannot be computed in the incomplete information version of the setup we study [for a discussion, see Benoit and Krishna (Reference Benoit and Krishna2001)], future experiments could give better insight into bidding behavior in such settings, as well as settings with complementarities between the items.

We only consider two types of auction formats, the English clock auction and the first-price sealed bid auction, and find that the auction format has a significant impact on the outcome (while theory predicts only minimal differences between the two). Other formats such as the all-pay auction were suggested for the optimal allocation of goods in budget-constrained settings (Che & Gale, Reference Che and Gale1996; Kotowski & Li, Reference Kotowski and Li2014), and exploration of behavior under these mechanisms could be a promising line of future research.

While recognizing the standard restrictions of the laboratory setting and external validity concerns, our results can have important implications for cases where the seller’s revenue is the main concern of the auctioneer, as well as for research in behavioral mechanism design.

Supplementary Information

The online version contains supplementary material available at https://doi.org/10.1007/s10683-023-09812-y.

Acknowledgements

The authors would like to thank Paul J. Healy, John Kagel, Ian Krajbich, Dan Levin, Ernst Fehr, Alexander Ritschel, Caitlyn Trevor, andmembers of the OSU Theory/Experimental group for their helpful comments and conversations. This study was supported by OSU Decision Sciences Collaborative and Journal of Money, Credit and Banking research grants. All subjects provided written informed consent, and the study was approved by the OSU IRB.